This chart may not look all that important…

… but it is. Let me tell you why.

That line represents the amount of gold held by certain investors.

It’s just hit an all-time high – an important story in itself – but what’s more important is that in order to get there, it’s just passed a level it hit in completely different circumstances.

Let me explain. If you’re a gold bug like me, you’ll be all too familiar with the gold-buying frenzy that took place after the financial crisis. Gold’s fuse that had burnt higher all the way through the 2000s, hit the firework after the crisis, and hit a peak in 2011.

But that didn’t stop the gold bugs buying. By then, gold’s decade-long run and parabolic post-crisis performance had created an industry that folks everywhere were buying bullion.

A member of the World Gold Council (he assured me he was not a bond villain, but he stood a fair sight taller than me and I’m 6’ 5”, so I wasn’t entirely convinced) recently told me an interesting anecdote from the period.

He was working at the Bank of England at the time, before he’d been offered a post at the WGC, and said that the only time he’d heard Bank of England governor Mervyn King even mention gold was when King had seen leaflets advertising gold products being handed out by his tube stop. This was indicative of a mania King declared, and they must do something to protect retail investors from the potential fallout. Central bankers, he concluded, don’t even think about gold, let alone suppressing its price as many gold bugs believe.

Gordon Brown probably didn’t think much about gold either when he sold it – only the promises he could make with it, his “Ambitions for Britain”. Perhaps he gives a little more thought to it now…

Gordon’s bargain-basement sales of UK gold reserves took place between 1999 and 2002. Crosshairs indicate the time of the final sale.

Gordon’s bargain-basement sales of UK gold reserves took place between 1999 and 2002. Crosshairs indicate the time of the final sale.

Then again, he probably still doesn’t think about it: “Forward not back”, etc. Do remember that slogan in the event you make a 600% loss on the taxpayers’ behalf – it might just win you an election.

It’s unlikely the “Brown Bottom” trade will be undone anytime soon now we have New Labour 2 in charge (catchiness of “Sajid Ceiling” notwithstanding).

But gold is flooding back into Britain…

As previously noted, while the gold price had a peak in 2011, that didn’t stop people buying it. The frenzy continued for over a year afterwards.

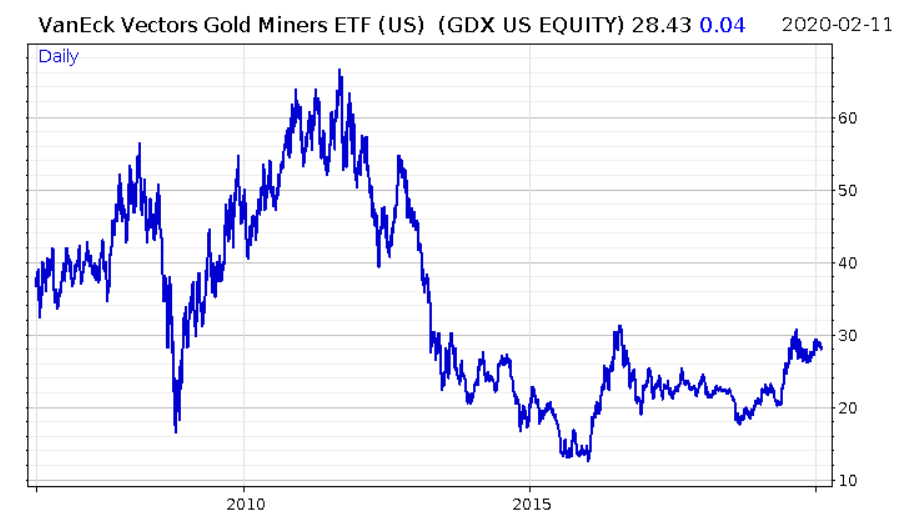

That’s reflected in that chart at the top, which shows holdings of gold by exchange-traded funds, or ETFs. Holdings peaked in late 2012, before sliding down and drifting to the side.

It’s only recently that those holdings have increased, and surpassed 2012 levels.

What I think is important to note about ETF gold holdings is that they’re rarely used by gold fanatics to get exposure to the gold price: they buy physical bullion, and shun “paper gold” like ETF shares. ETFs are the preserve of larger players, like investment funds.

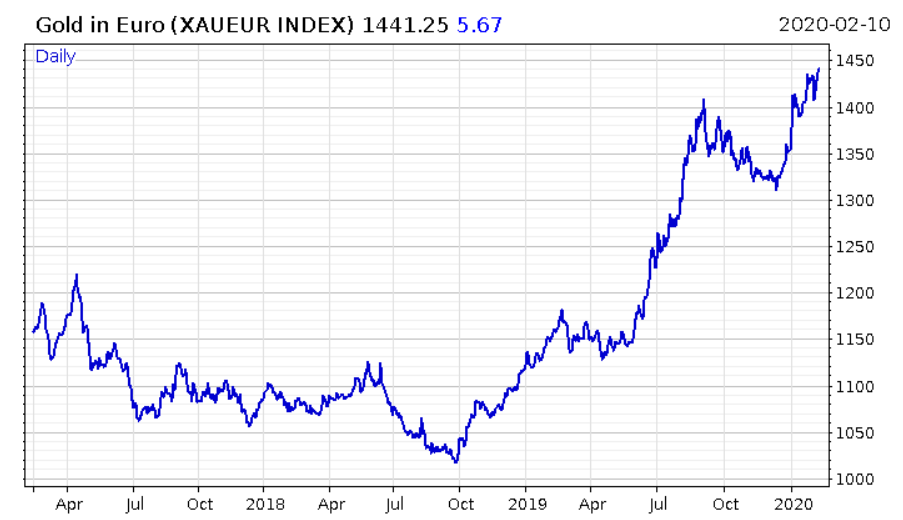

And importantly, the situation now is completely different from the early 2010s. Gold hasn’t been on a decade-long tear – hell, it only surpassed its 2011 peak in pounds last July. There isn’t a retail-investor driven mania – people handing out gold-buying leaflets outside tube stops.

And yet, the holdings are now at all-time highs – there is significant demand out there for gold. By whom exactly, we don’t know. But the exchange-traded funds (ETFs) that are taking the lion’s share of this demand, buying up the metal and issuing shares backed by it, are here in the UK.

21% of all the gold ETFs in the world, and 44% of those in Europe, are based here in the UK. And it’s three of those UK-based funds which really took the total ETF holdings over the edge: iShares Physical, Invesco Physical, and Gold Bullion Securities. The Royal Mint is due (finally) to launch its own gold fund soon (technically, it’s an ETC, an exchange-traded commodity, but explaining the difference is for another letter), which should only add to the UK’s weight within this market.

Some may believe this boom in UK gold storage is Brexit related, but I seriously doubt it. The London gold market has been a global hub for gold trading for centuries, and preppers don’t use ETFs anyway – they store their bullion themselves.

And besides, the rising gold price is hardly a UK-based phenomenon:

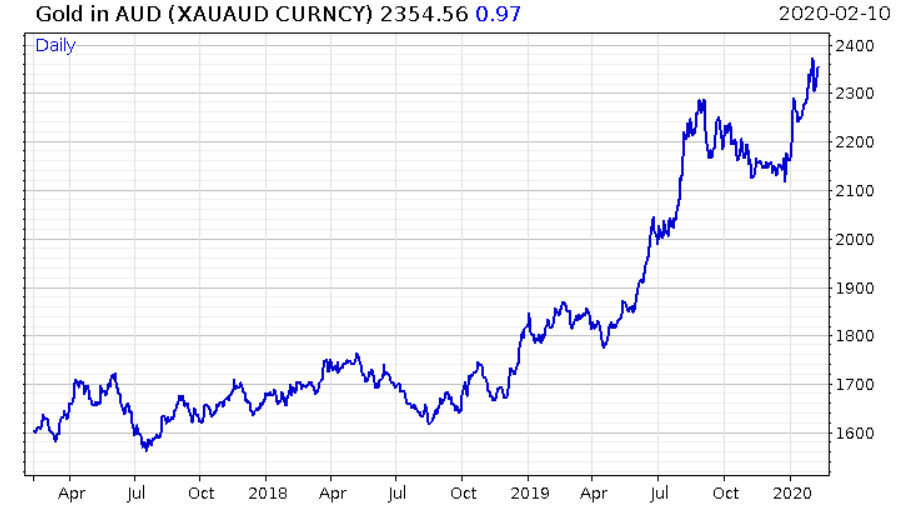

The figures are getting pretty wild in Oz:

What hasn’t yet passed its 2011 peak in the gold space, is the miners…

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates