ECCLESHALL, STAFFORDSHIRE – “Donald Trump has desecrated the values that make America a beacon to the world. Joe Biden is a good man who would restore steadiness and civility to the White House. If The Economist had a vote, it would go to Joe.” – The Economist, yesterday

Well there it is, dear reader. The Economist’s endorsement, notorious around the world for its ability to swing an election, has been set loose. Watch out below, President Trump…

All those undecided voters in swing states will be champing at the bit to vote Biden once they see that such a prestigious publication, ever in touch with the hopes and fears of the general public, has gone “full-Biden”…

Those left behind in “flyover America”, all those who’ve floundered in the dust of China’s rise and been brutalised by the opioid crisis… they’ll be raring to vote for Obama’s vice president when they see such a down-to-earth magazine push the bias boat out for him. After all, The Economist has always had their interests at heart really; always paid an ear to their plight…

I hope you’ll forgive my sarcasm – I really can’t resist when I see journalists in full self-righteousness mode. But one has to wonder exactly what’s happened to mainstream print media, that supposedly nuanced publications have resorted to telling their readers which election candidate “is a good man”, like a mother telling her infant child why they’re heading to a polling station.

One has to wonder why The Economist feels the need to show its so overtly biased cards. After all, according to its own prediction model, Biden has a 96% chance – I repeat, a 96% chance – of winning the election.

If it has faith in its model, it should be relaxed; a display to the world how calm and collected The Economist is despite all the chaos around them. Firm hands on the wheel, looking assuredly into the horizon.

And why shouldn’t The Economist have faith in its election predictions? It’s not like it was wrong last time…

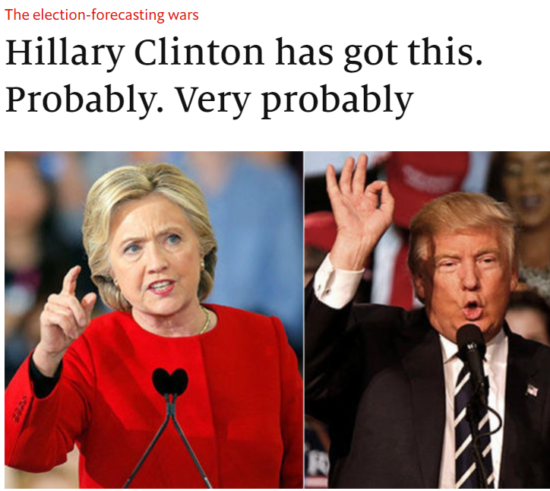

Article published by The Economist on the day of the 2016 election

Article published by The Economist on the day of the 2016 election

In its defence, at least the journos at The Economist put “probably” in the headline, and weren’t so hubristic as their peers, who may as well have been celebrating a Hillary Clinton victory in the days running up to her defeat.

My conviction that Trump will be re-elected grows the more confident outlets like The Economist become that he will lose. I have seen very little self-reflection from the journalistic establishment as to how they got it all so wrong last time – if anything, it feels like they’re doubling down with Biden. The real world can wait – we’ve got an election to swing…

Macro analyst Luke Gromen published a decision tree recently, detailing the potential consequences of a Biden/Trump presidency and a Democrat/Republican congress – but in an amusing twist, all of the outcomes were the same:

“More federal fiscal stimulus, monetised by the Fed and the US banking system.”

Or to put another away, there is no political outcome here that doesn’t mean more money printing by the US government.

Makes you wonder just how important the great theatre that the US election really is for investors when there are some outcomes that can only go one way. And on that note, just how different is the American situation from us here in the UK?

As Tim Price wrote recently over at The Price Report:

UK government finances were not exactly in robust health before the emergence of coronavirus. Now they look disastrous. Due largely to coronavirus-related spending (matched with the complementary destruction wrought by the government on the private sector), the UK national debt has effortlessly vaulted up through the £2 trillion level (the equivalent of £30,000 for every single person in the country)…

At the same time, the likely damage still to come to sterling as our economy flatlines versus its international peers will likely reiterate the value of holding defensive stocks in more attractive foreign markets, especially Japan. Generalised currency weakness, fiscal laxity in major economies outside the UK and almost universal money-printing, of course, argue in favour of sensibly priced gold and silver miners – for investors with the appropriate risk appetite and sufficient tolerance for the inevitable price volatility…

You can discover Tim’s method and which investments he’s relying on to prosper through the chaos here.

The phrase “universal money printing” is a daunting one. It reminded me of something Simon Mikhailovich, the former hedge fund manager (and Soviet citizen), opined recently on the subject of “escape routes”:

Differences can hold as much insight as similarities: When getting out of the USSR was really hard, deciding where to go was easy. Now, getting out ([of] countries, investments or currencies) is easy, but deciding where go is really hard.”

Where to go indeed? If you read yesterday’s letter, you’ll know I’m a fan of shiny paperweights. But for a more comprehensive solution you should take a look over here…

Wishing you a good weekend,

Boaz Shoshan

Editor, Capital & Conflict

PS I’m not the only one to be a little critical of the mainstream news this week – Sam Volkering has taken a snipe of his own with The MSM strike again…

Category: Market updates