God damn them all,

I was told we’d cruise the seas for American gold,

We’d fire no guns,

Shed no tears…

Now I’m a broken man on a Halifax pier,

The last of Barrett’s Privateers…– Barrett’s Privateers (unofficial anthem of the Royal Canadian Navy)

OUTSIDE A PUB, SOMEWHERE IN LONDON – The past eight months have been a hard time for gold investors. Or should I say, a hard time for gold investors with a short-term outlook. Any gold bulls trying to cruise the market with leverage over the last half year now is no doubt feeling like a broken man indeed…

I’ve been listening to Barrett’s Privateers quite a lot recently. It tells the tale of fishermen who have been lured into privateering (state-sanctioned piracy) with the promise of looted gold, only to find themselves totally out of their depth at their first encounter with danger. The moral of the story is especially applicable to investing – know what you’re doing, and be prepared for what the market can throw at you – but I bring it up for another reason in today’s note.

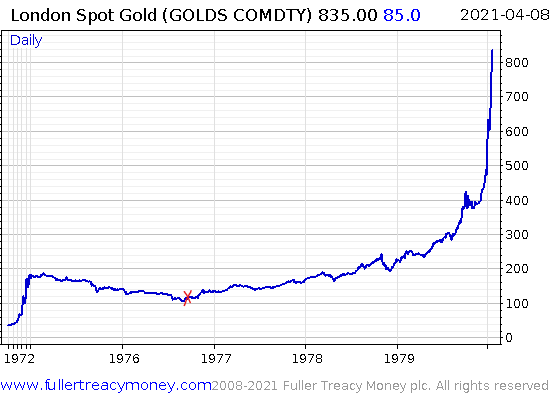

Despite being very popular in the Canadian Navy, Barrett’s Privateers is not actually an old sea shanty from the age of fighting sail. It was written and sung by a Canadian folk singer (the late great Stan Rogers) and recorded for the first time in September 1976 – at almost exactly the same moment when the gold price bottomed:

First recording of Barrett’s Privateers indicated in red – less than a month after gold bottomed at just over $103 in August 1976. Gold would never be so cheap ever again…

First recording of Barrett’s Privateers indicated in red – less than a month after gold bottomed at just over $103 in August 1976. Gold would never be so cheap ever again…

You’ll often hear people speak of the gold bull market through the 1970s like it was constant all the way through the decade. As though the gold price just took off as soon as Richard Nixon ended the gold standard and never looked back.

But it wasn’t nearly so straightforward. As you can see, while gold did jump high to begin with, there were entire years in the early 70s when the metal traded down. Those who’d wisely bought it fearing inflation were no doubt jeered at as being out of touch at the time.

I firmly believe that the pullback after August is just another of these periods where the gold price falls for a while inside a broader bull market. And similarly, I’m sure it will be forgotten in a few years’ time.

I’ve been dwelling recently on gold’s value as an asset which endures and prospers during eras of declining trust: trust in institutions, in government, and in society itself. A reader wrote in with his own reasoning on the matter:

I spent most of my career, between 1957 and 2001, in the public sector. In the 1970s our trade unions agreed a deal with the government that we should receive an index-linked pension based on RPI. Now that was the deal under which I worked for about 25 years until I retired in 2001. For the first few years after my retirement, the government honoured the deal. Then, in 2008 when government profligacy and greedy bankers caused a financial crisis, the indexing of our pension was changed to CPI.

The financial crisis was not our fault, but we had to pay for it. Then when you look back at previous government ratings, and see what happened to war loan bonds and the confiscation of gold, you realise that lending to government long-term is not risk free, quite the reverse. Even in 2019 we were overdue for another government inspired financial crash and the pandemic money printing has just brought it closer. I am long gold to well over 50% of my investment capital, most of it physical gold stored off-shore with some in a safe deposit box. I don’t trust ANY government any further than I can throw it.

The bear market in trust has a way to go yet, I fear…

But that’s all from me for today – I’ve got pubs to pay custom to.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

PS Gold’s pullback since August has been attributed to the rise of bitcoin. While there is some evidence to suggest that some investors have been swapping their capital out of gold ETFs and into bitcoin, I don’t believe this will continue to occur for a long period of time as ultimately these assets are completely different. Bitcoin will never be able to replace gold; but it doesn’t need to, for it isn’t a precious metal. It is something entirely different…

Category: Investing in Bitcoin