Will bitcoin hit $10k by midnight tonight?

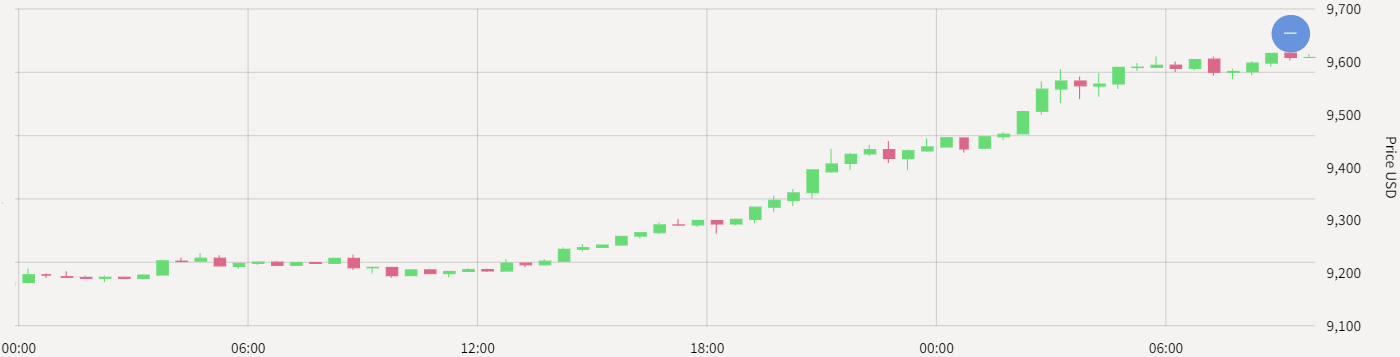

It’s at $9,600 as I write this, up more than 400 bucks since yesterday morning – and if recent weekends are any guide, the psychological $10k level may well be on the horizon.

BTC since yesterday morning. Source: ByteTree

BTC since yesterday morning. Source: ByteTree

I was expecting BTC to spend some time consolidating at the $9k level; its sudden splurge past it from $8,000 seemed like the market was getting out over its skis. But the only consolidation we’ve seen, lasted all of three days – and that wasn’t even at $9k, but between $9,100 and $9,300.

Now we’re back to the races as this breathless run continues for the big ₿. If we don’t see $10k tonight, I reckon we will have by Monday – the momentum is stronger than I thought, and it appears that the miners are actively trying to lure the market higher.

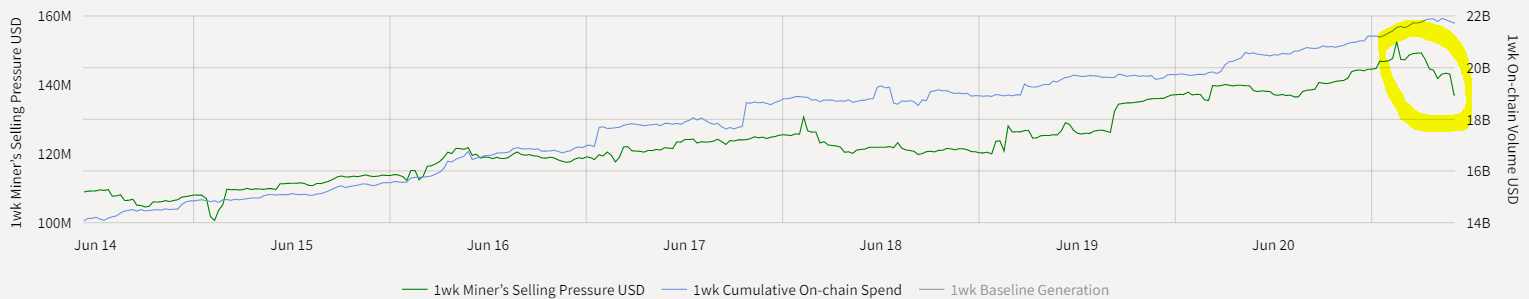

Having sold increasing amounts of BTC into the rising strength of the market this week – with little dampening effect on the price – they’ve abruptly begun reducing their selling (highlighted in the chart below). By reducing their supply of BTC to the market, demand should squeeze the price higher.

Miners selling pressure in green, network spend in blue. Source: ByteTree

Miners selling pressure in green, network spend in blue. Source: ByteTree

Worth noting is the increasing “network spend” of bitcoin. This is the value of BTC being transacted across the bitcoin blockchain, which Charlie Morris views as a key valuation metric for the network (the higher it is, the higher the intrinsic value of bitcoin). Though the price has been rising, its fundamentals appear to be too.

BTC has only been at $10k or higher for 3% of its entire history. Hitting that level may well be what stirs the embers of FOMO (fear of missing out) in investors who were burnt in the last crypto crash.

Bitcoin generates most of its performance within ten days of every year. Believe it or not, if you exclude those ten days from its performance on an annual basis, it’s actually down 25% since 2013. The fear of missing out on those ten days of glory is a powerful force. Those who invested in crypto during the 2017 boom will find it hard to resist.

A serpent in Eden

Thank you for all your responses to my question of whether you would ever consider using Libra – the answer was a resounding no! Most readers who responded were very disapproving of the Zuck or Facebook being anywhere near the money supply:

I suppose that at 60 I would fit into the category of older guys. However I would never touch any form of currency, crypto or otherwise, that was so closely involved with Facebook. The narcissistic, navel contemplating, worship of the trivial that is Facebook surely cannot be a serious basis for a currency. I think and hope that you are underestimating the millennial generation.

&

… I consider MZ to be, pretty much, the incarnation of evil! Anybody who starts a product as a means of identifying “campus hotties”, who embeds algorithms into his product that are addictive, knowingly, & who pays lip service to any restriction that might reduce his revenue from advertisers should not be allowed anywhere near a product like Libra.

As would I, dear reader, though I have no memories of one – that was sadly well before my time.

The potential for Libra to be abused by its creators has not gone unnoticed. It’s been amusing to see a curious image used to market the project…

… get photoshopped to resemble something rather different:

The guys who live on the edge even claim the Libra logo has a hidden meaning, that it’s a symbol of the serpent in the Garden of Eden:

I wouldn’t go that far. But the Zuck has a hell of a PR campaign job on his hands if he wants to convince everyone that he has their best interests at heart.

Wishing you a great weekend,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates