November already, huh? It feels like this year has flown by even faster than the last.

With the nights drawing in and the Christmas trees nearly upon us, it’ll soon be time to reflect on the past year. How will 2019 be remembered, I wonder?

Year of our discontent

Oh, baby, baby, it’s a wild world

And it’s hard to get by just upon a smile…

– “Wild World”, Cat Stevens (1971)

So far this year, we’ve seen massive protests in (clears throat):

Algeria, Bolivia, Bosnia, Brazil, Chile, Colombia, Ecuador, Egypt, Ethiopia, France, Haiti, Hong Kong, Indonesia…

(inhales)

… Iraq, Lebanon, Peru, Russia, Serbia, Spain, Sudan, Uganda, Ukraine, Venezuela and Zimbabwe. Not to mention the polarisation here in Blighty caused by Brexit.

But have no fear, dear reader. Yusuf Islam (or more commonly known by his stage name Cat Stevens) is here to help. No, really – he’s brought a Peace Train and everything:

Thomas the Tank Engine, Woodstock edition goes viral in Turkey

Thomas the Tank Engine, Woodstock edition goes viral in Turkey

Source: BolgeGundem.com

Yes, that isn’t photoshopped. I wonder what Recep Tayyip Erdogan was thinking right as that image was taken…

But all joking aside, while the status quo is being ripped to shreds around the world, investors have been able to “get by just upon a smile”.

While 2019 started on a low after a brutal 2018, it’s now on track to end on a roaring recovery:

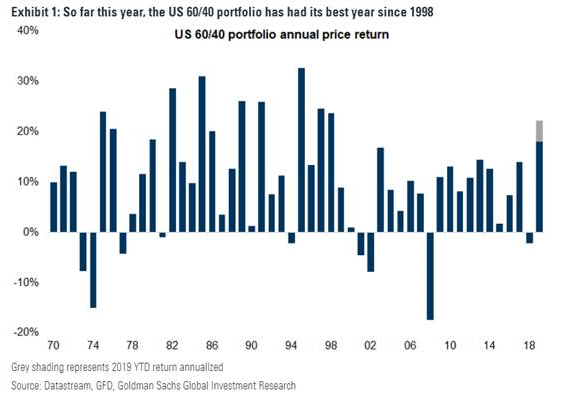

And US investors following the classic 60/40 pension portfolio, where 60% is invested in stocks and 40% in bonds, haven’t had it this good since 1998:

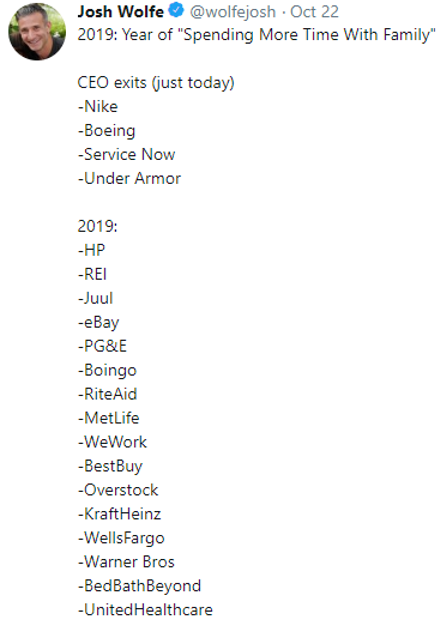

And that’s despite CEOs dropping like flies. To “spend more time with family”, of course, as venture capitalist Josh Wolfe wryly noted on Twitter recently:

… and that’s just the folks who’ve left.

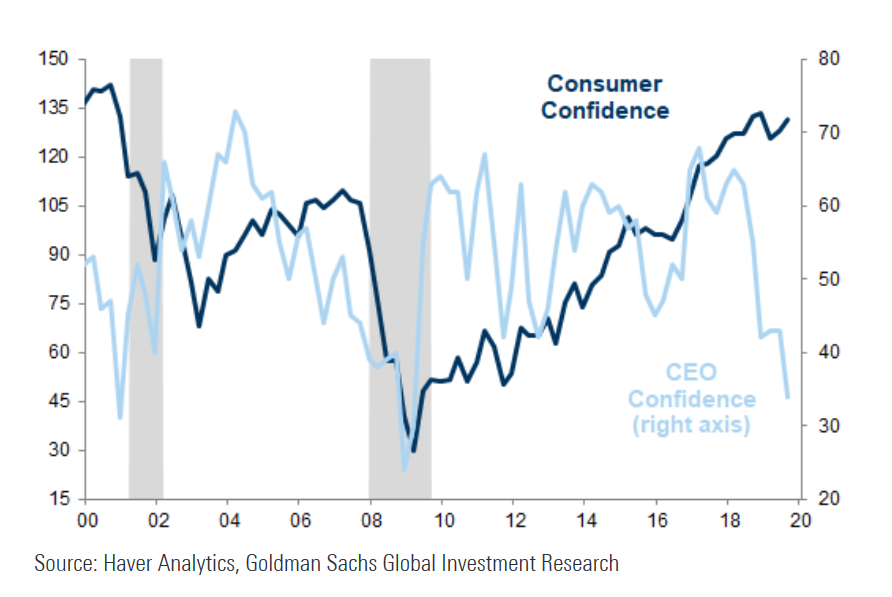

The CEOs who remain are feeling damn pessimistic, in stark contrast to consumers, who’re walking on sunshine. CEO confidence isn’t far off 2008/9 levels right now, and while consumer confidence back then had been similarly kneecapped, right now it’s at giddy levels:

Who is right? The executives or their customers? Time will tell us, though right now I reckon the consumers have it right. As frequent readers will know, I reckon we’ll see one last hurrah, a brutal, cathartic melt-up out of this market before it cracks.

One last thing before I leave you for today. Here’s that first chart again, of the MSCI world stockmarket index. Does anything about the last few years jump out at you?

Something did for me.

It’s that almost perfect line-up in the middle. It could’ve been drawn by a drunkard with a setsquare. 2017 was a truly remarkable year for the global stockmarket:

It’s no surprise that during such a steady and seemingly benign boom that the most adventurous asset class of all – crypto – went nuts.

Right now, my best bet for how 2019 will be remembered in markets is as a repeat of 2016. Throughout the year I’ve commented on the similar events that occurred this year and back then: government bonds roaring to previously unbelievable prices, corporate bonds being similarly pushed to realms never before conceived; gold getting a decent jolt upwards; and bitcoin getting a boost too, as the US stockmarket continues its ascent. And all of that with increasing wealth inequality and political unrest in the background.

If 2019 ends as a rerun of 2016… will 2020 be a rerun of 2017, and the drunkard return with the setsquare to draw another straight line upward for asset prices?

With central banks returning to the printing press, I’m warming to the idea. It is a cynical trade – really just a bet on our monetary overlords continuing to hose cash into the financial system and successfully drowning all dissenters.

But we’re a way off yet – there’s still a couple months left of 2018, and last year’s Christmas Eve was the worst on record for some. But then again, perhaps that will get the central banks to do their upmost and get the “Peace Train” going full speed ahead beforehand…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates