At the beginning of last year, a member of Trump’s National Security Council leaked a deck of PowerPoint slides to the press which had been presented to senior Whitehouse officials.

In order to counter the rise of China, the presentation argued, a radical solution would be required: nationalise the US mobile network and ramp out a 5G network in 3 years.

Networks, it claimed, are where the main battle for supremacy against China will be fought:

Source: US House of Representatives Committee Repository

Source: US House of Representatives Committee Repository

A Cold War with 21st century characteristics will stage many of its battles not in the four domains of land, sea, air, or space, but in the fifth domain: information. This is “the information age”, after all.

Allowing an adversary to control the plumbing of that information – eg letting Huawei set up your 5G network – is obviously out of the question, something which has not changed since we first said it almost a year ago now in A goose in the crossfire (13 December 2018).

But considering this memo was leaked in 2018, if they want nationwide 5G by 2021, they’ll need to get a move on – they’ve not even nationalised the mobile networks yet!

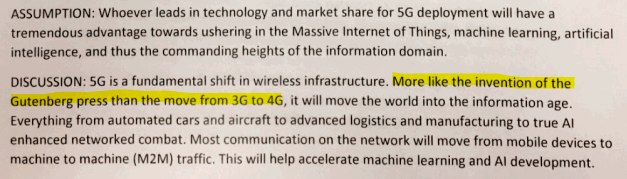

Who knows how much traction the idea got, but the presentation provides some interesting insights into how high-ranking members of the US national security establishment view 5G technology:

The slide deck was titled “Secure 5G: The Eisenhower National Highway System for the Information Age”, making an overt comparison of Eisenhower’s construction of the interstate highways which put many Americans to work and created the infrastructure which then facilitated an economic boom.

Such comparisons would be unlikely to provide solace to the telecom providers targeted for nationalisation, but of course they have no choice but to comply. As market philosopher Ben Hunt describes Edward III’s bankrupting of Italian banks to finance his wars, “a sovereign’s gotta do what a sovereign’s gotta do, and private capital just has to deal with it”.

But that doesn’t mean there are no ways for private capital to profit from the situation. With 5G clearly a nation security priority, and coming our way via one path or another,

The sun also rises

However, this Cold War will not only be a digital struggle – the more traditional avenues for state-on-state confrontation are emerging too. And these come with their own investment potential.

Brightly coloured balloons aren’t the first thing that comes to mind when I think of submarines, but the Japanese think they go together just swell:

Source: Kawasaki Heavy Industries

Source: Kawasaki Heavy Industries

That’s the Toryu, a Soryu-class submarine being launched two weeks ago – the latest addition to Japan’s “Self-Defence” force.

It’s not nuclear, but diesel-electric – nice and quiet for sneaking around the Pacific coast of Asia and stalking the Chinese navy. Toryu too comes with 21st century characteristics – in this case, lithium iron batteries. Japan is the first country in the world to implement such batteries in their subs, which allow them to patrol for longer. All the other nations which can afford the luxury of a submarine force is still using the less efficient lead-acid batteries.

The re-militarisation of Japan is coming – the rise of China makes it almost certain. And it’s a trend you can invest in – a topic Nickolai Hubble and I wrote about in The Fleet Street Letter Monthly Alert earlier this year.

But such a development will disturb waters that have long been still – and nobody knows what damage the ripples might do. I spoke to an ex-Singaporean Naval officer earlier this week, a gentleman who now works for the Singaporean Economic Development Board. He was in town to promote Singapore and it’s vision of the future to City types, but I was curious to know how much he thought economic growth in the region was underpinned by maritime stability – and what Singapore’s plan would be to maintain that stability.

Having hung up his military cap, he couldn’t tell me much in the way of strategies that Singapore may pursue – but I can tell you, he sure as hell wasn’t happy about Rising Sun Flags spreading across the Pacific…

Wishing you a good weekend,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates