THE OLD SMITHY, STAFFORDSHIRE – I can’t promise that you’ll agree with everything you’re about to read. Especially if yesterday’s poll is to be trusted.

But we wouldn’t be doing our job if we weren’t challenging your views on investing, money, and the world in general. And this is an issue which effects virtually all of our readers – certainly for those of us living here in Blighty.

Following the last few letters of Capital & Conflict where we focused on the new lockdown restrictions, I’d like to share somebody else’s perspective on the matter – both on the consequences for investors and the world in general.

What follows is a hefty chunk of one of our premium research publications that was sent out to subscribers last week. It’s written by Charlie Morris, City fund manager by day and editor of our most prestigious publication by night: The Fleet Street Letter Wealth Builder. You’ll be hearing a lot more about and from him in the near future, and I’d like to introduce you to him if you’re not already familiar with his work.

The title alone is sure to be perceived as controversial by some; I’ve no doubt it would disqualify the text as “unfit for publication” by lesser organisations. But this happens to be one of Charlie’s finest works in my view – and I think you should read it.

Even if you want to leave it for his views on the WuFlu, I suggest you stay for his investment observations…

Sweden was right

By Charlie Morris

Editor, The Fleet Street Letter Wealth Builder

I turn 50 tomorrow and what a gift from the stockmarket to mark the occasion.

Tech stocks started to give up ground earlier in the month, in what I deem to be the tail end of a generational bubble. Tech has been acting as the safe haven from Covid-19, because computers hate viruses but rather like Covid-19. The tech trade is largely played out, even though no one seems to have told Zoom and Tesla.

A second wave of the virus in Europe has triggered further lockdown measures. Stockmarkets have taken it badly as the bursting of the tech bubble has hit the new economy, while the new lockdown measures have smacked the old economy.

From personal experience, I had a bad cold/flu in February, as did many of my family and friends. Colleagues were spluttering all over the office. Around that time, I took the Central Line (worse than Wuhan) on the Tube six times per week and visited the Alps. It is inconceivable that I wasn’t exposed to it before March, and the same goes for most of us.

I’ve avoided the Covid-19 conversation, because it’s well covered elsewhere – in fact, obsessively so. From a medical perspective, I have had little to add, but when it comes to the numbers, I’m no slouch. My thoughts on the policy response is as follows:

- The early lockdown was prudent because we had no idea how dangerous the virus was.

- That is largely because China was lying.

- Asia has done well in managing the virus but blocking it does not solve the problem, we must learn to live with it. Cases in Japan and South Korea are rising.

- Sweden, like the UK in the early days, went for herd immunity. They were heavily criticised but have been proved right.

- The UK changed tack in March and opted for lockdown. The result is that Covid-19 is not yet played out like it soon will be in Sweden.

- Covid-19 will soon see its millionth casualty which is very sad, but with circa 60 million deaths each year, the excess deaths are modest. This pandemic won’t even show up as a blip on the charts in the great scheme of history.

- Lockdown is overdone. Jobs and the economy also save lives and are underrepresented in the arguments.

- Having discussed this with many friends and colleagues, I don’t know anyone who supports lockdown.

- Lockdown is destroying jobs, theatres, restaurants, public finances, travel and an entire generation who have seen their education disrupted.

- This pointless, fruitless, patronising, nanny state, misinformed, politically weak, morally bankrupt and costly lockdown makes me wonder what the government is smoking.

- China is still lying.

- Sweden is right. The solution is herd immunity.

The lockdown has set back the economic recovery unnecessarily, and also contributed to the recent shake-up in the stockmarket. I’ll get to the market damage, but first I want to show you the UK versus Sweden.

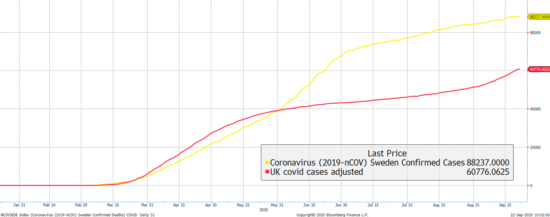

The case data is hugely unreliable because it massively understates the number of cases earlier in the year in both countries, as there was minimal testing. We know the numbers are wrong but have no idea how wrong.

Many people who had it haven’t reported it, and many have had it and don’t even know they have. I suspect the UK, and other globally connected places, had tens of millions of cases before governments even acted. At least with widespread testing in the UK and Sweden, we can start to compare data. I have reduced the UK data by 6.6 times to reflect the population differential. This means we can more or less read these on a like-for-like basis.

There is a visible second wave in the UK, France and Spain. Sweden has seen cases grow faster over the summer, but they are decelerating rather than accelerating. The lockdown was successful in temporarily holding back the virus. As soon as it ends, the virus gets back to work. In Sweden, the virus is struggling to find new hosts as the population has built herd immunity.

UK and Sweden Covid-19 cases

Source: Bloomberg – as described with UK data population adjusted (divided by 6.6) 2020 year to date

Source: Bloomberg – as described with UK data population adjusted (divided by 6.6) 2020 year to date

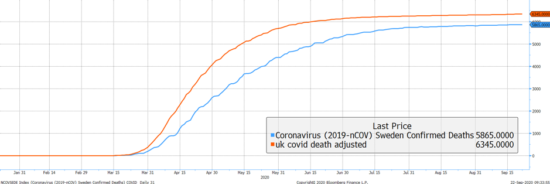

Some believe that herd immunity is heartless and dangerous, but if you adjust for population, the UK has had approximately the same number of deaths as Sweden. I gather much of the falling death rate is down to improved treatment and the early passing of the frail.

UK and Sweden Covid-19 deaths

Source: Bloomberg – as described with UK data population adjusted (divided by 6.6) 2020 year to date

Source: Bloomberg – as described with UK data population adjusted (divided by 6.6) 2020 year to date

The government needs to move on and deal with the many other serious issues from Brexit to cladding. The Covid-19 strategy should focus on protecting the vulnerable, and the news should talk about something else.

Macro implications

As I wrote last week, September has seen a dip in inflation. That initially impacted the tech stocks, which made a new low on Friday. Ironically, they held up the best during Monday’s correction. Covid-19 is tech’s friend. Since we’ll all end up like Sweden anyway, that friendship will have to come to an end.

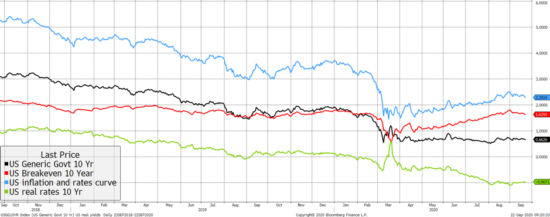

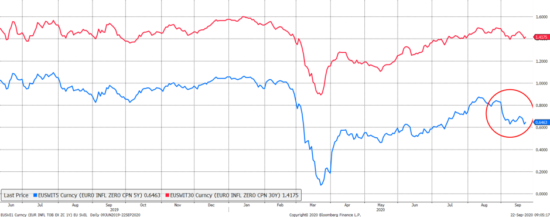

US inflation expectation (breakeven, red) have turned down while the yield has remained flat. In a proper recovery you would expect the bond yield to rise along with inflation. This isn’t (yet) happening which is troublesome for the banks.

The big mover has been real rates (yield less inflation green) which drives gold. This hasn’t fallen since early August which explains why gold has stalled.

US rates and inflation

Source: Bloomberg – as described, past two years

Source: Bloomberg – as described, past two years

The line I rarely show is the blue one that adds rates and inflation together. You won’t find it in a textbook, but I discovered it some years ago and call it “the curve”. Essentially if the curve is zero, your country has turned Japanese (or European), and monetary policy is no longer an effective tool. If it is high, monetary policy can do great things.

My observation was that it can correlate with the stockmarket quite closely. This correlation tends to increase as the numbers tend towards zero. In other words, it works better in low inflation/low rate countries.

The curve is falling and dragging the market with it. Lockdown means less demand and less pricing power. If the government wants to support asset prices, it had better print some more money.

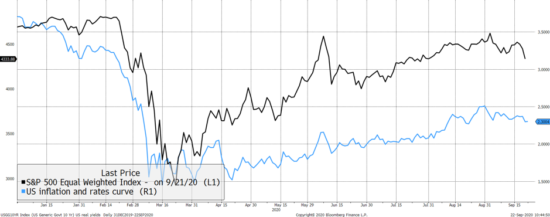

The curve drives the market

Source: Bloomberg – as described past two years

Source: Bloomberg – as described past two years

To illustrate how close this relationship has become, I’ll zoom in on 2020. Even the nooks and crannies fit quite well. It just shows you how important the macro backdrop has become.

Source: Bloomberg – as described 2020 year to date

Source: Bloomberg – as described 2020 year to date

Over in Europe, five-year inflation expectations have nudged lower too, which reaffirms that the recovery has stalled. Stimulus will be helpful for asset prices, but I would prefer to see an ease of lockdown.

Eurozone inflation falls

Source: Bloomberg – eurozone 30-year inflation swap (red) and five-year (blue) past two years

Source: Bloomberg – eurozone 30-year inflation swap (red) and five-year (blue) past two years

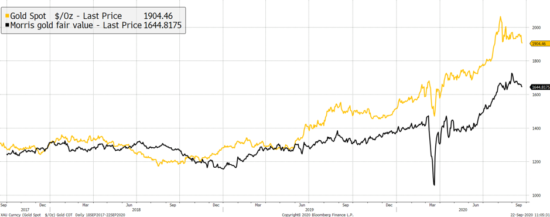

Lower inflation is no friend of gold, and the price has dipped as a result. To drive gold higher we need a lower rate, which is getting harder, or increased inflation. Longer term I am gunning for the latter, mainly because governments will keep on printing. What choice do they have?

Gold and fair value

Source: Bloomberg – as described, past three years

Source: Bloomberg – as described, past three years

But gold is trading at a 15% premium to my fair value calculation. This seems to be trending higher, which is what you would expect to see during bull markets. This premium is modest, but a premium is a premium and that can be a vulnerability when sentiment turns against gold. But I don’t see that happening because flows are still supportive and for good reason.

Gold premium

Source: Bloomberg – as described since 2000

Source: Bloomberg – as described since 2000

Investors continue to allocate to gold because the world is awash with debt that will never be repaid. Gold is the tried and tested way to protect yourself against this debasement. That doesn’t make it risk free or protected from market shocks, but it will do what it is meant to do when the time comes.

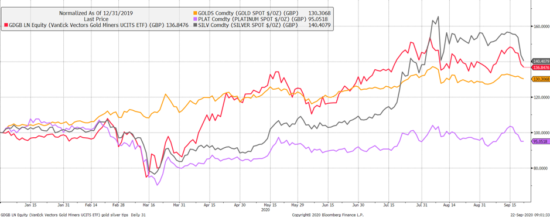

The real shock on Monday came from the silver market which is nearly 20% from the $30 high reached in August. This is entirely normal behaviour for silver, whether it’s going back to $20 or up to $50. But unlike gold, September has seen some selling by investors.

Gold has great depth and can withstand selling pressure, but silver is fickler. Inflows cause it to soar and outflows collapse. There is no question, silver is speculative.

Gold and its friends

Source: Bloomberg – as described, 2020 year to date

Source: Bloomberg – as described, 2020 year to date

Yet silver is still ahead of gold and the miners, and way ahead of platinum. Consolidations are normal and I would say you should own silver, platinum and the miners when gold is in a bull market, which it still is. Sit tight. Also recall the BOSEQ strategy I have mentioned at times. That is “Buy odd, sell even quarters”. It’s observational but gold has tended to perform best in Q1 and Q3. Q2 is normally the worst with Q4 being lacklustre. Q4 is coming and so the lull could last for a few weeks yet.

Finally, Bitcoin has also enjoyed a savage September. The on-chain metrics are chugging along and give me no reason to cool on it at this stage. Bitcoin (black) is volatile but remains correlated to tech (red), because it is tech.

Bitcoin still leads tech

Source: Bloomberg – bitcoin (XBT) as described, year to date

Source: Bloomberg – bitcoin (XBT) as described, year to date

It’s a reminder that in this market, the macro shocks are hugely influential. This one isn’t entirely down to lockdown because its seeds were sown in early September when tech turned down. But lockdown certainly hasn’t helped.

There are no plans for us to fly around the world and pick up where we left off last March. What started as temporary is starting to feel permanent.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Investing in Gold