I’ve something special for you this fine Sunday. While you don’t normally receive my daily notes here at Capital & Conflict over the weekend, today we’re making an exception – we’ve received some valuable intelligence straight from “Corona-land” that’s worthy of your time.

The letter below is from my colleague Richmond Hess, who scratched it out on the flight back from Taiwan. Thankfully, he’s not come into the office yet – he is, after all, a potential super spreader of the virus (his words not mine). Nickolai Hubble has a cough at the moment, and it’s certainly not helping his popularity…

More importantly, he offers you an insight into what’s going on in South East Asia right now – and just how deeply it’s affecting the economic engine of the developed world. A great risk for us all, certainly – though perhaps an opportunity for some wily investors…

I’ll let him brief you on the details.

Hope you’re enjoying the weekend,

Boaz Shoshan

Editor, Capital & Conflict

An unvarnished account from a could-be super spreader

Richmond Hess

My name is Richmond Hess. I am a researcher and writer here at Southbank Investment Research. And I am writing this letter to you from international airspace.

Specifically, I’m aboard China Airlines flight CI69 from Taipei, Taiwan, to London Gatwick. I’ve just spent the best part of a month in Taipei. A city that the coronavirus has sunk its teeth into.

I was supposed to board this plane four days ago. But due to the outbreak, I had to “self-isolate”. That meant missing my flight. I also doubt I’ll be particularly popular at the office on Monday morning.

I’m taking the reins here today at Exponential Investor to give you a “boots-on-the-ground” account of what’s happening out here. And what the carnage going on in Asia could mean for your wealth.

As you’re about to see, my background is unlike most mainstream analysts. So at the least, this letter will give you a view that’s different from the status quo. At the most, it could help you profit handsomely from this “Black Swan” event.

Before joining the Southbank Investment Research fold, I ran a company that manufactured medical devices. We sold approximately 70% of our products to China.

For the best part of ten years I travelled back and forth between Cambridge and Beijing. During that time I set up manufacturing operations in Qingdao on the east coast. And Guangzhou, a short hop north from Hong Kong, in the south.

The rest of the time I spent developing products with our partners. And selling our equipment to vaccine manufacturers all over the country. (Read: drinking Baijiu – a 70%-proof, fermented rice wine – with Chinese businessman until the early hours. I’m confident it shortened my lifespan considerably.)

After a decade in Asia I signed a distributorship with the largest poultry producer in China. This allowed me to escape my Chinese hamster wheel. I now spend my time doing what I love… researching and writing about financial markets!

So where do I start?

First, are the mainstream media, the Chinese and the World Health Organisation painting an accurate picture of what’s going on out here?

I’ll let you decide for yourself.

As I mentioned, I’ve spent the past month in Taipei, the capital of Taiwan. (For the uninitiated, China considers Taiwan part of China. Taiwan and pretty much the rest of the world consider it a state of its own.)

We also took a short trip to Thailand. This is where I had my first “corona-connected” experience. A stark reminder that if society were to break down, it’s you against the world.

On the plane back, a man was violently coughing and spluttering. All of the passengers in his immediate vicinity asked to move to different seats. Eventually he had a whole row to himself plus the rows in front and behind him.

It really is every man for himself.

And that feeling seems to be spreading to the UK, too.

A few days ago I saw this pop up on social media.

Back in Taipei, it’s a ghost town. Below is a snap of Taipei 101 (formerly the tallest building in the world), slap bang in the centre of the city. At the weekend this place is usually a sea of cars, tourists and shoppers. This is the Oxford Street of Taipei.

But on Saturday afternoon, almost no one.

(The left is pre-outbreak. The right is post.)

In fact, it seems the entire population has relocated to pharmacies. Where queues of people are bursting out of the doors.

And this is despite the government enforcing a rationing system that restricts citizens to buying two masks every 7 days.

Now the thing is, Taiwan has just 18 confirmed coronavirus cases. A drop in the ocean compared to mainland China’s 40,000 confirmed cases.

So I decided to do a little digging to see what things are like closer to the epicentre. And it appears the situation is far worse.

According to friends in Beijing almost everything in the city is closed. Cinemas… gyms… shops… bars. The whole kit and caboodle.

Another friend of mine heads up the British Chamber of Commerce in China. He let me in on a study his team carried out into the impact the virus will have for British businesses in China.

It doesn’t make for pleasant reading.

97% of respondents to the study report a negative impact on business due to the virus, with 54% reporting that impact as significant.

Another study carried out into the impact on the wider Chinese economy as a whole stated the worst-case scenario is China’s GDP will slow by 1.5%.

So how is this affecting the global economy? And crucially, does this create an opportunity for us as investors?

Well, if you know where to look, those questions answer themselves.

China is the engine of the global economy. Making up 20% of global GDP. It also swallows up more oil, copper and steel than the rest of the world… combined. So the first place worth looking is the commodities markets.

Well, copper just hit a three-year low. Brent crude : a 13-month low.

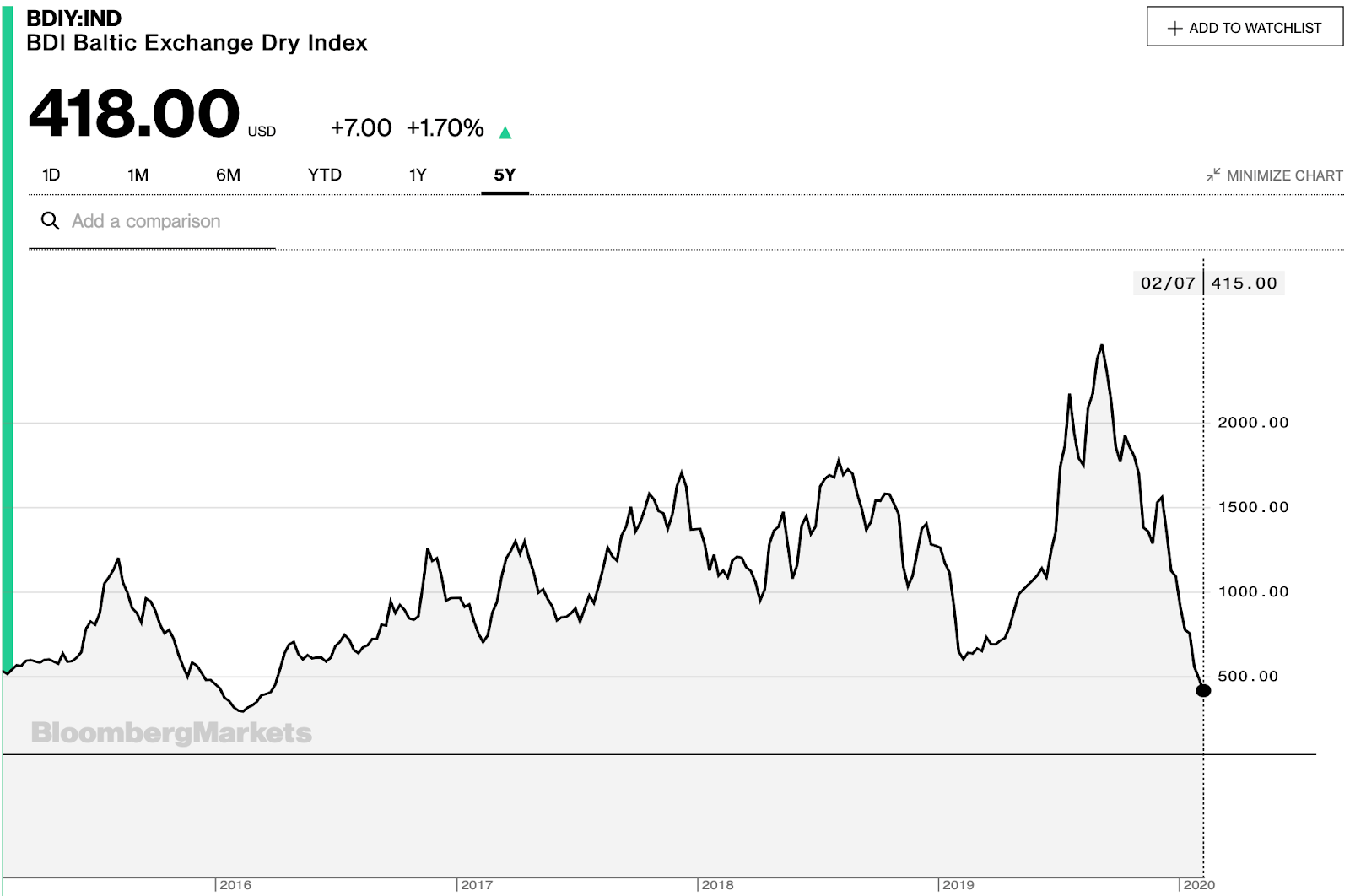

But for me the next chart is the real kicker.

Take a look at the Baltic Dry Index – a bellwether for global shipping rates.

As you can see, it has plunged 83 % from its all-time high just five months ago.

For my money when first quarter earnings rolls around in April a lot of companies will announce they’ve taken a hit.

But here’s the silver lining. And it all has to do with investor psychology.

If those first quarter earnings reports do fall flat on their face, investor fear could kick in. And that could cause valuations to divorce themselves from fundamentals.

We’ve seen what that looks like on the upside in the last few days with Tesla’s almost vertical move.

But come earnings season, we could see it on the downside in a big way.

And if you’re of the persuasion that the authorities will eventually screw a lid on this outbreak, that could create a huge buying opportunity. (.)

If you’re not of that persuasion… well, I’d wager we’ve all got more to worry about than numbers on the ticker tape.

Best,

Richmond Hess

Southbank Investment Research

Category: Market updates