Boaz here again. I’ve just finished working on a brand new project with Nick Hubble in our studio, which you’ll hear more about next week.

I hope you enjoyed Nick O’Connor’s thoughts on gold while I was away but today I’m back to finish our “Golden Age” series; this will be the last instalment (for the moment anyway).

While there are hundreds of moving parts inside the gold market, in this series we’ve been focusing on one of its strongest levers: “real” interest rates. When it is pulled down, the price of gold rises, and when it is pushed up, gold falls.

Two hands grasp the lever of real interest rates. And I believe both will be yanking that lever sharply lower in the near future, especially when the next economic downturn inevitably arrives.

Those two hands I’m referring to are nominal interest rates – which I expect to go lower – and inflation – which I expect to go higher.

On Tuesday, I made my case for much lower interest rates, enforced by central banks.

Today I’ll make my case for much higher inflation – enforced by government.

Fiscal Froth

Despite all of the monetary stimulus injected into financial markets “the economy”, central banks have not been able to create a lasting recovery. The “sugar highs” of monetary stimulus wear off fast, and create a longing for ever larger “sugar hits”.

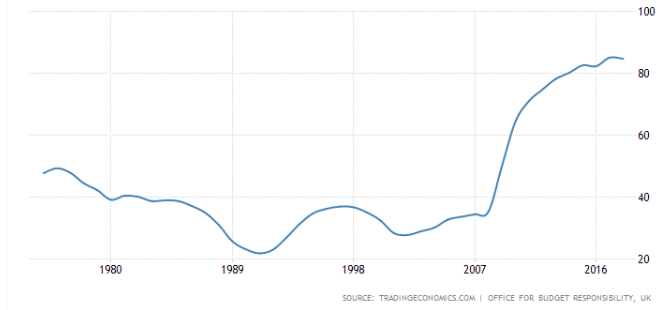

The central bankers have been desperate to debase their currencies and inflate away the mountainous debt strain of debt since the credit crisis. So far they’ve been successful in inflating the price of financial assets and the amount of air in packets of crisps. And in their attempts, they’ve created an ever larger quantity of debt, and the inflation they’ve sought has not emerged (yet, anyway). Their failure will not deter them however, as we noted in Part II.

But while central banks have found it hard to create inflation, for governments it is easy.

And the drastic consequences of the central banker’s monetary madness, which everyone was looking for in the markets… have begun arriving in the ballot box.

During the 2016 US elections, Donald Trump promised to unleash fiscal stimulus with a tax cut. And after being elected by those who weren’t the beneficiaries of bailouts and quantitative easing (QE), he delivered on his promise.

And then, most importantly he got away with it. Or he has in the short term, at least – and that’s all the incentive a power-hungry politico needs. The subsequent growth in the US economy and the performance of the US stockmarket have caught the attention of politicians around the world, who have asked, “If he can do it, why can’t we?”

Since then, the political narrative on government debt and deficit spending has shifted – on both sides of the aisle. We arguably never actually had austerity in the UK, merely a redistribution of government spending.

George Osborne’s aim to reduce public debt as a proportion of GDP was never accomplished, and the absolute value of that debt has only increased, along with government spending. But that hasn’t stopped Theresa May declaring that “austerity is over”, which I believe is a foreshadowing of fiscal stimulus – and subsequent inflation – in the next downturn.

The desire to turn away from austerity and spend heavily can also be seen elsewhere, like in the recent Italy drama, with the coalition government driving for fiscal stimulus through higher budget deficits. Dick Cheney’s line that “deficits don’t matter” have become gospel – and not just in the US, which is another prime example.

On the other side of the House of Commons stands a more garish example of a shift to fiscal stimulus: Jeremy Corbyn’s “People’s QE”. This where a central bank creates money to lend to a state-owned enterprise, which then invests in whatever pet projects the government pursues.

It’s not actually a very new idea. I have it on good authority from an economist with connections at the Bank of England (BoE) that during Mervyn King’s tenure, an internal survey was conducted asking BoE economists what they thought would be the most potent form of economic stimulus regardless of political constraints.

There was a clear policy favourite amongst their replies: the BoE buying infrastructure bonds directly from the government. More simply: the BoE creating money to lend to the government to build infrastructure. While “People’s QE” was highly criticised, he may find a much more compliant BoE than you’d imagine if he comes to power.

Using the central bank to finance government spending has also captured the imagination of populists in France. This is Marine Le Pen, from RT:

“The governance that has been chosen and which aims for the ECB [European Central Bank] to fight only against inflation and to refuse to fight against unemployment, poses a real problem,” said the finalist of the presidential election in 2017. “The monetary creation by the EU, instead of being sent to agencies to be able to invest in the real economy or even directly to states […] is [given] to the banks and is lost, is diluted in the virtual economy,”

Where will the stimulus be directed? Well that depends who’s in power. Infrastructure of some sort is a fair guess, though I get the feeling that as tensions rise in Cold War II (a story for another time), the money will go towards large defence projects and possibly even space development/weaponisation.

Whatever the case, the money will be funnelled into the domestic economy. It will be used to restore fallen industrial areas from grace to attract votes, and at the same time decrease reliance on foreign countries for goods critical to national security. But more importantly, wherever the money is injected, it will create inflation. That inflation will occur while interest rates are already on the floor, pushing real interest rates even further into negative territory than they are today, and push gold higher.

As I’ve said before, this “Golden Age” is not a happy one – it is one of deep financial repression, where savers are keelhauled to fortify debtors. How far will governments and central banks push it forward? Well the answer’s on a postcard, as my colleague Tim Price likes to say, but a certain line by William Blake does come to mind – “You never know what is enough until you know what is more than enough.”

The end to this road is a long way off if it exists at all, and all I can confirm is that the journey will be wild. And on a wild journey, it’s worth owning a bit of gold.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates