On behalf of the Southbank Investment Research team, we hope you and your family are well in the aftermath of events in Manchester.

If there is any relevant analysis about terrorism to come, it’s not yet an appropriate time.

There are plenty of other issues to take a look at though. And today’s favourite is China.

4 Stocks to Watch: Protect Your Wealth Amid a Korean War

Did you know farmers still can’t own land in China? They’re allocated plots by a collective. The result is a tiny average farming plot size. Combine that with labour intensive farming techniques and you get an average plot size per worker around 0.32% of Australia’s, which is at the opposite extreme.

Why should you care about China’s tiny inefficient farms? Because vast amounts of rural workers are set to be out of a job in coming years as China looks to commercialise farming.

With half the population still living rurally, it’s important that British investors remember China still has plenty of changing to do. The “Made in China” phenomenon is far from done. There is a heck of a lot of cheap labour waiting to be freed up. Only odd Chinese agricultural policy is preventing the change.

But the government has signalled it wants corporates in the farming business because inefficient use of land is harming Chinese food security. Communists love food security slightly more than they love collectivism. And so the world needs to prepare for a few hundred million more workers lining up outside Chinese factories.

Meanwhile, China’s financial sector is still filling the gloomy section of the media’s reports. For the first time ever, banks are having to borrow money at a higher cost than they lend to their corporate customers. Borrowing at a higher rate than you lend is not exactly a good business model. It can’t last.

The government’s finances are in trouble too

The ratings agency Moody’s downgraded China’s bonds to A1 from Aa3 and the outlook is now negative. Dramatic increases in debt are to blame according to the release.

Chinese stocks and the yuan fell on all the bad news. The question is how it all resolves itself. Will the government replace the shadow banking sector as a source of funding? It just cracked down on the industry, hence the funding crisis in China’s mainstream banks. Any support for a failing banking sector could worsen the government’s financial position even more – something Moody’s is predicting.

The trouble with debt booms is that it’s hard to keep them going. But if you don’t, a financial crisis takes hold. These days, central banks have so much power and influence that debt booms don’t need to end, apparently. At least that’s the theory we’re all testing.

Politics is left as the main source of a potential crisis. And there’s no shortage of politics.

Greece’s benefactors failed to agree on further financial support. The EU and International Monetary Fund are arguing about whether to reduce Greece’s debt to put it on a sustainable path, or to keep the country reliant on international support so that policy pressure can continue.

India announced the conclusion of raids into Pakistani-controlled regions of Kashmir, while Pakistan claimed the raids never took place. The aim was to destroy terrorist camps, which Pakistan claims don’t exist.

South Korea fired warning shots at what might’ve been a drone from North Korea after the country tested another missile.

And the spat between the Philippine president Rodrigo Duterte and Chinese president Xi Jinping over oil in the South China Sea continues.

The good news is, there’s a straightforward way to benefit from all these geopolitical risks…

Is bitcoin better than gold?

One of the reasons to invest in gold is as a geopolitical hedge. When there’s some sort of political mess which endangers the harmonious workings of the world’s financial and economic system, the gold price spikes. That’s because it’s a non-financial asset. It’s an opt out from the financialised world which relies on international cooperation.

At least it was a good hedge. These days the price of gold is toyed with in financial markets to the point where the actual metal doesn’t play much of a role in determining prices. In a rush to meet margin calls on their other punts during a crash, traders might sell their gold positions, for example. Then the price of gold falls alongside other assets.

So where can you turn to instead? How can you make a good gain while your other assets slump thanks to Donald Trump, Xi, Kim Jong-un and whoever else is causing trouble?

Bitcoin seems to be an excellent choice.

Each time geopolitical turmoil pops up somewhere, the price of bitcoin spikes. Recent trouble in Venezuela and China are two examples. Each financial shock, crackdown or poor economic release has sent the bitcoin price higher. When things calmed down again it falls.

The reason this happens is very straightforward. Just like gold, bitcoin is a non-financial asset. It’s designed to operate outside the government’s legal system and the financial world’s infrastructure.

But it’s a lot less arcane than gold and far more convenient to actually use. Venezuelans are using bitcoin to buy everyday goods on Amazon in the US and then having them smuggled into the country. The Chinese are evading strict capital controls to get their money out of the country. Even terrorists use bitcoin in arms deals, and that industry seems to be in quite a bull market…

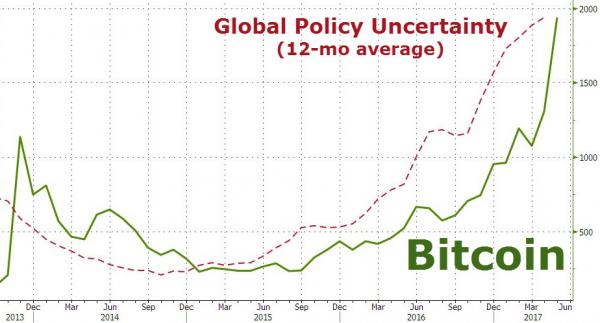

Zero Hedge published this chart showing the bitcoin price next to the Global Policy Uncertainty Index. The index measures the levels of unpredictable and surprising government policy. You can see the two have been moving together.

Meanwhile, gold is languishing. That’s partly because the US dollar is considered a safe haven for money too. When people rush their money back to the US, it bids up the dollar. Because gold is priced in dollars, the US dollar price falls.

As a UK investor you aren’t subject to this. At least not to the same extent. That means gold is still a decent option. But it hasn’t exactly doubled like bitcoin did already this year.

Until next time,

Nick Hubble

Editor, Capital & Conflict

Category: Investing in Bitcoin