“You Americans don’t smoke anymore. You live long, dull, uninteresting lives.”

– Black Hawk Down

A Blackhawk helicopter over Iraq. Source: WikiCommons

A Blackhawk helicopter over Iraq. Source: WikiCommons

It’s strange to think that once January comes around, all the kids born in this country when Black Hawk Down was released will be able to vote.

How times change. The Americans may not smoke any more – but they do vape. And while they still live long lives, life expectancy in the US has been decreasing for the last five years.

And the eponymous helicopter of the film has changed too: a new variant will be released that will be “optionally manned”. From Military.com:

Sikorsky has two goals in mind for its optionally manned S-70 helicopter: to make the autonomous technology easy to retrofit on existing aircraft for users like the U.S. Army, and to give pilots various modes of autonomy so they can commit more time toward their mission, according to company officials.

Sikorsky’s original S-70 helicopter model would become the Army’s UH-60 Black Hawk and spawn a family of helicopters used by multiple military services.

The company, now a subsidiary of Lockheed Martin Corp., this week said it’s progressing through its flight test program by incorporating more autonomy software and sensors onto the aircraft, with a fully autonomous flight projected sometime in 2020, said Igor Cherepinsky, Sikorsky Director of Autonomy…

Chief test pilot Mark Ward said the S-70 optionally piloted vehicle (OPV) has recorded 54.5 flight hours thus far on the flight control system. “And we’ve cleared the flight envelope to … 150 knots indicated airspeed,” Ward said during the phone call.

That’s about 172 miles per hour.

The key now is to move seamlessly through varying piloted modes, “from the pilot 100% in the loop to autonomy [at] 100% and … to everything in between,” Ward said.

We wrote last week about how drones are becoming much larger as well as smaller (Why is everything a reboot or a sequel? – 10 October). The optionally manned Blackhawk is another example of a drone which does not appear as alien as the word “drone” implies, for it wears an old and recognisable face.

This autonomous technology is almost like a zombie virus or a possessing entity that reanimates old machines. Perhaps the self-driving cars of the future won’t look like futuristic Teslas as everyone expects, but will actually be old Ford Focuses, dredged from the scrap heap…

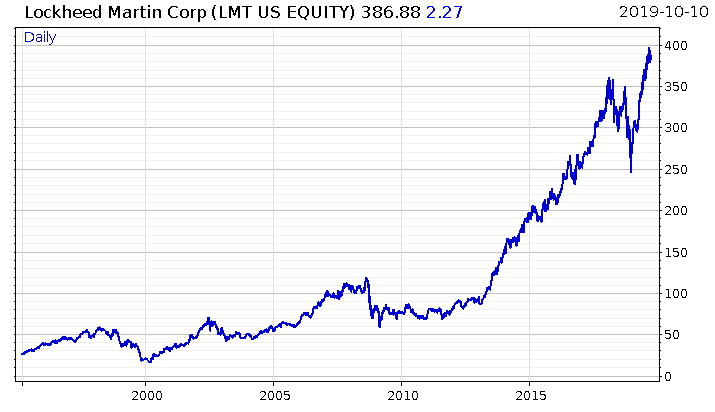

Nick O’Connor, our publisher, asked me for some charts of defence stocks recently, to illustrate military spending’s impact on the performance of military companies. While there were plenty of candidates, Lockheed takes the cake, straddling not only the War on Terror and now Cold War II, but the share buyback complex as well.

Marilyn Hewson, Lockheed’s CEO, was recently named by Forbes as the most powerful woman in the world. She’s certainly a force to be reckoned within the stockmarket – since taking the role in 2013, she’s more than tripled the company’s market cap. It was under her leadership that the company acquired Sikorsky, who make the Blackhawk. And there’ll be plenty more drone contracts flown its way…

Marilyn Hewson, Lockheed’s CEO, was recently named by Forbes as the most powerful woman in the world. She’s certainly a force to be reckoned within the stockmarket – since taking the role in 2013, she’s more than tripled the company’s market cap. It was under her leadership that the company acquired Sikorsky, who make the Blackhawk. And there’ll be plenty more drone contracts flown its way…

The capital that will build the drones of the future is being allocated today

There’s a constant flow of cash going into drone technology; it’s pouring in as though from a hose, especially from the US military.

US.mil awarded Boeing a $7.5 million contract for product and hardware support for unmanned aerial systems… General Atomics a $15.5 million contract for unmanned aircraft support services and a $8.9 million contract to improve nine of its drone control stations… the University of Mississippi a $12.6 million contract for “High Performance, Low-Acoustic Signature Unmanned Aircraft System Operations”… and White River Technologies a $635,680 contract for a demonstration of an unmanned aerial vehicle magnetometer system.

And that’s just the US, in just one week. I’ve been monitoring this for months, and there hasn’t been a week where million-dollar contracts aren’t being signed left and right.

The prospects of drone proliferation, especially of the military variety, is an ominous one. But it’s a trend that investors should be well aware of – it will only grow stronger, and the companies at the forefront stand to markedly increase the wealth of their investors.

A Capital & Conflict reader wrote to me last week highlighting my scepticism for government spending, while at the same time how much I write about military development:

… you’re sceptical of governments. Ok, agreed. Except, it seems, when it comes to developing technology for killing people. You advocate for military expenditure due to the technology gains which then trickle into the private sector. Why trust them to do that, but not other forms of activity typically left to the private sector? Govt medical R&D bad, but govt WMD R&D fine?! That seems inconsistent, no?

I don’t advocate for military expenditure. I merely see it coming on the horizon, in very large quantities; those drone contracts are the tip of a very large wedge. And in the context of a great power struggle between East and West, I expect that military expenditure to do what it has in previous great power struggles: lead to technological breakthroughs that trickles into the private sector and changes the world.

The only thing I “trust” the government to do is act in its own self-interest, which in this context means to compete against foreign governments in order to survive. Since the fall of the Berlin Wall until relatively recently, the threat of a hostile great power like the USSR wasn’t perceived to be there.

The government has instead poured taxpayers’ money into projects with less… innovative applications, like giving hundreds of people jobs as “diversity officers” in the NHS. The Cold War at least gave us the internet; perhaps something similar will come of the diversity officers, but somehow I don’t feel very confident about it.

It’s worth noting that military R&D has a medical component to it anyway, and that “govt medical R&D” can mean exactly the same thing as “govt WMD R&D”.

Take China’s interest in genetic medicine for example. There’s a country which certainly likes its medical R&D, though perhaps not for the reasons everybody would suspect:

Maj. Gen. He [of the People’s Liberation Army] has anticipated that “Modern biotechnology and its integration with information, nano(technology), and the cognitive, etc. domains will have revolutionary influences upon weapons and equipment, the combat spaces, the forms of warfare, and military theories”. Consequently, pursuant to this new “Revolution in Military Affairs,” success on the future battlefield will require achieving “biological dominance,” and this “biological frontier” of warfare will emerge as a new domain for new methods of confrontation…

“Obviously, genetic weapons possess many advantages over traditional biological weapons,” as one researcher from the Academy of Military Medical Sciences has argued. In particular, the weaponization of CRISPR is expected to prove more lethal and more precise in ways that could cause major changes in the dynamics of future warfare, despite the risks that would be inherent in its employment and the current limitations of this nascent technology. In the long term, genetic weapons are anticipated to have more of a “strategic deterrent function,” and the AMMS researcher has warned that “willful abuse of genetic weapons will bring unpredictable disasters to all mankind”. Such theories and speculation about future capabilities could become actual possibilities for the PLA pursuant to academic and commercial research that is currently underway.

Right of reply, as always to [email protected].

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates