Well there we have it. As we wrote in Tuesday’s note (The Bond girl, the Cuban icon, and the man from Dixieland), we were watching the dollar for its next move. If it broke higher in value, it’d be bad news for the global economy… while a cheaper dollar would bring relief.

The dollar was ranging after the crisis in March in an ever-tighter pattern. But now it has broken lower:

The dollar index: the value of the dollar measured against the world’s major currencies

The dollar index: the value of the dollar measured against the world’s major currencies

It’s good news for investors: the global reserve currency has got cheaper, and for the meantime shouldn’t be getting more expensive, provided nothing especially wild happens (though that’s anything but guaranteed these days).

Due to the dollar’s use throughout global trade outside the US, a cheaper dollar is effectively a subsidy for economic activity. It’s a bit like cheap energy, which we already have – if the dollar manages to weaken significantly on top of this, it could be a very bullish combination. A double market subsidy going into the global economy. The question is, with so much restriction on activity, and so many unemployed as a result of them, will this “double subsidy” juice markets hard in the near term?

Charlie Morris over at The Fleet Street Letter Wealth Builder is bullish on several assets as a result of the dollar’s break lower: “gold, silver, bitcoin, emerging markets, commodities, banks, Europe, European banks (!), UK, Japan, industrials, value etc.”

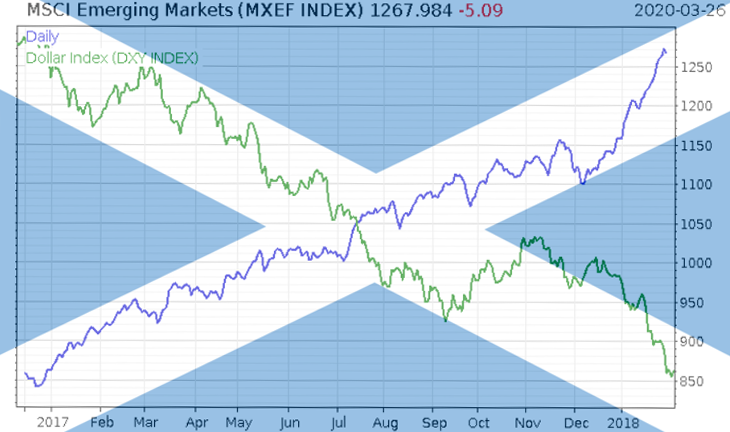

It’s early days yet – as you can see on the chart, the dollar has a way to go before it reaches the lows it hit last year, let alone in 2020 before the March crisis. But a cheaper dollar is certainly good for the rest of the world. I posted this chart in Capital & Conflict earlier this year, but it bears repeating as a recent example of the effects of a weaker dollar. As 2017 illustrated to a tee, emerging markets (blue) boom when the dollar weakens (green):

While the US cheapening its currency acts as a boon to the rest of the world, it’s hardly just the Americans who are in on the act…

The Printing Olympics

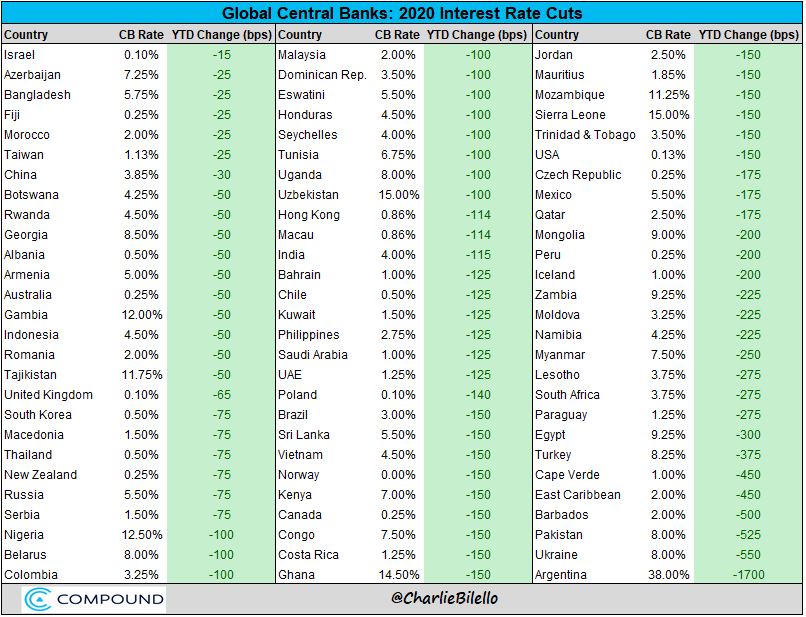

What does the UK have in common with Poland and Israel? The central banks of all three reduced their interest rates to 0.1% this year. An incredible 81 countries have cut rates so far this year, as detailed by this great table from Charlie Bilello:

BPS = basis points, the hundredths of percentage points in interest rates that have been cut

BPS = basis points, the hundredths of percentage points in interest rates that have been cut

Source: Charlie Bilello, on Twitter

Eighty-one countries. That’s more than 40% of the world’s central banks trying to make borrowing cheaper at the expense of saving. Ultimately, it’s more than 40% of the world trying to devalue their currencies.

With the global reserve currency now dipping, it’s hard to see gold not rising in all of those currencies – the UK included. Especially now that Andrew Bailey, the new governor of the Bank of England, is saying negative interest rates in the UK are now on the table. Surviving that scenario is what the next issue of The Fleet Street Letter Monthly Alert is going to be all about.

What strikes me though, is that while the US stockmarket is getting back to the races and shrugging off the “The Ides of March”, stocks everywhere else in the world, including here in the UK, are telling a quite different story – with the pattern of the FTSE repeated all over the world’s stock exchanges. What it means, I’m not entirely sure just yet – but we’ll be exploring that later on next week…

Wishing you a good weekend,

Boaz Shoshan

Editor, Capital & Conflict

For charts and other financial/geopolitical content, follow me on Twitter: @FederalExcess.

Category: Market updates