What a week it’s been.

Yesterday, Jerome Powell at the Federal Reserve told the Senate Banking Committee that they should not assume that the US dollar will remain the world’s reserve currency, and that bitcoin was a store of value – both highly incendiary claims in their own right.

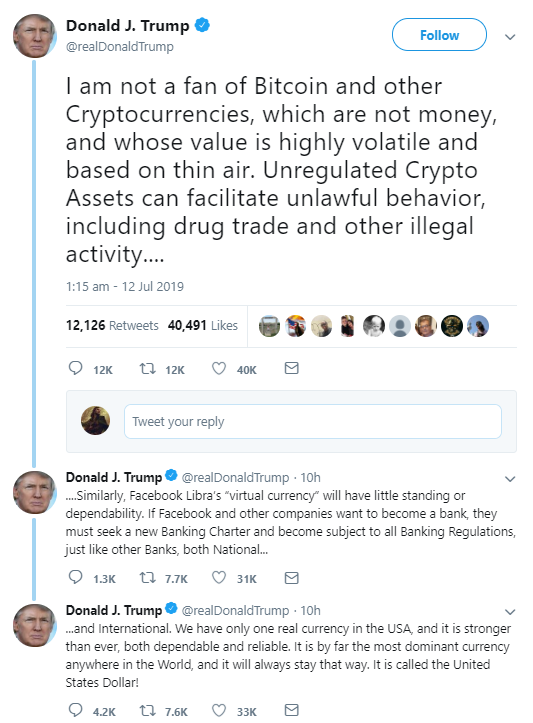

And then just this morning, we get… this:

What a thoroughly entertaining year 2019 is shaping up to be.

The US president used his Twitter account to extol the strength of America’s “cherished DOLLAR” in the past, railed against the “devalued” euro, and continually attempted to goose the stockmarket higher with it, but this marks the first time the crypto world has been honoured with such a tweet.

Trump’s attempt to, to use internet slang, “cancel” bitcoin, has not done much to its price. But his use of the term “Unregulated Crypto Assets” is notable. This may be a signal that such “UCAs” will be declared contraband at some point in the future: “Render unto the government the UCAs, and you will not be prosecuted”, etc. The contrast between the views of the president and his central banker illustrate the increasing politicisation of money, something we’ll be writing more about next week.

But in the meantime, let’s look under bitcoin’s bonnet. For though the BTC price has been all over the place this last week…

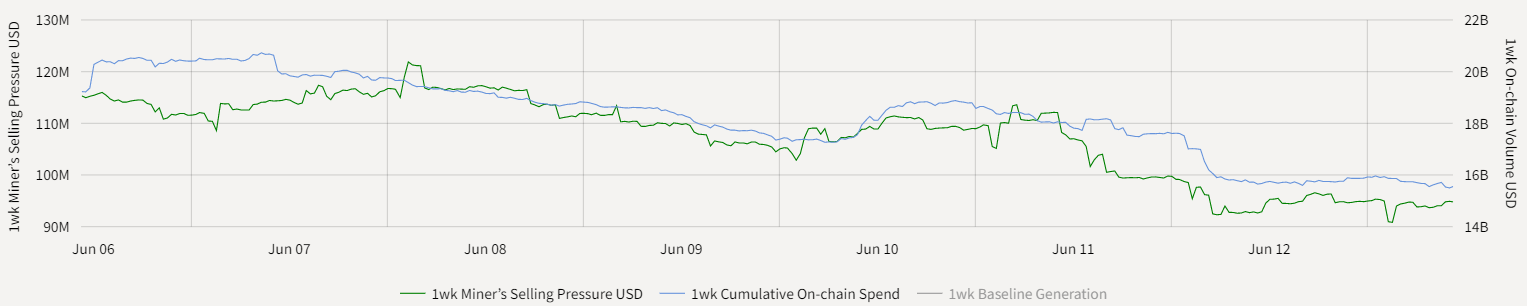

With miners restricting market supply to support its price…

Bitcoin’s presidential recognition has coincided with the network hitting a key level, which believe it or not, may indicate that its $11.5k price tag is currently undervalued…

The only metric that matters?

Charlie Morris over at The Fleet Street Letter has taken his skills as a multibillion-dollar multi-asset fund manager, to cryptocurrencies, or as he would call them, “digital assets”.

Charlie reckons cryptocurrencies are really social media stocks on steroids, and can be valued as such by measuring their network effect. The greater the participation in the network, the greater their value. And as cryptocurrencies like bitcoin are public ledgers, that participation can be measured in minute detail, by anyone.

Charlie takes all the data produced by the almighty bitcoin blockchain and distills it down into various metrics, and he believes one such metric is absolutely key to knowing whether bitcoin is over or undervalued.

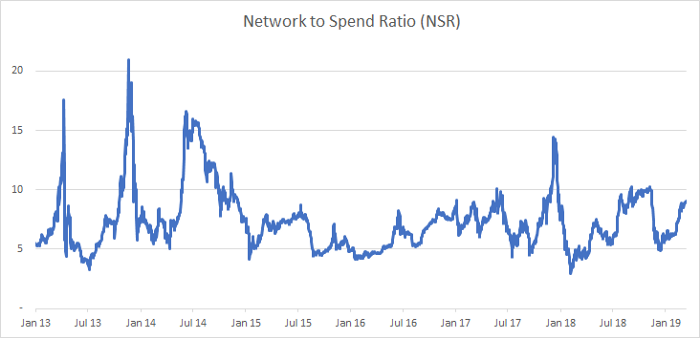

Meet the innocuous sounding Network to Spend Ratio, or NSR. Put simply, this is a measure of how high the market is valuing bitcoin, relative to how much people are actually using it. If the market is pricing bitcoin highly, and yet little value is being transacted across the network, this is a sign that BTC is overvalued. Conversely, if much value is being sent across the network, but the bitcoin price is low, this would indicate that BTC is undervalued.

In practical terms, the NSR is a display of how many past weeks of bitcoin transactions (in dollars) you would need to add together to reach the current value of the entire bitcoin network (“the market cap” of bitcoin – BTC price multiplied by the number of bitcoin in circulation).

So for example, if the market cap of bitcoin was $80 billion and $10 billion of BTC was changing hands each week, then the NSR of bitcoin would be eight weeks.

Historically (though it feels strange to use that term in relation to bitcoin), the NSR has averaged 6.5 weeks:

NOTE: Charlie published this chart in March, so it’s missing the most recent data – the NSR zoomed above 13 after this before crashing down. Source: ByteTree

NOTE: Charlie published this chart in March, so it’s missing the most recent data – the NSR zoomed above 13 after this before crashing down. Source: ByteTree

If a 6.5 week NSR is bitcoin’s fair value, then an NSR below that indicates bitcoin is undervalued, and above that, indicates it’s overvalued.

It should be noted that this doesn’t work every time however – the NSR has given a few false signals, like in February 2018, when the NSR indicated BTC was cheap, and BTC got hammered for the rest of the year. It should be treated as an anchor rather than as gospel.

The NSR today? At the time of writing, 6.41 weeks. If the NSR is correct, BTC standing at an incredible $11.5k, is still undervalued (albeit slightly).

It’ll be interesting to see what presidential recognition does to the BTC price. You can keep track of the NSR yourself at Charlie’s website here – just scroll down to “Valuation”. I know I’m not gonna stop checking it any time soon…

Have a great weekend!

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates