Financial markets often seem very detached from the real world.

It can be hard to relate the green or red numbers flickering up and down on a screen to what’s actually going on outside.

But sometimes, the seemingly inscrutable movements of those numbers have very real – not to mention strange – consequences.

Across the UK, gangs of thieves are prowling around parking lots and residential areas, looking to loot unattended cars of one particular item. They bring tools to harvest this forbidden fruit – hydraulic jacks, drills, and saws, to get under the chassis and tear it out.

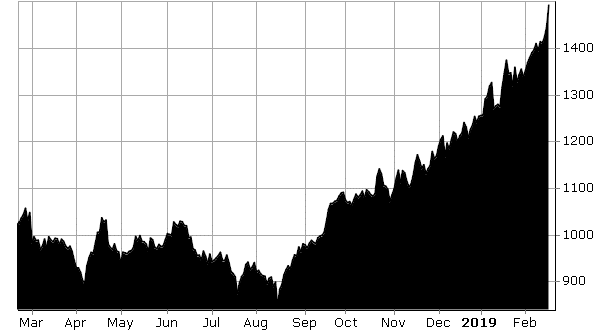

According to the Metropolitan Police, there have been at least 900 incidents of this since summer last year. And that number is only set to increase, for reasons that can be found in the chart below:

This is palladium, which has just whizzed past gold to become the most expensive precious metal around. It’s used more in heavy industry than jewellery, notably in catalytic converters, those devices used in car exhausts to reduce emissions.

Palladium is generally used in catalytic converters for petrol engines, with its sister platinum used for diesel engines. With diesel engines politically unpopular of late (hello, Volkswagen), petrol engines, and consequently the palladium market, have picked up the slack.

But as you can see in that chart, there really isn’t much slack in the palladium market. Production is tight, and can’t be rapidly brought online quickly to deal with the rise in demand. As a result, the price has just bolted higher… as has the reward for thieves who steal the converters and gut them for the palladium within.

Platinum price (blue) against the palladium price (green) since the Volkswagen emissions scandal

Platinum price (blue) against the palladium price (green) since the Volkswagen emissions scandal

Just a few hours ago as I write this, palladium has hit an all-time high of $1,500 per troy ounce, or £1,147. The folks who bought in August, are close to doubling their money in the space of six months.

I bought palladium back in 2016 when it was 600 bucks, so I’m feeling pretty chuffed. But not nearly as chuffed as the folks who bought palladium miners last year must be.

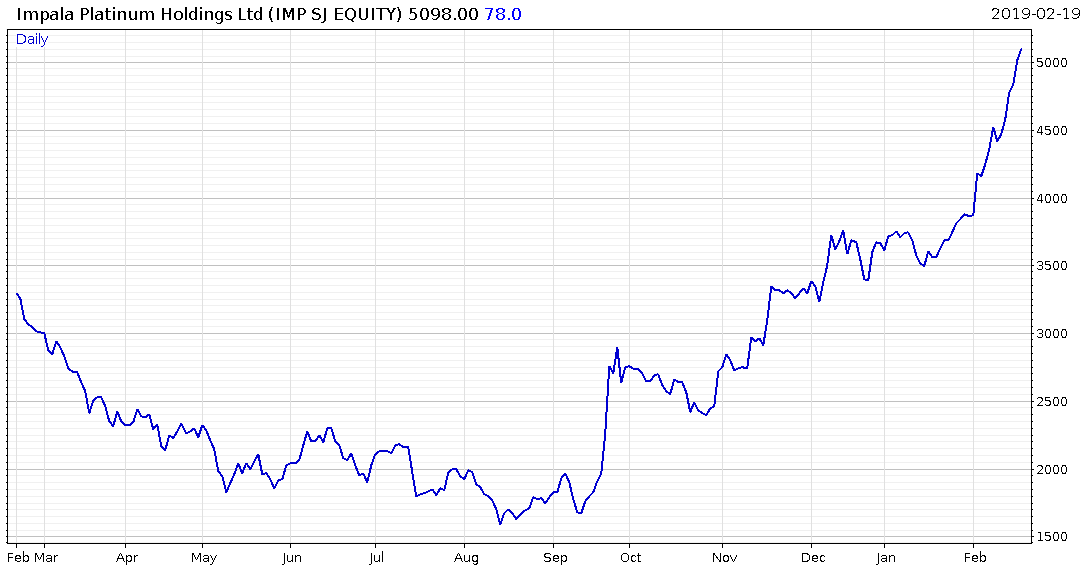

This is Impala Platinum, which despite its name, is one of the world’s largest producers of palladium:

Speculators who got in on Impala in September have more than tripled their money in less than six months.

Mining companies aren’t all the same. Other palladium producers haven’t done as well as Impala – that’s why knowing which miners hold the most value is key. But when precious metals take off, the miners go nuts – and the opportunities to profit can be immense.

That’s what Eoin Treacy has been working on for our 2019 Gold Summit. He reckons that gold’s recent rip higher has barely begun, and that high-quality miners are going to have a day in the sun like never before.

He’ll be delivering a keynote address at the summit next week, where he’ll outline exactly how he’s allocating his capital in preparation for “the big one”. In his view, it’s the investors who get in now that are set to reap “parabolic profits” when gold starts to shine. It’s not to be missed – you can sign up here if you haven’t already.

I’m still pondering what to do with my palladium. Sell, or hold? Data coming out of China and Germany indicates that automobile sales are weakening, a further indicator that recession is on the way. If people aren’t buying cars, palladium demand should take a hit.

But with governments ever more keen to reduce emissions, stronger catalytic converters, and thus palladium demand, is set to increase by decree. While car companies may try to substitute or use less palladium as it gets more expensive, such changes cannot occur overnight – and so an already tight market may just get tighter.

The $1,500 mark is a psychologically important one – if there’s to be a change in trend, it’s likely to occur around this point. If it keeps ripping higher, I’d keep a closer eye on your car – especially if it has a petrol engine.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Investing in Gold