Welcome to the final day of my five part series on bitcoin and the blockchain. Thank you for staying with me, and I hope you are finding this brave new world exhilarating.

I concluded yesterday’s piece by looking at bitcoin in three ways. As money, as a commodity, and as a tech stock. It has components of all three. Digital assets are a new asset class in their own right.

It can certainly be used as money, but it behaves more like a commodity. I described how bitcoin has utility and is building a network, in a similar way to social media. For valuation and evaluation, I believe bitcoin’s characteristics are more closely aligned to a tech stock than either money or ‘electronic’ gold.

Like many exciting tech stocks, there are no profits. In fact, there never will be, but bitcoin has a utility. Not only can we exchange value over the Internet, but the blockchain is a purposeful public database. The more people that use it, the more the network will establish roots. Once that happens, the network will morph into something we can’t live without.

The young stockbroker asked his boss, “why did the market rise today?” To which he replied, “more buyers than sellers my dear boy”.

It’s an old adage but, in truth, supply must always match demand. In any market, there must be the same number of buyers and sellers. The price is what enables them to discover equilibrium. In this story, the buyers were more eager than the sellers. The quantities, on both sides, were the same.

With bitcoin, the supply is known far into the future and so the only remaining variable is demand. That will be related to bitcoin’s usefulness. By studying the activity within the network, we can estimate what it ought to be worth.

The approach I have chosen is to treat the bitcoin network like a toy helicopter. The faster the blades spin, the higher the helicopter will fly. If the network is vibrant, it will reach the skies. If it is dead, it will never take off the ground.

There are several ways of measuring network activity. The first is to see how much value changes hands each day in dollar terms. Unfortunately, this simple question is difficult to answer. The blockchain can report something known as the ‘total output volume’. Unfortunately, that overstates the truth by roughly six times. Allow me to explain.

Imagine I paid you £1 using a £9 note and you gave me change using a combination of £2 and £6 notes. Confused? This is how the bitcoin network operates. The total output volume would register £9. We only want to count £1. A note or piece of bitcoin could be any size. Imagine having a bank note for £12.53.

This is known as the ‘change algorithm’. There have been attempts to solve it, but they are just guesses, without proof or disclosure. If this was solved, it would tell us how much value changes hands each day.

I will also disclose to you that I am trying to solve this very problem on my blockchain analysis platform called CCdata.cc. If it worked, the site would be live, but it isn’t, so it doesn’t. But maybe one day, and I promise, Capital and Conflict readers will be the first to know.

This is a complex area (I sense your emails being drafted already) and so we will move on to another way to measure the bitcoin network. Without knowing how much monetary value changes hands each day, what else is there?

The network and transactions

There’s the number of daily transactions – that is around 160,000. However, many of them are small and are used to ‘wash’ bitcoins to make them harder to track by the authorities. In this instance, I smell the underworld at work.

The number of transactions has a link to the network value, but there is too much noise in the data. The bitcoin washing causes transaction surges without impacting the price. This is activity, but it’s not value creating, just a way to keep ahead of the law.

The third approach is to study network fees. Bitcoin transactions typically pay a fixed fee of 0.0001 bitcoin. That’s around three cents at current prices. Large transactions are exempt from fees. Data-heavy transactions are not. Recall that bitcoin not only allows the transfer of value, but also information.

Strictly speaking, a fee isn’t compulsory. The incentive to pay is that the miners will process those transactions before the others, because they get paid. It’s a bit like first and second-class post. Both should work, but first is a little quicker.

As an aside, I’ve always wondered what the postman does with second-class post. Does he leave it in the bag for an extra day? Answers on a postcard please.

We have looked at three network measures. I have opted for fees over transactions or total output volume. This is because they are the most representative measure of network activity.

Bitcoin operates 24/7 and a week is more representative than a day. Weekdays are busy and weekends are quieter. The seven-day week takes this into account. A week is a complete micro economic cycle and avoids unnecessary volatility.

Last week, the total fees paid to the network were $70,000; that is value that goes directly to the miners for servicing the network. Those were all genuine transactions. The reasons for the transactions could be speculation, value transfer or sending messages.

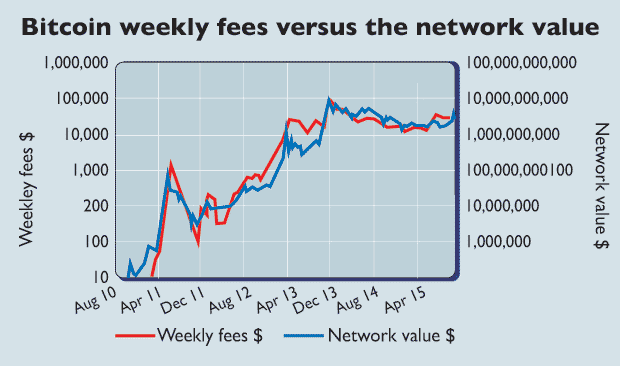

The chart plots the bitcoin network value alongside the weekly fees generated. The two series are closely related. This confirms that there is a close relationship between the fees awarded to the miners and the value of the network.

Source: Charlie Morris, Capital and Conflict

Between 2011 and late 2013, bitcoin’s weekly network fees grew ten-thousand-fold from $10 to $100,000. That was a glorious era of network growth.

In late 2013, the network was valued at more than $10bn. That was unsustainable, and subsequently fell by 77% by early 2015. The drop in the network value was more or less in line with the shrinkage in fees. Falling fees reflect a contracting network. You can see this happened twice. First in late 2011 and second from late 2013.

Less network = less value

The exciting development is that the fees have been in a rising trend since the summer. Unsurprisingly, this has caused the price to surge from a low of $160 to a high of $500 two weeks ago. Now you can guess what inspired this award-winning, five-part, primetime mini-series on bitcoin.

More network = more value

As I write, a single bitcoin is priced at $320.

Looking at the chart, the fees sometimes lead the value and vice versa. When the fees are leading the network value, the market has yet to catch up.

If the network grows whilst the price lags behind, this would be bullish. Assuming the growth continues, the price should catch up.

When we measure a stock’s valuation, we might use a PE ratio – that is price/earnings with units expressed in years (it’s not actually a ratio).

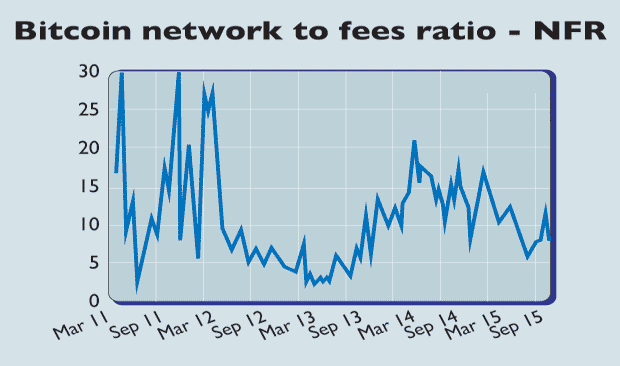

Applying this to bitcoin, I’ve created the ‘network to fees’ ratio, which we’ll call the NFR. The current reading is 79,000 and if we divide it by 10,000 (to simplify it) the answer is 7.9.

NFR = network value $ / weekly fees $ / 10,000

Source: Charlie Morris, Capital and Conflict

The data is haphazard pre 2012 because the network was too youthful for economic statistics to make much sense. However, since that time, the data has started to settle down.

In mid-2013, the NFR dropped to a low of 2.5. The NFR is telling us that bitcoin was exceptionally cheap at that time. The price of bitcoin had materially lagged the size of the network. Don’t forget, the network had grown ten-thousand-fold over the prior two years.

The market acknowledged that the price had lagged the network growth. The result was a price surge in late 2013. The price got ahead of itself in a speculative frenzy. It then peaked when no more buyers could be found. The market must balance and so the price had to fall.

To add to the problem, the network started to contract. Much of the activity in those days was speculation. Today, there are more uses for bitcoin. It is still speculative, just less so than in 2014. Bitcoin is growing up.

The price held up relatively well until mid-2014, whilst the network was contracting. The valuation became too high with a NFR of 21. That meant fees had fallen whilst the price hadn’t. The result was a deep and prolonged bear market.

Buy low and sell high. Using this valuation methodology, and nothing else, you could have bought in mid-2013 at $105, sold in mid-2014 at $675 and bought your coins back in the summer for $270.

Not bad considering, you haven’t had to study a price chart. Nor follow the news. This is just a simple and logical metric linking the network to its underlying value. It’s rational, it’s logical and it works.

You can also see that bitcoin actually got ‘cheaper’ between 2011 and 2013, even though the price rose. The price leap was from $2.50 to $50, yet fees grew from $60 per week to $15,000. In other words, fees grew 300 times whilst bitcoin appreciated by ‘only’ 24 times.

Like all the best growth stories in history, the price can’t keep up with reality. That’s why technology investing is so difficult. The doomsters are right most of the time. But the game changing companies like Google, Microsoft and Apple were consistently a step ahead of the market, year after year.

Obviously it was better to buy bitcoin at six cents and do nothing, but dreaming of what might have been isn’t a great strategy. At least this technique allows you to make a decision based upon value and fact. I promised to share with you the fair value of bitcoin and so I will do just that.

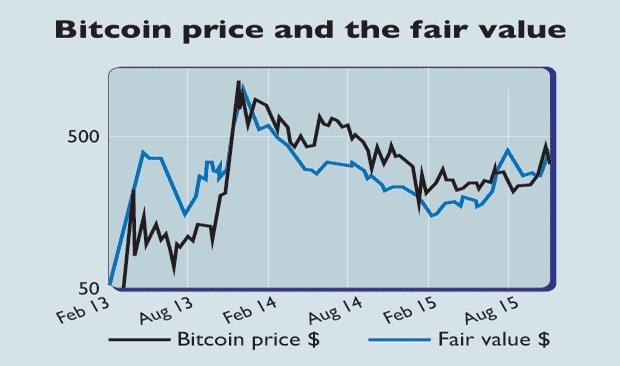

Source: Charlie Morris, Capital and Conflict

There you have it. The fair value of bitcoin, as at 12 November 2015, is $386. You can buy bitcoin today for $320. According to my analysis that’s a 17% discount to fair value.

Yesterday, the fees paid to the miners were $8,693. Ten days ago, they touched $20,331. It was only a blip that soon came back down to earth. If these levels could be sustained, the bitcoin network value would rise rapidly. In fact, bitcoins would be worth $800 each.

If you believe bitcoin has a future, you are currently able to buy it slightly below its fair value. That means your future returns will include the underlying network growth plus a little extra.

If instead you buy bitcoin above its fair value, your returns will be the underlying network growth less however much you overpay.

If the network shrinks, it doesn’t matter how much you pay, you’ll simply lose money. So you should only buy bitcoin if you believe it is here to stay.

I hope you have enjoyed learning about this remarkable new world of finance. Next time you see the words bitcoin, blockchain, cryptography or distributed ledger, don’t look confused, because you a now an expert. I personally award you with a Capital and Conflict award. You are now a fully qualified bitcoin and blockchain barstool expert.

You’ll be able to tell your friends how this remarkable invention will change the world. I’ve left you with more questions than answers. That’s normal, as the world rarely changes with a plan. This is the process of creative destruction. At least you can now ask the right questions.

I hope you have enjoyed reading this series as much as I have enjoyed writing it.

Category: Investing in Bitcoin