Gold.

Some love it, some hate it.

We’re in the former camp, but whether you like it or not there are forces at work we believe will push its price higher. I’m currently writing a report on what those forces are, and I’d like to share the first part of it with you today. So let’s not beat around the bush, and make our case.

The first two reasons are effectively two angles on the same phenomenon – falling real interest rates – and so before we continue, it’s worth explaining what those are and what they mean for gold.

“Real” interest rates measure how much interest you can earn in a currency above the rate of inflation. It’s a relatively simple calculation: interest rate for a currency – inflation rate of that currency. The resulting figure is a measure of how much purchasing power can be earned without taking much, or any, risk.

In an era of positive real interest rates, you can not only preserve your purchasing power against inflation, but grow it without taking a lot of risk – keeping your savings in the bank, or buying UK government bonds.

Conversely, in an era of negative real interest rates, such strategies will not shield your purchasing power. Inflation is higher than the rates received on bank deposits and government bonds, and so the money invested is steadily eroded.

Those deeply in debt (like the government) benefit from negative real interest rates, as their debt and the interest they pay on it is worn down by inflation. This is a form of financial repression, an economic “blood transfusion” where savers are bled of their purchasing power to benefit debtors.

Now, while gold is often avoided by investors as it doesn’t pay interest, when real interest rates are negative, this actually works in its favour.

Gold will maintain its purchasing power over the long term. And when the purchasing power of cash is crushed by negative real interest rates, the cost of gold – in cash – increases as a result.

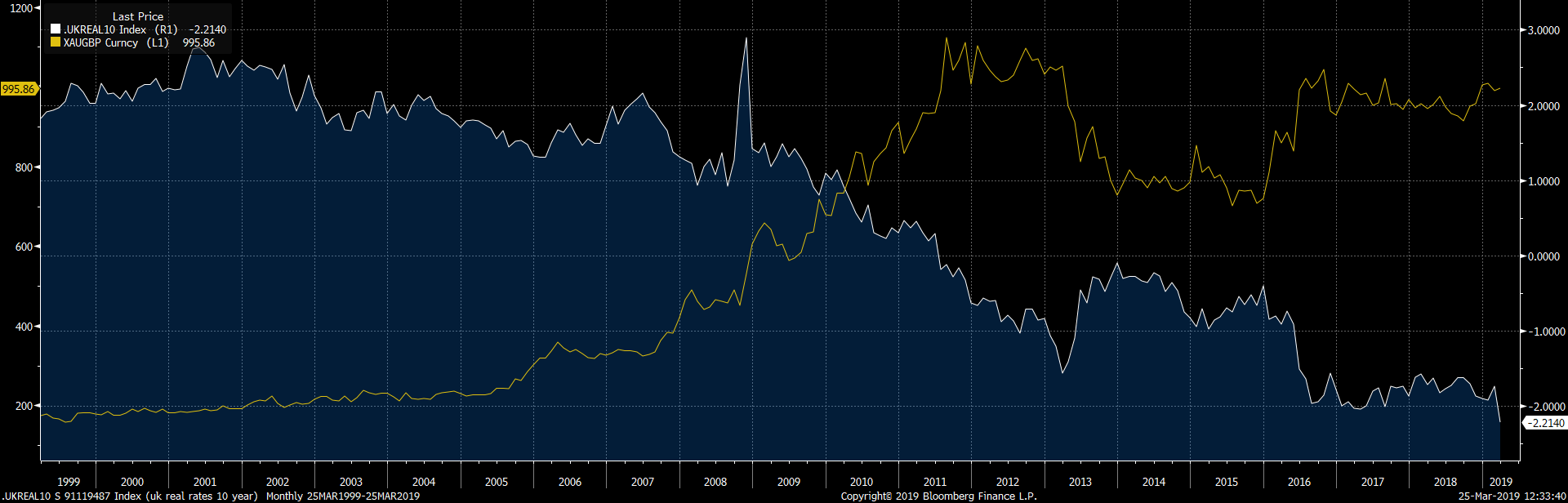

Just take a look here at real interest rates in the UK, contrasted with the price of gold in pounds:

UK real interest rate in white, gold price in GBP in gold. Click to enlarge

UK real interest rate in white, gold price in GBP in gold. Click to enlarge

The “real interest rate” here has been calculated here using the ten-year UK government bond yield minus UK inflation.

And here is the same for the US:

US real interest rate in white, gold price in USD in gold. Click to enlarge

As you can see, the price of gold runs roughly opposite to real interest rates in both currencies. When real interest rates fall, gold rises, and vice versa.

Although real interest rates are already negative in the UK, I believe they have much further to fall both here and across the pond. This can happen if 1) inflation rises 2) interest rates fall or 3) both.

So far, it’s the extraordinary measures of central banks that have rammed real interest rates lower, and gold higher. While I expect that will stay the same (or get worse), we are now seeing the entry of a new player to the equation, who’s bringing a significant dose of inflation to the party…

I think number 3 is on the way, and that financial repression is just beginning. More on that tomorrow – stay tuned!

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates