Fed chairman Ben Bernanke presses the president and Congress to cut government spending. Because there’s only so much the Fed can do to save a debt-sodden economy. Now it’s time for politicians to do their bit. Bernanke, with one eye on his legacy, hints in the very mildest terms about tapering the Fed’s $85bn in monthly asset purchases.

The US dollar surges and the prices of financial assets plunge. So the president swiftly makes a statement thanking Bernanke for his years of service as Fed chairman – but alluding to his departure from the Fed. The markets take another knock. At this point the president names an ultra-doveish personality as Bernanke’s replacement – someone who can be trusted to keep the stimulus show on the road. The markets rally. The president has maintained the illusion of a healthy economy on the road to recovery.

A fresh crisis

Under its new chairman, the Fed keeps printing. QE4 is unveiled, an even more aggressive programme than any of its predecessors. The extra cash helps stock markets rally even further.

Seemingly out of nowhere, a fresh crisis ignites. Stock markets collapse, interest rates spike. Banks clamour for support from the Fed. The Fed redoubles its already extraordinary efforts at quantitative easing (QE), but to no avail. The Fed advises Congress and the president that the monetary system must be reset.

An angry electorate asks why, just like in 2008, banks are getting free money when they, the public, are not. Foreign exporters to the US start to lose confidence in the dollar. The US State Department agrees with the Fed – the system must be reset to something like Bretton Woods. The global currency system must be tied to the US dollar, and the US dollar must be backed by gold. With the support of the president, Congress instructs the Fed to devalue the dollar to gold and to reset it at a fixed exchange rate.

Fantasy? Possibility? Probability? This scenario, sketched out by US investors Lee Quaintance and Paul Brodsky of QB Asset Management, might strike you as far-fetched.

I see it as inevitable.

Because the financial crisis is morphing into a political crisis. And politics has shown itself to be incapable of fixing things. Or in other words, as Herbert Stein once wrote: “If something cannot go on forever, it will stop.”

The problem with gold

The problem with gold is not a change in the economic fundamentals. The fundamentals are still disastrous for unbacked money and for bondholders who have loaned fiat money. The problem for gold is psychological. When the price of any asset falls as gold has over recent months, it is human nature to question it. If that asset was a stock or a bond, you might do the difficult thing and cut your loss.

This is not special pleading on my part on behalf of gold – although roughly 80% of my assets are invested in gold, silver or gold and silver miners. I’m saying that gold is unique in that it has neither credit nor counterparty risk. This is important because the financial and monetary systems are under severe strain. I have written before, gold is arguably not even an investment per se, but rather a conscious decision to refrain from investing until we can once again operate within a sane monetary system, in which one can make sensible judgments about relative values.

Dramatic sell off

But the sell-off has been dramatic. So these are testing times for even the most ardent aurophile. If you accept my thesis that the rationale for holding gold hasn’t changed, then it is possible to view this as no more than a setback to the medium term story.

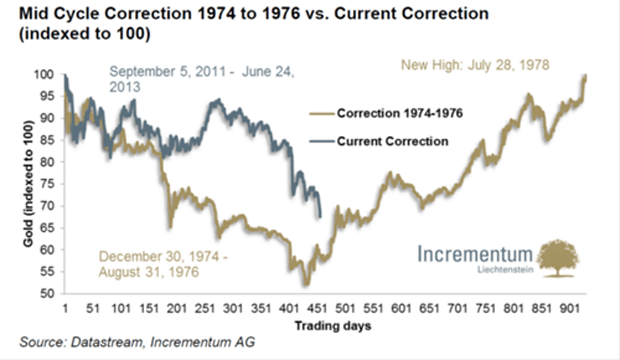

If you accept this thesis, it is possible to view the sell-off somewhat more dispassionately. We have been here before. The correction in the gold price that began in September 2011 resembles the correction that gold suffered between 1974 and 1976. Despite that correction, gold subsequently rose to new highs. The sell-off has, however, proved to be an excellent reminder of an investment truism: pound-cost averaging makes sense when markets are volatile.

The sell-off between December 1974 and August 1976 was plainly a correction within a longer-term bull market. I strongly believe that the current correction is precisely that. As ever, over time we will know for sure.

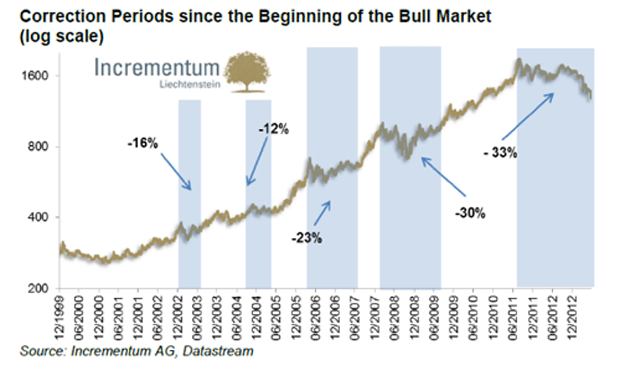

I think there are two characteristics of the sell-off in gold that have caused the weak hands in the market to capitulate. One is the scale of the sell-off in price terms. And the other is the duration of the sell-off, as shown in the chart above, which is now the longest period of negative price action since the current bull market in gold began in 2000. Anybody who bought gold since mid-2011 is now nursing unrealised losses. That those losses happened as equity markets powered ahead makes them even harder to live with.

Gold’s place in your portfolio

Financial forecaster Toby Birch says, “if gold was bought as part of a jigsaw to complement other assets then it has done its job. After all, a portfolio is supposed to consist of diversified investments with inverse correlations that cushion and complement each other”. And that, of course, is a good description of The Price Report portfolio: a diversified array of investments which have little or no correlation with each other. Indeed it would be naïve to expect every single one of the portfolio’s four discrete asset classes – debt, equity, uncorrelated funds, and real assets – to rise lockstep with each other.

There will always be times when at least one of these four engines idles, and of course at times more than one of them. But provided that a) the overall asset allocation split is sensible, and that b) the underlying investments are well chosen, then the performance of the portfolio overall can comfortably be left to the market to determine. All that’s required (admittedly a big ‘all’ in such a confused economic environment) is patience and a stout heart.

Research

Gold analyst Ronni Stoeferle of Incrementum AG in his exhaustive research note In Gold We Trust, writes that, while the consensus is convinced that the gold bull market has ended, he is equally convinced that the fundamental argument for gold remains absolutely intact: “There exists no back-test for the current financial era. Never before have such enormous monetary policy experiments taken place on a global basis. If there ever was a need for monetary insurance, it is today.”

The following press extract from The New York Times, touching on investor psychology in relation to swings in the gold price, is instructive:

“Two years ago gold bugs ran wild as the price of gold rose nearly six times. But since cresting two years ago it has steadily declined, almost by half, putting the gold bugs in flight. The most recent advisory from a leading Wall Street firm suggests that the price will continue to drift downward, and may ultimately settle 40% below current levels.

“The rout says a lot about consumer confidence in the worldwide recovery. The sharply reduced rates of inflation combined with resurgence of other, more economically productive investments, such as stocks, real estate, and bank savings have combined to eliminate gold’s allure.

“Although the American economy has reduced its rapid rate of recovery, it is still on a firm expansionary course. The fear that dominated two years ago has largely vanished, replaced by a recovery that has turned the gold speculators’ dreams into a nightmare.”

This piece was published, not in 2013, but on 29 August 1976. Like I say, we have been here before. In the ensuing three years following The New York Times article, the price of gold rose by over 700%.

Category: Investing in Gold