Considering the amount of press garnered by China’s Silk Road project in recent years, it’s surprising how little attention was paid to the US’s announcement that it was launching a Silk Road of its own earlier this month.

The Silk Road, China’s colossal infrastructure plan winding from Beijing’s throne into Europe and Africa known formally as the Belt and Road Initiative (BRI), now has a rival with its origins in Washington.

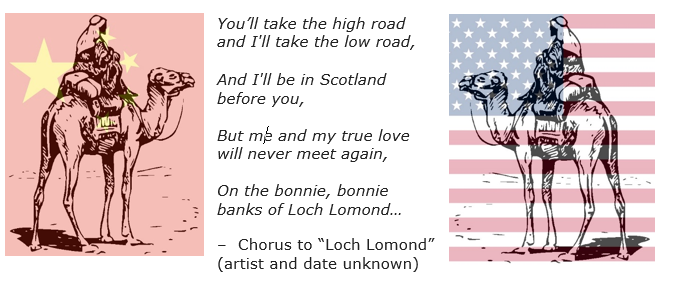

Neither will reach Loch Lomond’s bonnie banks or Scotland at all, but now China is no longer a “true love” of the US, Washington is looking to take “the high road” with an emphasis on the quality of the infrastructure rather than the quantity of it.

There was a sense of inevitability that this was going to occur – the Donald Trump administration has been bashing the BRI for years now. But almost exactly a year after Vice President Mike Pence said this at the APEC (Asia-Pacific Economic Cooperation) summit…

Know that the US offers a better option. We don’t drown our partners in a sea of debt, we don’t coerce, compromise your independence. We do not offer a constricting belt or a one-way road.

… we finally have an idea of what this “better option” actually is.

It’s called the Blue Dot Network (BDN). I know – it appears neither superpower could be bothered branding their grand empire-building strategies with a name matching their ambition.

But despite its meek label, make no mistake – this is the US’s attempt to build another Silk Road in the Indo-Pacific. Two superpowers aggressively building infrastructure in the region is damn bullish for the economies that are plugged into them – the risk is that a Cold Wars start heating up too.

I remember reading a while back that the infrastructure that gets laid first on China’s Silk Road in developing countries isn’t for vehicles – it’s for the internet. China wants its 5G provided by Huawei all across the BRI. If the US is serious, it’ll need to get its 5G act together and promote something similar across the BDN –

We wrote last week how the US Navy securing the world’s shipping lanes for free gives them significant leverage over countries which rely upon maritime trade. Part of China’s Silk Road strategy is to escape that leverage by building up land infrastructure all across Eurasia: if sea transport is unavailable, goods can simply be transported over land instead.

While land transport is significantly more expensive, it would reduce US influence on China, and vastly increase Beijing’s influence in all the regions plugged into its infrastructure. It would also promote further internationalisation of the renminbi, just as the dollar was globally adopted through the US’s control of the sea.

The key difference of the BDN is that the majority of the capital to fund it will come from the private sector, rather than coming directly from state coffers. It’ll be led by overseas private investment corporation (OPIC) of the US, a government agency set up by Richard Nixon in 1971, which funds itself by issuing development loans. Its Australian and Japanese counterparts have signed up too.

From what little we know about the star-spangled Silk Road is that it’s trying to appear much more socially responsible than the BRI, which has gained significant bad press in recent times for destroying the environment and harming the sovereignty of nations on its trail. From the project’s opening press release:

The development of critical infrastructure—when it is led by the private sector and supported on terms that are transparent, sustainable, and socially and environmentally responsible—is foundational to widespread economic empowerment…

This endorsement of Blue Dot Network not only creates a solid foundation for infrastructure global trust standards but reinforces the need for the establishment of umbrella global trust standards in other sectors, including digital, mining, financial services, and research…

Such global trust standards, which are based on respect for transparency and accountability, sovereignty of property and resources, local labor and human rights, rule of law, the environment, and sound governance practices in procurement and financing, have been driven not just by private sector companies and civil society but also by governments around the world.

Right now the capacity for loans within the BDN play will be a “mere” $60 billion, which is nothing compared to China’s almost $1 trillion projected spend for BRI. However, as the BDN will be funded by the private sector, the amount of loans brokered is effectively uncapped.

As we’ve written often in this letter, the collapse in returns from traditional investments like bonds have led to a massive increase in demand for assets within the “alternative” category. And within alternatives, lies infrastructure loans. If the US plays its grand strategy right, it’ll find a way of hoovering up the grand quantities of pension and sovereign wealth fund money that’s chasing yield, and funnel it into its Silk Road.

Blue Dot or Belt, I anticipate that mainstream investors will end up funding one or the other. And while that may well mean earning decent returns in a world of no interest rates, it’ll also mean absorbing the casualties of the rival road wars.

As we stroll closer to this fork in the Silk Road, it’ll soon be time to decide your direction: will it be the high road, or the low road?

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates