Have you watched Treadstone on Amazon Prime by any chance? It’s a spin-off TV series from the Jason Bourne series of films.

It’s not quite the same as watching Matt Damon pulverise legions of CIA/FSB foes without any equipment, but it’s entertaining nonetheless.

Half of the series is set in the Cold War Europe of the 1970s, with the other half of the plot in present day everywhere else. The plot revolves around the sale of a Soviet era nuclear warhead called “Stiletto Six” from a former member of the KGB to a North Korean general (in this reality, the KGB somehow got its own stash of nukes in the Cold War).

The former KGB man doesn’t want unmarked dollar bills, gold, or bearer bonds for the nuke though. No, in one of the more amusing details of the show, he’s after 500 million dollars’ worth of ambiguously labelled “cryptocurrency”.

It’s not made clear exactly what this cryptocurrency is – it’s just called “cryptocurrency”, is carried around on a USB stick, and a lot of people get killed in pursuit of it.

I guess there’s a certain harmony in something as unstable as a rogue nuke being exchanged in the most unstable means of exchange on Earth. As any who’ve observed the space will know, $500 million worth of crypto one day can be an awful lot different from $500 million of it the week, or day, before or after.

Either Mr KGB is a long-term investor (a “hodler”) in crypto, or he doesn’t care how much he gets for the nuke. Volatility in bitcoin, the coin around which almost every other crypto spins, is currently at a level that would suggest the price will either be 40% higher or lower within one year. Lord knows just how much higher that percentage would be if you went and used the nuke after buying it…

Perhaps I’m being unfair, and the screenwriters were referring to the digital tokens called “Global Cryptocurrency”, ranked 669th on coinmarketcap.com. However, its total market cap is $2.6 million, which would make transferring $500 million through it pretty tricky.

Half a billion bucks of bitcoin could be flushed through the crypto market however, provided Mr KGB doesn’t mind the aforementioned volatility while the “hot potato” USB is on its way to him.

He’d need to be very sneaky when it came to transferring the BTC to an exchange to sell it, but the bitcoin market could take $500 million in the teeth and keep smiling. Total market cap for BTC is $178 billion at the time of writing, with $41 billion changing hands in the last 24 hrs – half a billion of selling pressure could likely be sustained without altering the price too much.

This fictional nuke dealer’s dilemma is important. Not just because it’s illustrative of how aware the world is about crypto to the point that it’s become a Hollywood plot device (and not just because it lets me write about pulp TV), but because it highlights an underlying issue with cryptocurrency in general.

If a cryptocurrency like bitcoin is supposed to be a store of value and a means of exchange… how much value can I actually exchange with it? Anybody trying to launder half a billion bucks of black market nuke money is going to have a very hard time using the overwhelming majority of existing cryptocurrencies like the aforementioned “Global Cryptocurrency” token.

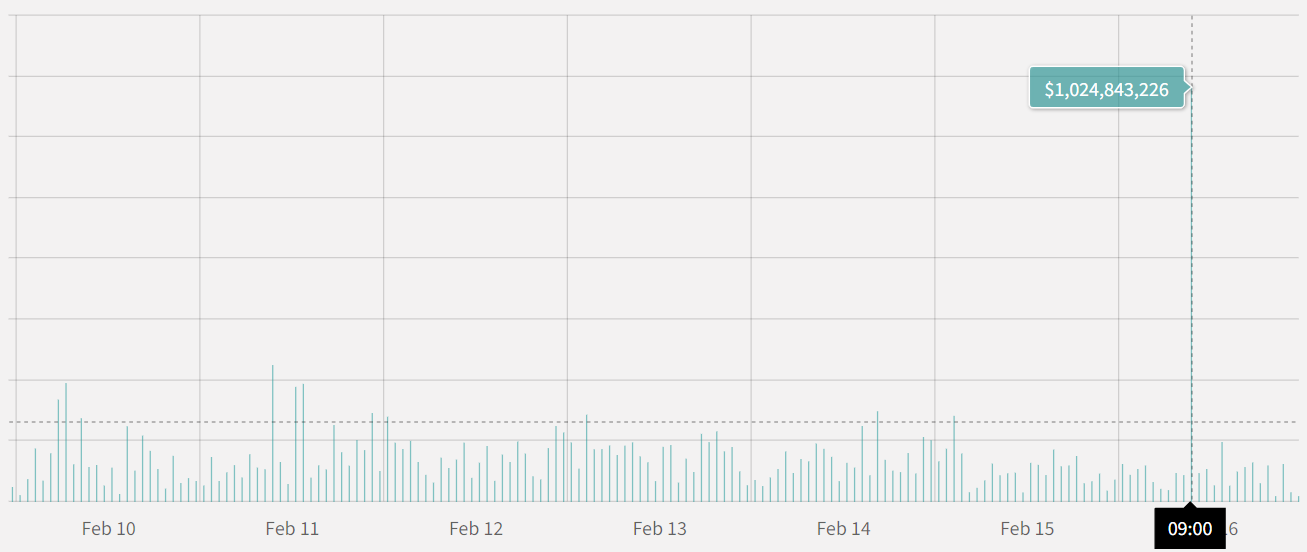

In recent issues of Capital & Conflict, I’ve been drawing attention to increasing number of billion-dollar transactions going across the bitcoin network. While these used to be a gleam in a dreamy software developer’s eye, they’re happening more and more often – there was one just yesterday at 9am:

Transaction values (USD) across the blockchain over the past week

Transaction values (USD) across the blockchain over the past week

Source: ByteTree

For whatever reason, somebody wanted to move a billion dollars’ worth of value from one place to another on Sunday. And so they did it, by wiring a billion dollars’ worth of BTC to another bitcoin address (effectively another “bank account”, just without the bank). But there’s very few cryptocurrencies in existence that have the capacity to allow such a transaction – something you should bear in mind when you hear calls that a new token is about to supplant bitcoin. Let me explain.

Whenever these billion-dollar BTC transactions have taken place, supporters of other cryptocurrencies have taken the opportunity to claim that the billionaire would have a much easier time if they were using a different cryptocurrency; the transaction would have been cheaper and/or faster had they just used xXinsert altcoinXx instead, they claim.

I’ve seen supporters of a crypto called Nano (which is focused entirely on providing lightning-fast payments), being pushed as a superior wealth-transferring vehicle for example.

The thing is, Nano has a market cap of $138 million. That billion-dollar transaction just couldn’t be absorbed by the currency without causing a gigantic boom and bust as they swapped fiat for Nano, made the transaction, and the new owner of the Nano tried to sell it all for fiat.

Not only would the billionaire end up losing vast amounts of the original billion in trying to build up a billion-dollar position in such a small market, but the new owner would lose huge amounts when they tried to sell it all. In short, such a transaction could break the currency if done suddenly.

Bitcoin can handle such a transaction however, by merit of its high market cap and deep liquidity (lots of buying and selling of both large and small quantities).

Though gold bugs don’t like to acknowledge it, this is also one of the reasons why central banks and other government institutions own gold. Because gold is valued all over the world and so many people, institutions, and investors own it, the gold market is very liquid: you can buy or sell large positions of it, without moving the market much.

One of the reasons central banks buy it is so they can buy any currency, whenever they want, in a pinch, even (and especially) in a crisis. They don’t have to buy and hold some other fiat currency destined to lose its value, when they can instead just buy it for gold when they need to. In this way, by owning gold they own a perpetual “call” option on the global reserve currency – the US dollar.

There’s an interesting circular dynamic at play here, whereby the greater bitcoin gets in market value, the more it gains in utility. This may sound counterintuitive, or the hallmark of an unsustainable system, but it is really the foundation of all network-based systems.

You wouldn’t be able to send any valuable information over a telephone if nobody else had one. Nor would you be able to communicate anything useful over Facebook if nobody else had an account. Once there are other people willing to own phones, sign up for Facebook accounts, and buy and sell bitcoin, all of these networks increase in value exponentially.

You could say that if a cryptocurrency is to succeed, somebody needs to be able to buy black market nukes from Mr KGB with it…

But that’s all for today. Tomorrow, I’ll show you how the Feds whacked bitcoin in 2017 to prevent it from gaining value – using the same tried and tested technique they crushed gold with in 1974….

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates