Now we buy bonds for capital appreciation, and stocks for yield!

– Kyle Bass, hedge fund manager

Outside the European Central Bank (ECB) in Frankfurt stands a massive artificial tree.

Named “Gravity and Growth”, this sculpture built of brass and granite stands almost 60 feet tall. It towers over the manicured real trees nearby.

The fake tree is a pretty apt metaphor for the eurozone, in that all of the leaves are concentrated together in the wrong place, and there’s a heavy ball crushing down on the whole thing from the top.

“In times of austerity we think it is important to spend money on art because it is a unifying theme between countries,” said an ECB spokeswoman when the tree was erected in 2015. “It is not about decorating the headquarters, it is about helping the cultural world.”

The ECB spends millions on contemporary artwork, with a collection of over 480 pieces. It’s plenty of money to spend, after all. It even commissioned an app in which you can view its collection.

Forget front-running its next stimulus programme and buying the bonds the ECB is about to purchase, the shrewd investor should start bashing together some garbage, call it “contemporary art” and flog them that instead. Considering the bonds will pay you less than nothing, your “artwork”, paying nothing, begin to look much more appealing.

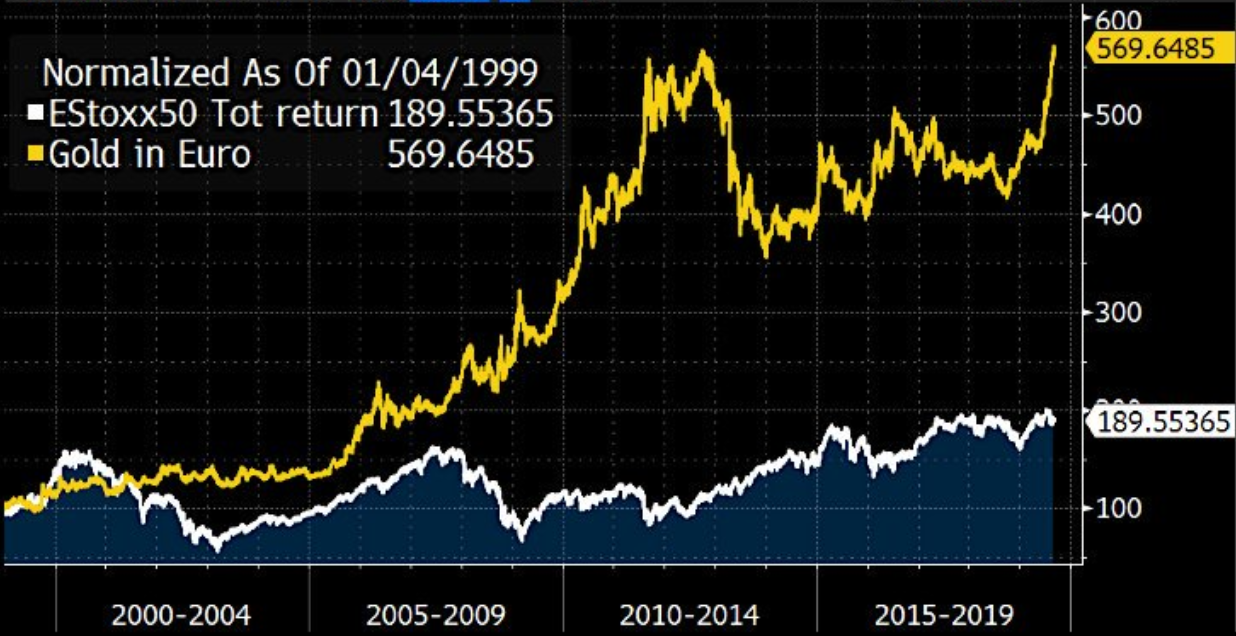

Assets that pay you nothing are in high demand in the eurozone, for just this reason. European investors who shunned gold as a “pet rock” have been absolutely destroyed by those who simply bought and held gold since the formation of the euro.

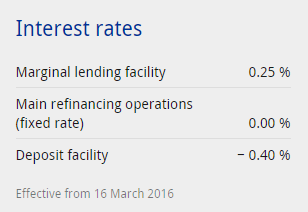

Source: Holger Zschaepitz on Twitter

Source: Holger Zschaepitz on Twitter

Note that that’s the total return of the EuroStoxx 50 in white there.

If you invested in the 50 biggest and most liquid companies in the eurozone, and reinvested all of the dividends for 20 years…

… you’d still end up looking like a big girl’s blouse compared to the investor who just bought and held an inert piece of shiny metal dug up from the ground over the same period.

Pity the Eurostoxx investor. For two decades, they’ve been feeling a hell of a lot of gravity, and barely any growth.

With ECB incumbent Christine Lagarde making comments like…

“All things considered, in the absence of unconventional monetary policy adopted by the ECB – including the introduction of negative rates – European citizens would be, overall, worse off.”

And…

“I don’t believe that the ECB has hit the effective lower bound on policy rates.”

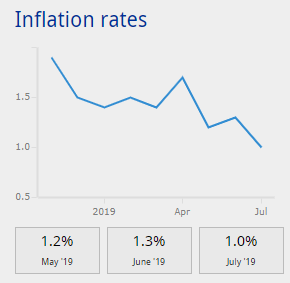

… while ECB policy rates look like… well, this:

And with inflation in the eurozone falling despite all of these efforts…

… forming an image of the sheer scale of the rate cutting and money printing to come becomes a test of the imagination.

Perhaps the ECB will pity the Eurostoxx investor as we do, and begin buying stocks to make them feel better, so that they can start spending some of this freshly printed faux wealth and actually generate some inflation, goddammit.

Whatever the case, in a world where the very notion of receiving interest has been turned upside down, inert metals dug up from the earth which you can hold in your hand begin to look very shiny indeed.

Consider the absurdity that German government has this year earned €6 billion, not from raising taxes, but simply from the interest which it earns on its own debt. Feel free to read that sentence again.

There’s plenty of money to make playing with these market absurdities. But the investors who favour the real

But play your cards right, and it’s possible to be rewarded by the ECB for something both real and absurd…

A fool and his money are soon parted

That fake tree I mentioned was one of three pieces of artwork commissioned by the ECB in 2014. Another was a mathematical function printed out in large 3D lettering.

The third was an artist overtly rinsing the ECB of its money.

Nedko Solakov sold the ECB a basic aluminium plaque, which says this:

A Site-Specific Piece on Standby

On this very spot, a glorious site-specific artwork will be erected, which will effectively visualise three of the most important qualities of the European Central Bank—its stability, independence and flexibility. Created by one of the most significant European artists working today, the artwork* will be installed at a specific moment in the future when we—all of the employees of ECB—have definitely achieved all of our goals, when all the tasks on our agenda are entirely fulfilled, when we are all completely satisfied with what we have done, are doing and will do for the common benefit of The European Union.

*The work is planned to be 53 meters high, almost reaching the ceiling above your head.

On the subject of when the ECB will receive the promised work, Solakov had this to say:

“This will of course never happen because a serious institution is never satisfied,” he told Reuters. “I just let the people imagine what the sculpture would look like.”

Those three works of art were paid for by the ECB with a pre-allocated budget of €1.25 million.

Solakov got a fat slice of that… for an aluminium plaque. Nice work, if you can get it.

A project in construction which costs a fortune… promises to deliver a glorious end result… but which exists only in the imagination.

It’s no wonder the ECB bought the work – Solakov’s aluminium plaque embodies the dream of the euro.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates