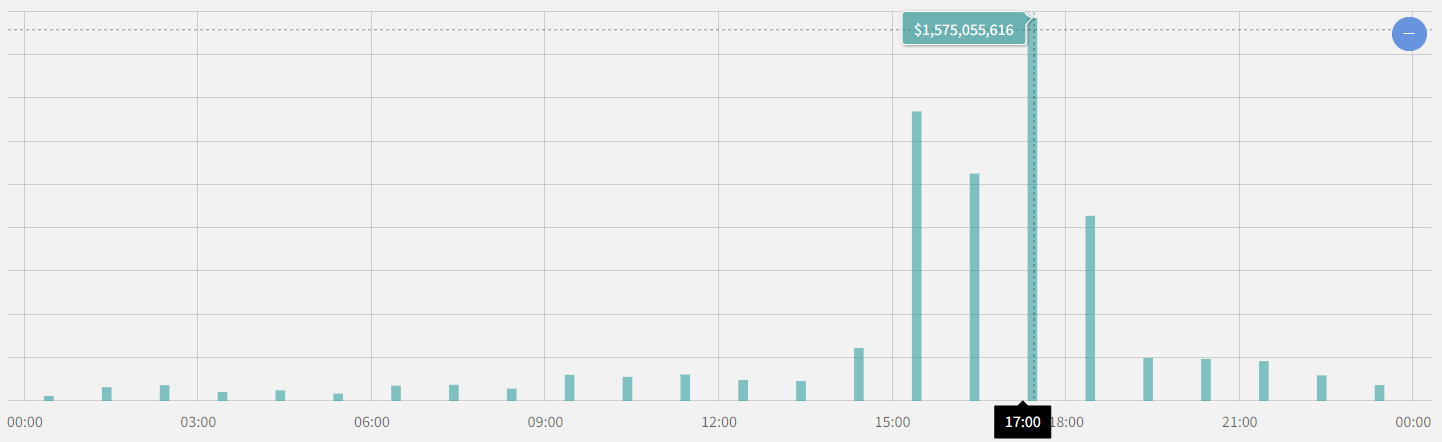

Between 3pm and 6.30pm on Monday, three and a half billion quid’s worth of BTC was transacted over the bitcoin blockchain.

Nobody knows who it was or what it was for. And as every transaction verified by the bitcoin miners has a cost, paid for by the entity sending the money, it’s unlikely this was just done for fun.

Such a large concentrations of bitcoin transactions in a short space of time suggests relatively few actors involved

Such a large concentrations of bitcoin transactions in a short space of time suggests relatively few actors involved

Source: ByteTree

Billion-dollar bitcoins transactions were incredibly rare just a few months ago.

Hell, not that long ago the very idea of such large value transfers was a pipe dream that existed only in the imagination of a dreamy bitcoiner.

Their increasing frequency in the real world is something you should be paying attention to: they are indicative of bitcoin and the broader crypto space reaching maturity.

But does that mean it’s time to invest your treasured funds in the big ₿?

As you likely already know, Charlie Morris, our resident fund manage and expert multi-asset investor, has developed ground-up strategy for valuing bitcoin, having watched the space evolve since 2013.

He keeps his subscribers at The Fleet Street Letter up to date with his regular readings on the market, but today and tomorrow, he’ll be sharing how it all works with you.

With that, I’ll leave you to Charlie…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Bitcoin for the cautious (Part 1)

By Charlie Morris

With 22 years of experience as a professional investor (and a gold guru), I was drawn towards bitcoin because it was a potential game changer. I never worried about whether the world needed digital money or not, just that it was inevitable at some point in time and that may as well be now.

The magic bullet comes from the blockchain, and just like the atom bomb, once that knowledge is out of the box, you can’t put it back in. The bottom line is that bitcoin/blockchain enables value to be exchanged around the world, securely and in real time, without a bank. However sceptical you might be, that should warrant your attention.

Bitcoin is famous, or infamous, for many reasons. Above all must be the extraordinary gains made by the early adopters, closely followed by the endless scandals. A bitcoin began trading in 2010 at around 6 cents each, and the price has doubled 17 times since. I can’t think that has ever happened before in a public arena, and in such a short period of time. And before you think it must be over, bitcoin as an investment is broadly equivalent to BP, GlaxoSmithKline or Diageo.

If bitcoin doubles four more times, it will catch up with the world’s most valuable company, Aramco. Seven doubles would see it catch up with gold, and ten doubles would exceed the value of all the stockmarkets in the world. No one can be sure how many more doubles will follow, but if this movement captures the mainstream, several more doubles will follow.

Under the surface is an entire ecosystem that has been growing for ten years. In a typical week, the bitcoin network processes over two million transactions that see $10 billion change hands around the world. Those transactions are split between data, retail, speculation and institutional trading. Some of the activity is morally dubious (not dissimilar from large cash transactions), yet most of it is hustling its way into the future.

The implications are far reaching. This movement has the potential to slash one of the remaining blocks in commerce – transaction fees. Next time you go to Paris and enjoy a spectacular lunch, think twice about how you pay.

If you use a credit or debit card, issued by your UK bank, the chances are that there’s an extra pudding on your bill. No wonder bankers are labelled “fat cats”. Scale this idea up across foreign exchange, transactions, trade finance and contracts, and you soon realise that there is plenty of disruptive potential.

As “digital assets” become more widespread, I cannot promise you that bitcoin will win all of the prizes, but it has a first mover advantage, that has ensured its lead. I suspect that it will be challenged time and again and maintains its dominance in today’s marketplace.

One reason for that is the network effect where, in the words of Abba, the winner takes it all. There is little point in me being on one network, while you are on another, as we can’t transact. That is why internet companies enjoy such high valuations because, rightly or wrongly, they are deemed to be lasting monopolies.

What drives the price of bitcoin?

The most important thing is the size of the underlying network. Once you realise that, everything fits into place and the price movements are no longer a mystery. It is logical because if no one cares about bitcoin, and no one uses it, it will be worth precisely zero. But if lots of people care, and lots of people use it, it becomes enormously valuable.

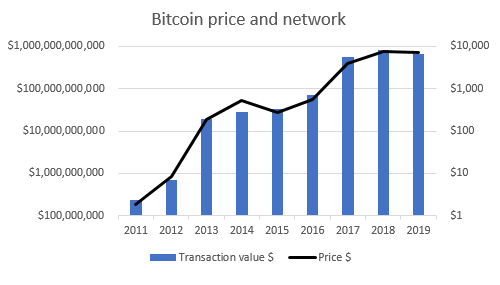

The chart below shows the average bitcoin price each year and the amount of money that transacts over the bitcoin network, known as transaction value $ (TV$).

Think of the bitcoin network as a simple helicopter with the blades representing TV$:

- If the blades don’t spin, the price won’t get off the ground

- If the blades spin, it will rise until the air thins and then hover

- If the blades spin even faster, it will rise into even thinner air and hover

- As the blades slow, it will fall, and hover when the air is thicker

- As the blades keep slowing, it will keep falling

- And if the blades slow quickly, it will crash.

To any pilots out there, no critique of my simple model please, I hope you get the point.

Back in 2009, the bitcoin code was released (the helicopter) but people using it (the blades) took time to get going. Only once people discovered bitcoin, and what to do with it, did the network begin to grow.

It didn’t take long to become a highly speculative asset as word spread. Bubbles and crashes coincided with the booms and busts in the network. The end result was a price that multiplied, despite several devastating crashes.

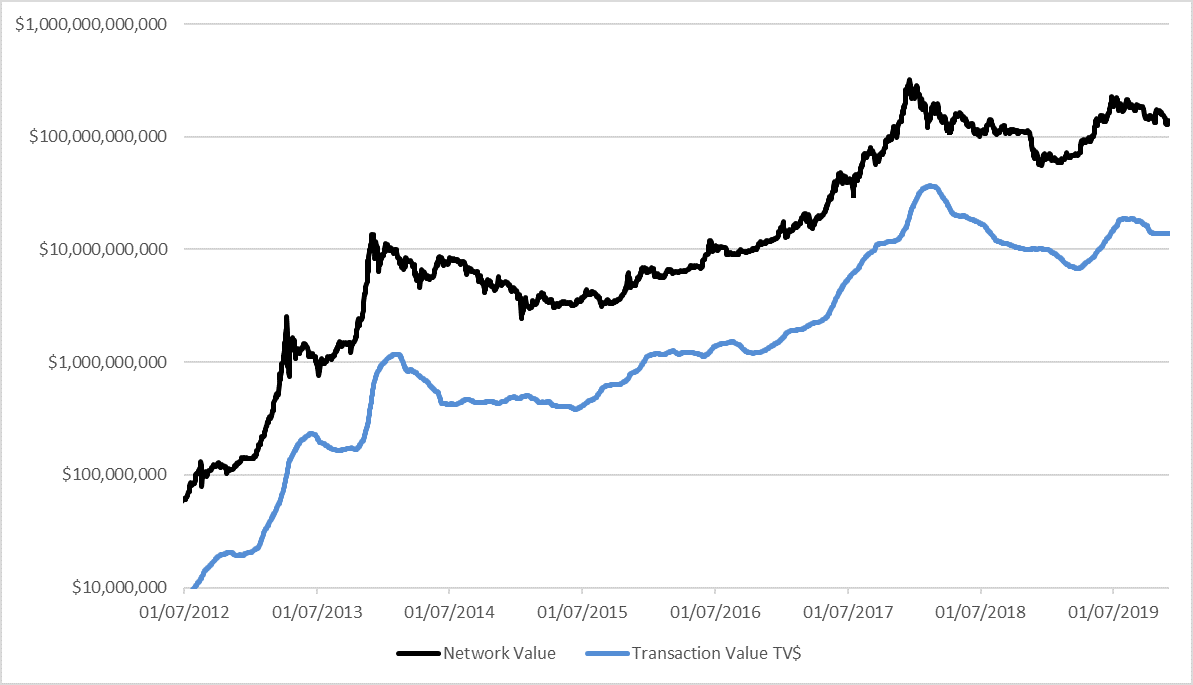

The next chart shows you the network value (NV), which is all the coins in existence multiplied by the bitcoin price in black. It is similar to market cap for a company, except that you’d be foolish to buy all the bitcoins, because they’d be no one to exchange value with (remember it’s a network).

The blue line is the transaction value (TV$), which shows how much value changed hands each week, and is smoothed over the past 12 weeks.

Bitcoin value relates to transactional usage

Source: ByteTree.com – bitcoin network value $ (black) and transaction value $ (blue) since 2012

Source: ByteTree.com – bitcoin network value $ (black) and transaction value $ (blue) since 2012

Bitcoin’s TV$ is highly correlated to NV. That becomes clear as if you divide the black line by the blue line, the answer is a ratio that is remarkably stable over time. Since it divides network value by transaction value, it is called NVT, and is measured in weeks.

The long-term average has been 6.8 weeks. That means all the bitcoins in the world are collectively worth approximately 6.8 times the amount of value that is transferred across the network in a single week. Or you could say the network is worth 6.8 weeks’ traffic.

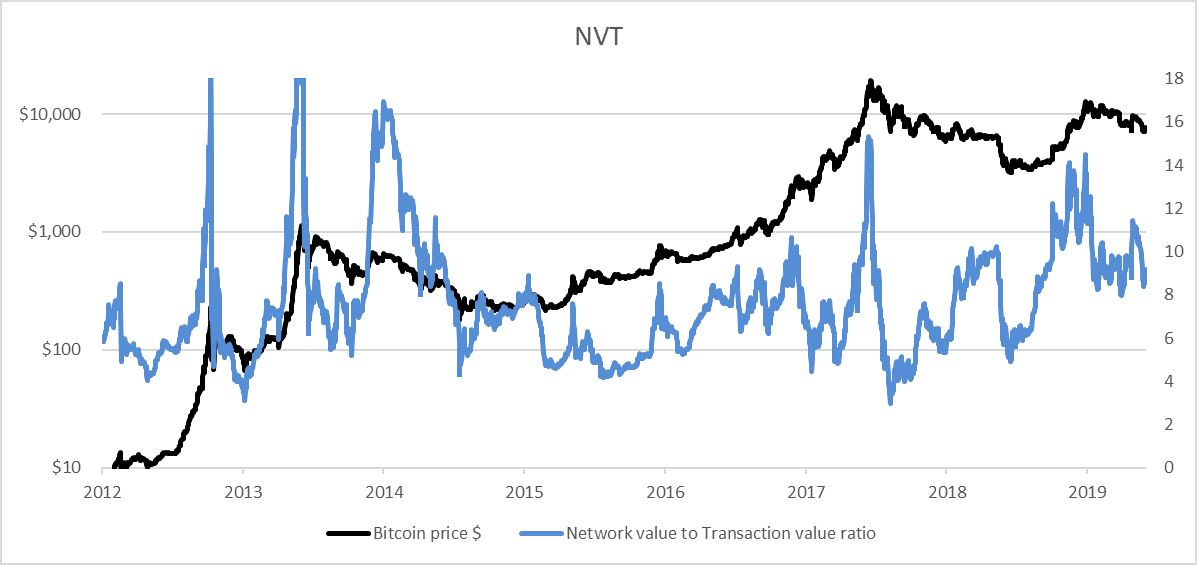

Bitcoin price and NVT

Source: ByteTree.com – price $ (black) and NVT since (blue) 2012

Source: ByteTree.com – price $ (black) and NVT since (blue) 2012

But recall that the average NVT is 6.8. The actual number at any one time varies between 5 and 15. Bitcoin is expensive when it is high and cheap when it is low. It is simple stuff, and just like an equity price to earnings ratio, you should buy low and sell high.

However, there’s a caveat. During bear markets, it can take the network longer to cool than price. That’s a bit like a company’s profits in a recession. They fall slowly at first, then quickly. This can give the impression that bitcoin is cheap, when the market is still declining.

What I would say is that, just like in equities, the ideal buy is a low valuation combined with improving fundamentals. And the perfect sell, is a high valuation and deteriorating fundamentals.

This means valuation isn’t the full story as we also have to examine the network itself. In Part 2, I will take a closer look at the network and discuss transaction value $, network fees and network velocity. Put them together and you get a clear understanding of the state of the network’s health.

Charlie Morris

Editor, Southbank Investment Research

Category: Market updates