It wasn’t all that long ago that the price of a gold sovereign felt stuck around the £250 mark. Some days it’d be cheaper, some days it’d be more expensive… but between mid-2016 until May last year, the market’s idea of a sovereign was a small gold coin worth roughly £250.

This comes from his latest update to subscribers to The Price Report, so I’ve had to redact a few of the investments listed, but I think you’ll find his broader view on gold worth a read – not to mention his thoughts on uranium and copper…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Glamour stocks, gold, and generationally attractive commodities

Tim Price, The Price Report (28 May 2020)

Capital preservation, for me, always trumps the potential for fast and dramatic gains. And a capital preservation approach can still outperform a growth approach over the longer term when the damage suffered by the cumulative drawdowns associated with the risks of growth gets summed up.

Back in the mid-1970s, the glamour stocks of the day were referred to as the “Nifty Fifty”. Times changed and the nomenclature changed, but the downdraft for the dotcom favourites of the early 2000s was just as severe – and during the global financial crisis of 2007-9, the damage incurred by certain financial sector stocks was almost terminal.

In his latest research piece, “Making Plans for Nigel”, Kopernik’s founder, David Iben, draws attention to the opportunities now on offer for investors willing to take a more contrarian stance, especially in relation to the commodities sector. Like me he is an especial fan of gold, but this is more than just a gold story. As he writes,

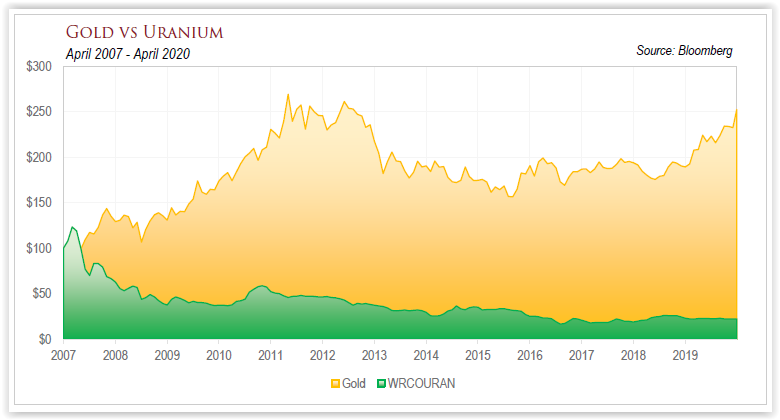

Let’s turn our attention to other commodities, which recently have reached generationally attractive prices. Most of them hadn’t been especially interesting since they were pushed skyward by the Chinese-driven bubble of a decade ago. They have become interesting again following their decade long decline, in absolute terms and relative to gold, followed by the recent virus-driven coup de grace. The following are various charts highlighting the damage. This all paints a picture demonstrating that gold is very cheap compared to the dollar, and other fiat currencies, gold miners are very attractive relative to gold itself, many commodity prices have become very depressed in relation to gold, and commodity related companies have become quite attractive relative to the commodities they own.

Source: Kopernik Global Investors, LLC

Source: Kopernik Global Investors, LLC

It’s a little early, in my view, to be purchasing copper – but copper can plausibly be tracked as a cyclical indicator pointing to global economic recovery.

Uranium looks particularly interesting, not least given the trend towards renewables and alternative energy. As Iben observes,

We don’t typically invest with a “catalyst in mind,” believing that attractive valuation eventually serves as its own catalyst, and having noticed that stocks usually rocket higher before people notice the catalysts. Uranium seems to be one of the rare exceptions. Catalysts have become abundant in recent months. Cameco Corp. closed MacArthur River (maybe the best mine ever). The U.S. Department of Energy stopped selling their stash, and the Russians stopped several years prior. The Kazakhs cut production once, then twice, and just announced a coronavirus related major reduction of supply. Similarly, Cameco closed its Cigar Lake mine, temporarily, due to the coronavirus. Two high-cost mines in Africa have finally closed. On the demand side, demand for electricity is down some, but Japan has reopened nine reactors and China has opened a similar number, with thirty more in various stages of planning and construction. Funds have been formed to buy and hold. Supply falls well short of demand. The price is up from $18 to $32, which is still less than a quarter of the peak. Prices need to double, if not triple, to avoid shortages and multi-billion dollar reactors sitting idle.

Source: Kopernik Global Investors, LLC

Source: Kopernik Global Investors, LLC

But as things stand, both on valuation grounds and because of the sheer scale of governmental reflationary stimulus around the world, gold remains my single favourite thematic investment. Those wishing to take the pure bullion route should consider the .

Those wishing to take the gold mining route should consider , or one of my favourite precious metals streaming investments, . In my worldview at present, all roads lead to gold. And not just gold. My friend, the investment strategist James Ferguson, writes:

The Fed’s aggressively huge QE has been equivalent, in just 6-8 weeks, to more than half of what was done over 6 years during resolution. This time, all money measures from narrow to broad are rising steeply; broad money at a record peacetime rate.

Bank lending is still growing too and the Fed’s $2.3 trillion loan stimulus programme has yet to begin.

There is even evidence the Fed has been funding the Treasury directly (i.e. MMT), despite MMT having no workable policy to rein back inflation once unleashed.

We know from past QE which assets benefit (risk-on, precious metals) and which lose out (diluted currencies, bonds). Whilst the bond market may be mesmerized by the output gap, it appears overly complacent about the magnitude and breadth of the policy intervention.

Gold, unsurprisingly, has already advanced to the cusp of a new all-time, record high but its leveraged acolyte, silver, is obligingly at a record relative discount, so at least inflation protection is cheap.

In other words, for portfolio insurance, portfolio diversification and currency protection, don’t limit yourself to gold. The includes roughly 50% physical silver. And if you seek a pure play, try .

For more thought-provoking analysis of the prospects for gold, if not necessarily a return to the gold standard, I recommend our latest State of the Markets podcast with the financial analyst and historian Russell Napier. The theme and threat of financial repression runs through this interview like a live wire.

For many years now I have lived happily with the conclusion that value investing – on my terms, at least – is the only form of investing worth practising. Everything else, per Messrs. Graham and Greenblatt, is simply some form of speculation. These are, of course, difficult times, for investors as for everybody else. Given the economic damage wreaked not so much by Covid-19 as by governments’ panicky over-reactions to it, the investment landscape of the future looks like being radically different from the recent past.

The Big State is back, and as a reflection of diminished opportunities, unconscionable debt issuance and weaker growth, bond markets look set for their own Waterloo, whether in the form of a debt jubilee, widespread defaults, a gigantic reset or a particularly messy outbreak of inflation or stagflation.

Given that property is in many respects a debt-like asset, not least by its sensitivity to interest rates, and in the light of new attitudes towards working and commuting in a post-Covid world, both residential and commercial property values need to be reassessed by careful investors.

So, of the three major asset classes, at least two of them seem to me to be facing significant headwinds. That leaves listed equities, in a world that, as David Starkey points out in his excellent interview, has committed economic suicide. And in the context of the monumental money printing fiasco we are now trapped within globally, “value” gold mining stocks are, in my view, now unparalleled opportunities from a risk/reward perspective (ie, with relatively limited downside but extreme upside). What type of stocks do you gain comfort from holding in this brave new world?

Until next time,

Editor, The Price Report

Category: Market updates