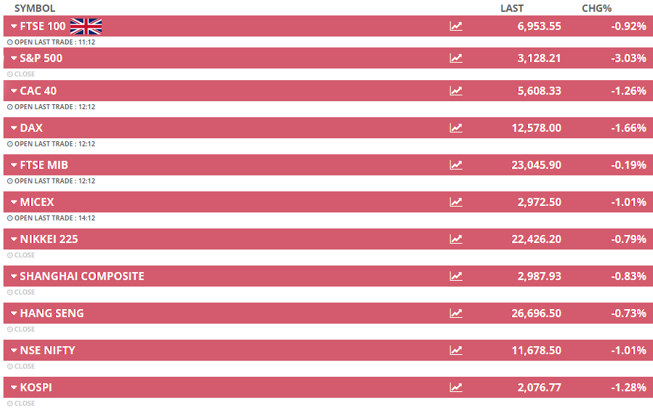

“Artist’s impression” of the global stockmarket after we buy everything the Shoshan-Hubble Inter-market Transnational Easing Scheme of 2020 is implemented and a BoE-financed foreign acquisition boom begins

“Artist’s impression” of the global stockmarket after we buy everything the Shoshan-Hubble Inter-market Transnational Easing Scheme of 2020 is implemented and a BoE-financed foreign acquisition boom begins

The British Empire, with its pink map and territory equivalent to the surface area of the moon, is no more. As we detailed on Tuesday, the UK’s imperial ambitions have become somewhat limited to the financial world. This “second empire”, based in the City of London and with key outposts in far-out islands, has become a key pillar of the financial system.

But Nickolai Hubble and I have sketched out a plan to make this empire much bigger. It’s an aggressive plan, with mighty ambitions – no easy feat by any stretch.

But armed with “the courage to act”, and a strong enough force of will, we’re confident that the UK can paint other nations stockmarkets – hell, the global stockmarket – pink, just like the imperials of old.

Sadly, this means adopting a strategy recently performed by a Frenchman. Not just any Frenchman, mind – the richest one in France. It’s the “Wolf in Cashmere” no less, one Bernard Arnault who’s done this recently, and incredibly, he’s done it to little pushback despite its implications.

In short, the European Central Bank (ECB) printed money for Arnault, which he then spent buying a major foreign competitor.

Arnault is the billionaire CEO of LVMH, the French fashion conglomerate which recently bought Tiffany & Co – the jewel of American luxury.

There’s no such thing as a free lunch. But there is such a thing as a free breakfast at Tiffany’s, thanks to the magic of central banking.

So here’s the deal: LVMH announced that it would be buying Tiffany last November for $16.6 billion. Over $10 billion of this would need to be paid by borrowing money, and it began getting into debt for this reason at the beginning of this month by issuing bonds.

The ECB has interest rates in negative territory, which led many investors to lend their cash to LVMH at negative interest. That alone makes the ECB a financial accomplice in this foreign takeover.

But it gets much wilder than that: it’s almost a certainty that the ECB printed money to give to LVMH – which only needs it to buy out Tiffany.

From Bloomberg:

It’s almost certain that a bond of this size will have been bought by the ECB (or will be picked at some point in the near future). Often the bank takes up to 20% of eligible issues, and there has been a real paucity of high-quality credit since the Quantitative Easing program kicked back into life.

That’s right: the ECB expanded Europe’s money supply to help a French fashion giant buy out the biggest American fashion company in existence. Everybody with savings in euros paid the richest man in France to buy out one of his competitors.

There may be no such thing as a free lunch, but thanks to Christine Lagarde, Madame Dinner-Lady supreme, there is such a thing as a free breakfast at Tiffany’s.

And this free breakfast really is free. While the LVMH bond the ECB bought by summoning euros into thin air is a loan… the ECB doesn’t need the money. At least one company which has owed the ECB money in the past has gone bankrupt and defaulted on the loan.

Of course, while that would be awful for an investor who’d made such a loan – it doesn’t matter to a central bank. While I’m not 100% on how legal this would be, in theory the LVMH could default on its loans to the ECB, and nothing would really happen. It’s the jewel heist of the century.

This incident is a product of the ECB’s tireless attempts to keep the eurozone economy standing: it’s called the Corporate Sector Purchasing Programme where the ECB maintains an incredible €189 billion portfolio of loans to European companies with high credit ratings.

As soon as one debt gets paid off (reducing the money supply), the ECB searches the market for another debt to replenish it (printing money to increase it). The €189 billion cap on the size of the portfolio will no doubt get bigger as time goes on and the hangover of the euro continues.

But intentional by the ECB or not, this is a subsidy on steroids. It’s mercantilism from the era of the East India Company in the modern age.

The Swiss central bank has been doing something similar for a while, where it prints francs to buy the shares of foreign companies. But it never buys Swiss companies’ shares – only ever foreign ones as it’s trying to devalue the franc against other currencies. It certainly never aids a Swiss company in buying out foreign competition.

Central banks going to war against each other, to acquire as much property and control for their own nations, with private companies as their mercenaries..?

Oh well. Don’t hate the player, hate the game.

So come on, Bank of England: get those printing presses rolling.

Come on, FTSE 100 companies: start issuing bonds by the billions, and start eyeing up your competitors. Print that money, sign those takeover bids, and let’s just buy the global stockmarket.

Let’s bring some ambition to the table.

Vodafone – you buy-out Huawei (and tell us what really goes on in there).

Unilever – buy Coca-Cola from Warren Buffett – and grab Pepsi as well. Money isn’t a problem.

BAE Systems – swallow Lockheed Martin and Raytheon.

And BP… go big or go home. Buy Saudi Aramco.

Plant Union Jacks in the Dow, the Dax, the Nikkei, the Sensex. Paint the damn market pink again for Queen, country, and to beat the French at their own game.

Ok, ok, maybe the governments of the foreign nations may have a problem with this, but it’s not like we couldn’t afford lobbyists with this programme – I’m calling it the Shoshan-Hubble Inter-market Transnational Easing Scheme. Maybe the diplomatic service can help out, and start earning those absurd defined benefit pensions.

And hey – Arnault swiped this one and barely anybody batted an eye. He just gave Donald Trump a hint ahead of time and then reassured him everything was fine afterwards. Hell, Michael Milken, who pioneered the leveraged buy-out (LBO – where a company borrows vast sums of money to swallow a rival) strategy used by LVMH just received a presidential pardon for the fraud he committed later on.

“Funding secured” as Elon Musk would say… Rule Britannia!

Wishing you a good weekend,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates