WINDERMERE, LAKE DISTRICT – Think you’d ever spend some of these?

They’re called “Goldbacks”.

That’s 24 carat gold, rolled thin as paper, and then insulated with even thinner layers of plastic.

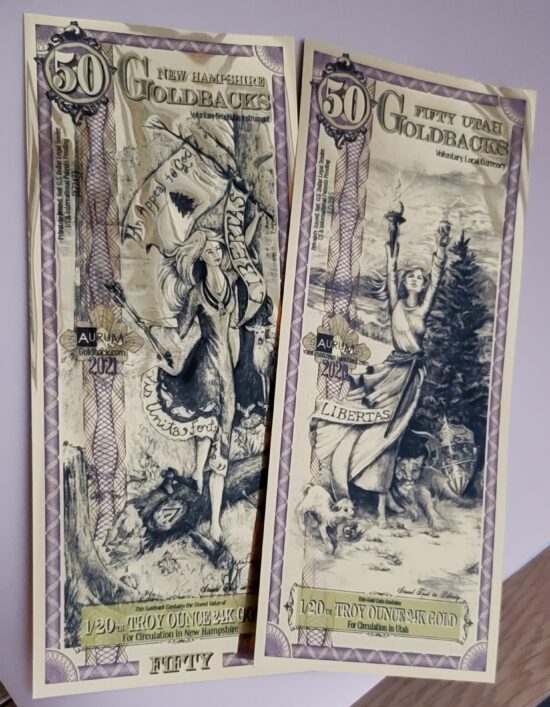

That’s the highest denomination Goldback there is: the 50. They both contain a twentieth of a troy ounce of gold – so about £65 in melt value at current prices.

There’s also a 25, a 10, a 5 and a 1 Goldback bill that have been “printed”, with the single Goldback bill worth about £1.30 in melt value at current prices.

In certain areas of the US, you can find these bills in circulation – freely exchanged for goods and services by consumers and businesses.

We wrote about the Goldback project a while back pre-WuFlu (How to get free gold – 4 October 2019). The purpose of the project is to make physical gold spendable again, by fixing what’s known as the “small coin problem”. Gold is so valuable today that its physical size is an obstacle to its return as a currency – e.g., with a sovereign worth north of 300 quid today, there aren’t many everyday purchases you could make with one (leaving aside their face value of £1).

The Goldback fixes this by swapping out coins for durable notes made of physical gold. It’s a novel concept made possible by modern technology, and the results are very striking.

The project started in Utah, but Goldbacks have since been issued in New Hampshire and Nevada, with the plan to expand the usage of sound money throughout the US. Each state’s Goldbacks – while containing the same quantities of gold – have different designs. As you can see in the image above, while both depict the virtue of Liberty, there are differing depictions for Utah and New Hampshire.

For a time, the folks who started it in Utah were sending a free Goldback to anyone who asked for one, no postage charges, even if you lived on the other side of the Atlantic. Sadly that offer is no more, but it is still possible to acquire them if you’re willing to pay a premium.

While I can’t spend them in the UK, I am a collector of these notes. I’ve even gone so far as to commit the cardinal bullion-investing sin of paying import duties on gold in order to get my hands on them.

Problem is, even if I were able to spend these notes… I don’t think I would. For why would I want to part with these glorious sheets of gold, when I could just fob everyone off with Andrew Bailey’s plastic scrip?

As Gresham’s Law states, bad money drives good money out of circulation. In ancient civilisations when unscrupulous characters began clipping coins to steal a little of their value, unclipped coins swiftly vanished from circulation – for citizens hoarded the better coins, and only transacted with the poorer ones.

Similarly, when silver coins in the US began being minted with less (and eventually zero) silver in the 20th century, the older, purer coins vanished from circulation. The populace knew the older coins were more intrinsically valuable – even if they had the same face value – and so held on to them for safe keeping.

And so it is now with totally unbacked paper money – gold is fully out of circulation and remains only in jewellery and the portfolios of shrewd investors. Why would you want to spend your gold? It’s paper cash I’m happier to part with…

And as you’ll be hearing in today’s episode of the Gold Summit, there’ll be more than enough paper cash to go around. You’ll be hearing from the founder of our business – the great Bill Bonner – and the wise Simon Mikhailovich, who made a fortune in the infamous “Big Short” trade of 2008 and then deftly moved into the gold industry. He’ll be telling you about all the chaos that went on behind the scenes in the gold market last year, and why the metal has become “the North Star” for investors everywhere. Don’t miss out: watch the interviews when they go live here.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

PS If you’d like to know more about the Goldback project, you can learn more on its website here.

And for those who’re suckers for pretty gold like me, and would like to buy some – shipping costs and import duties included – I purchased my Goldbacks from RareKoin and DefyTheGrid.

Neither myself nor Southbank Investment Research have any commercial arrangements with the Goldback project or the two vendors listed above.

Category: Investing in Gold