Jerome Powell at the Federal Reserve recently took to television to reassure the world that everything is, indeed, under control Gromit. While the Fed is of course the US’s central bank, his words are globally relevant to investors here in the UK as the world is on a dollar standard.

We may not buy things with greenbacks here in the UK, but much of the global banking and corporate operations which dominate the City and the FTSE 100 lend, earn, buy, and count their profits in them.

As central banks have made ever greater interventions into markets to prevent them from doing something “wrong”, investors look to them more and more for glimpses of the future. This has reached strange extremes, like when the Financial Times published an article analysing whether the colour of Mario Draghi’s tie was an accurate indicator of how much money he would print in the days following. These monetary elites have become something of market oracles, except they’re actively involved in creating the future they describe.

Powell’s appearance was an interesting one however, for the incredible candour he revealed. While central bankers are often very candid, this is rarely the case in the middle of a crisis. It’s normally only displayed afterwards once the storm has passed, and far fewer cameras are watching. Considering unemployment in the US has gone from the lowest level in 50 years… to the highest level in 80 years… in just two months, it’s safe to say that the crisis is very much still in play and that Powell is under a hell of a lot of pressure.

His appearance was on 60 Minutes, an American TV show that’s been on the go since the 60s, which follows an interview format. And when asking Powell what he’s been up to, the interviewer phrased this question:

“You simply flooded the system with money?”

Powell visibly hesitates for a moment, looking down for a second and pausing, before deciding to commit full heartedly to his response. He raises his head nodding several times, and responds, raising his head and nodding.

“… Yes, we did. That’s another way of thinking about it, we did.”

The interviewer continues, with a quizzical look on his face, “Where does it come from? Do you just print it?”

“We print it digitally. So we, as a central bank, we have the ability to create money digitally and we do that by buying Treasury bills or bonds or other government guaranteed securities and that actually increases the money supply. We also print actual currency and we distribute that through the Federal Reserve banks.”

There you have it folks, straight from the horse’s mouth. At its core, money printing is the name of the game, and that’s not just some fringe newsletter writer with a mullet in his tiny flat in London saying it, that’s the chairman of the Federal Reserve.

It’s a testament to how far through the looking glass we’ve come that we get such frank admissions from the monetary authorities when confidence is being tested during a crisis. The more obvious and blatant it becomes, the more I’m convinced that the printing press will be brought out to campaign rallies and polling stations to lure in voters.

So far, calls for “QE for the people” have come from those with a socialist bent. It’s rather lazy, and I don’t like using such a binary definition for topics as nuanced as politics, but I think it’s fair to say that those clamouring to “unlock the power of the public purse for the good of the people” have come from the political “left”.

But as I alluded to in yesterday’s letter, with this normalisation of printing money and ever more public awareness of it through TV shows like 60 Minutes it is only a matter of time before somebody from the other side of the aisle, who would fall under the banner of “right wing”, starts arguing that as we’re printing so many billions, why don’t we use it to engage in a vast military spending splurge to project power abroad and regain national prestige? Especially with Cold War II coming along, a new breed of military.

We’re seeing some glimmers of this bipartisan support for dollar debasement in the States, but in good time I reckon all over the developed world, money printing will be in fashion across major political parties both left and right.

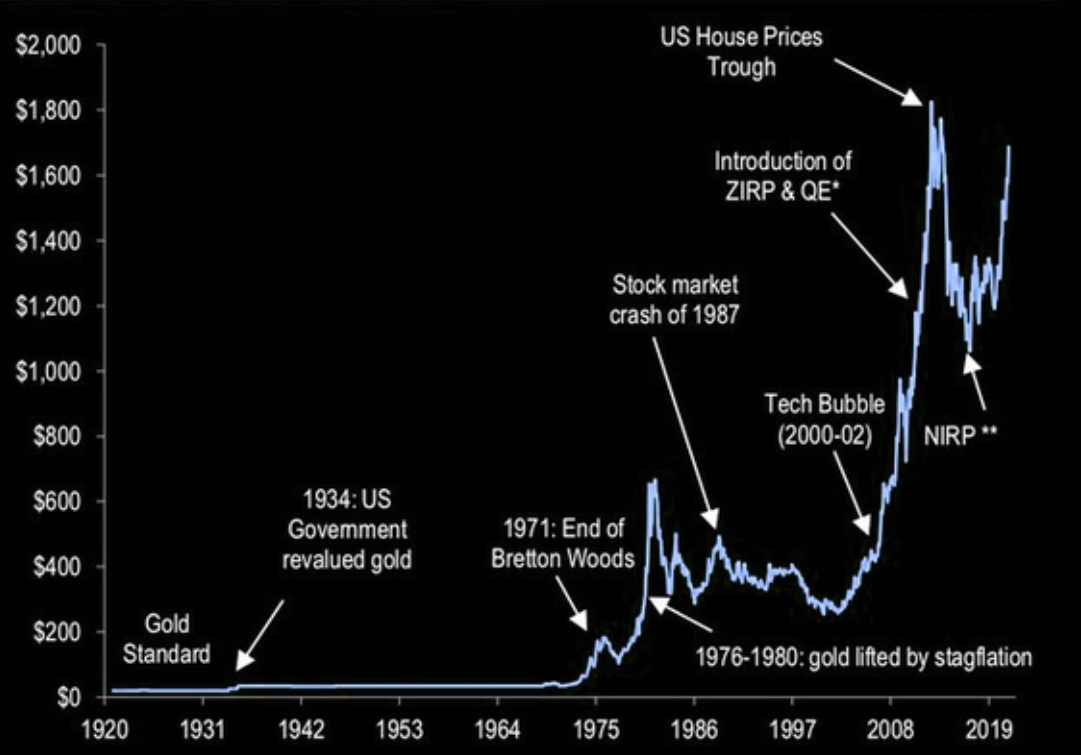

That’s why you own some gold. Not because it’s going up – it’s purchasing power will remain the same. But the same cannot be said for the purchasing power of what’s in your wallet or purse.

If you’ve been reading Capital & Conflict for a while, you will probably have seen plenty of charts of the gold price, but I thought I’d show you this one in today’s note as it’s particularly good.

Again, while this is in dollars and thus an “American” view of gold, as the dollar is the global reserve currency, the gold price in USD is most reflective of global demand. Note what happens after 1971 when gold is no longer pegged to any currency within the financial system:

That’s all from me for today. Back again tomorrow of course. If you want to see that clip of Jerome Powell for yourself, you can find it here.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates