There’s nothing quite like a nice suspension of Parliament to weaken a currency.

If you’ve been trading the pound, I hope you made the right call this morning.

The strength of the pound relative to the dollar from late last night until 11am today, in ten-minute candles. While £1 was worth $1.2280 around midnight, by 8.30am it was around $1.2155. May seem small, but the currency market is the largest in the world, and large moves in mature currencies require significant volume. Chart courtesy of FXStreet.

The strength of the pound relative to the dollar from late last night until 11am today, in ten-minute candles. While £1 was worth $1.2280 around midnight, by 8.30am it was around $1.2155. May seem small, but the currency market is the largest in the world, and large moves in mature currencies require significant volume. Chart courtesy of FXStreet.

Boris Johnson really has been doing his bit to create inflation in this country.

Central bankers should take note – Lord knows they’ve been trying their damnedest to bring it about in the developed world, but to no avail.

For over a decade they unceasingly strive devalue the currencies, and inflate away the debt burdens which hang heavy on their nations. But their successes are limited. The only thing that seems to have meaningfully inflated in line with their efforts is the net worth of bond investors… the price of property downtown… and the number of Rolls-Royces purring through Mayfair.

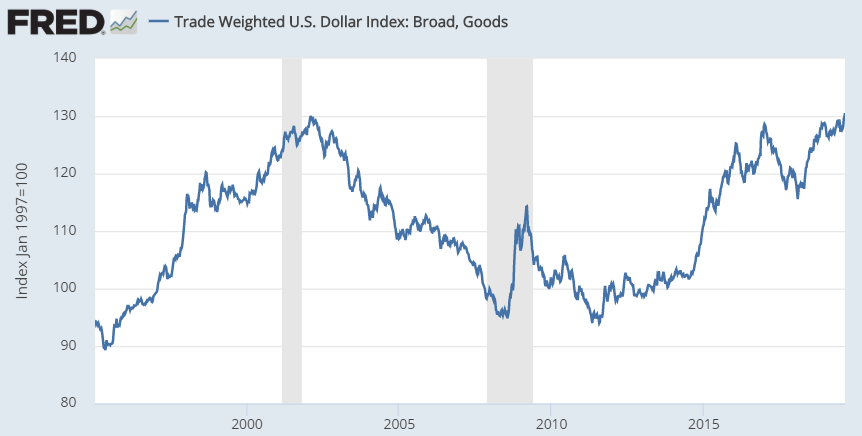

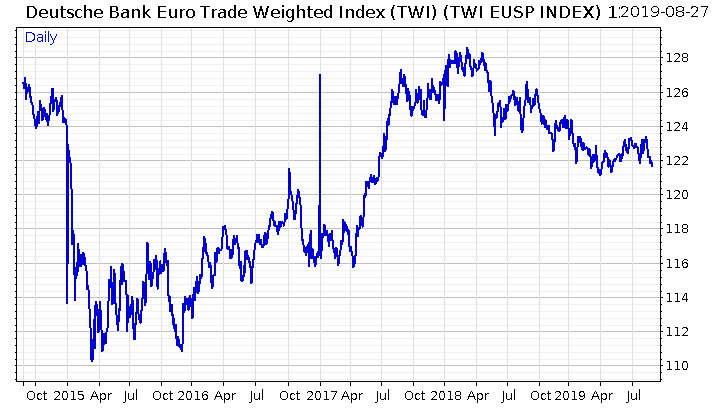

But the currencies of developed nations on a trade-weighted basis (TWI) have not got any cheaper.

(TWI = the value of a currency when measured against the currencies of the other nations they trade with most often. The higher the trade weighted index, the stronger the currency.)

The almighty dollar has never been stronger…

Though the crushingly indebted Italy cries out for a weaker euro, the FX market is not nearly so kind.

And though the masters of the yen in the Bank of Japan have been playing this game of devaluation, they continue to fail.

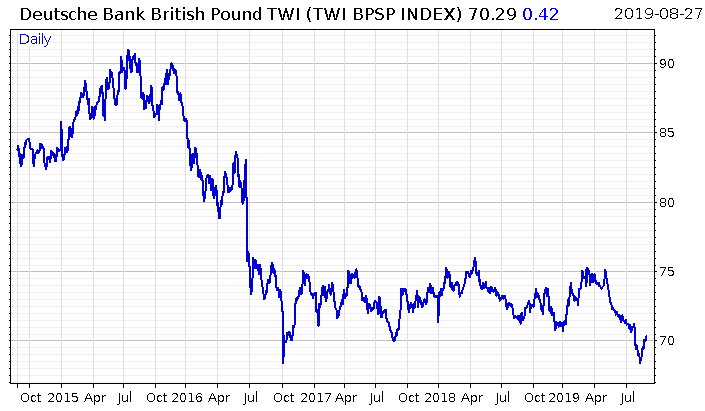

But lo, Boris Johnson, taking macroprudential matters into his own hands, continues to deliver sterling results. Literally.

Bear witness to Britannia, the international exception:

We’ve discussed some of the more imaginative ways in which a central banker may try to devalue their currency in a pinch. Mark Carney strutting around the City with a naked sword in his belt (as is his right as a Freeman of the City of London) and not explaining it to anybody was one such approach.

But Boris Johnson has proved that while central banks are tasked with generating inflation, in reality this is a politician’s game and we can comfortably rely on the government to unceasingly deliver it, whether we like it or not.

It’s no surprise considering the above that the price of gold in pounds is once again hitting new all-time highs.

A 1 troy ounce gold Britannia, which for so long cost a grand, will now set you back over £1,300. Britannia, former ruler of the waves, has since become a leader of British investment performance in retirement.

While central bankers may fail to meet their mandate, politicians stand ever willing to step into the breach. Which is why I hereby nominate Boris Johnson as Central Banker of the Year 2019.

God Save the Queen.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates