Oh well. It was good while it lasted.

At least my colleague won his bet and won’t have to get a three lions tattoo…

I’m just glad I had enough beer in the fridge to last me through the semi-final. I hope you did too.

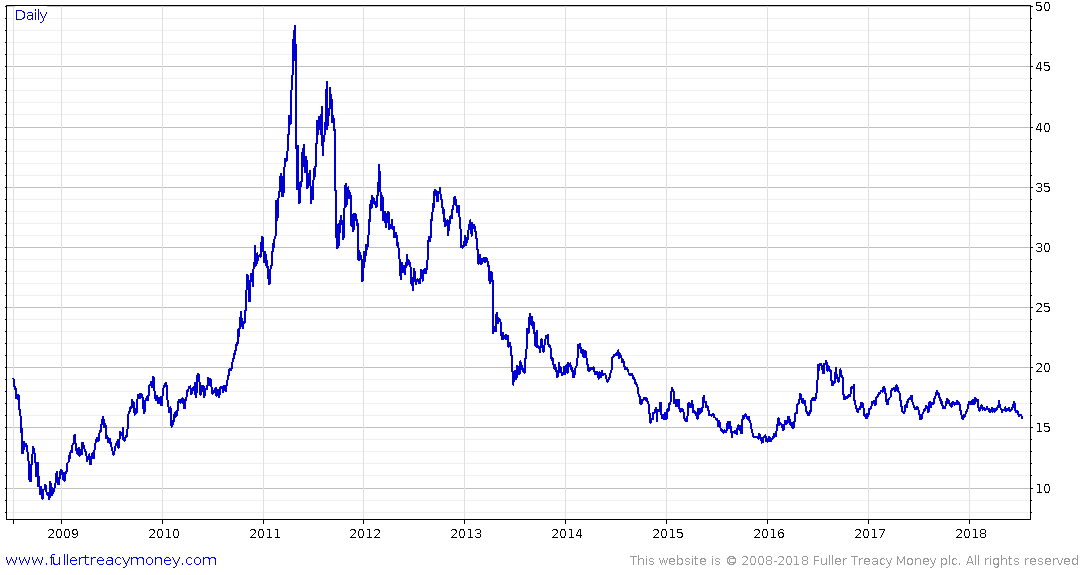

But back to the markets. Take a look at this chart.

You can see over the last few years that the price volatility of this asset has been compressed into an incredibly tight range. Traders aren’t buying an awful lot of it, and nor are they selling much of it either. It’s just bouncing up and down in an ever narrowing corridor, as idle traders skim each other for smaller and smaller profits.

My colleague Eoin Treacy calls ranges like these “explosions waiting to happen”. When volatility is compressed like this, it only takes a spark in the market – a catalyst – to blow the price sky high… or send it plummeting.

Or at least, that’s how the story normally goes.

But this is no normal asset – that’s a chart of the silver price. And this may be no normal range, but a manipulated one.

Nefarious intentions

“John, I have never seen such obvious evidence of a manipulated market in my entire life.”

This is a quote from the top brass at the CFTC (the Commodity Futures Trading Commission), to John Butler, a precious metals expert who was on yesterday’s episode of The Gold Podcast.

The CFTC is the market gatekeeper in the US, meant to regulate and prevent manipulation in markets like silver.

It clearly believes manipulation is going on – so why doesn’t it do anything?

It can’t find a profit motive. If somebody is keeping the silver price down, they’re not making any money from it. In fact, they’re probably taking serious losses.

If somebody is doing this, they’ve got an agenda that goes beyond profit making. That, and a big wallet.

But the CFTC needs a profit motive to go after whoever is involved, and it can’t find one. So it’s OK to manipulate and cheat the markets… provided you’re not doing it to make money!

But why would anyone do such a thing? Pin the silver price down at huge cost to themselves?

John thinks it could be an indirect means of holding the gold price down, by tinkering with the gold/silver ratio, which is an important historical benchmark. And a soaring gold price doesn’t look good for paper currencies…

I’ll let John explain in more detail. You can listen to the podcast in full on iTunes here or on Soundcloud here. If you have an iPhone, you can also find us and subscribe to future episodes on the podcasts app.

I got some terrific huge responses to yesterday’s letter. Thank you to all who wrote in! I can’t print, or respond to them all but I intend to share a few of them with you next week – Nick Hubble should be back with you tomorrow.

All the best,

Boaz Shoshan

Editor, Southbank Investment Research

Category: Investing in Gold