ABERDEEN, SCOTLAND – Thirty-seven thousand dollars per bitcoin?

Twenty-seven thousand pounds apiece?

Why not. Why not?

Watching bitcoin is like watching an art auction these days. The price just keeps going up, interrupted only by nervous pauses… and an ever-growing crowd of spectators gathers, hot with anticipation, wondering just how much somebody else will pay up for it. Though as we’ve been exploring over the last couple of days, this particular auction only appears to be in session during Asian daylight hours.

While extreme is the name of the game when it comes to BTC price action – and one gets accustomed to it over the years – the speed of this rally is giving me the willies. I actually had to change the opening lines of this letter to add three thousand to the opening figures, as when I began writing it yesterday, BTC was 35k in dollars and 25k in pounds. It’s not so much the price that rubs me the wrong me way – it’s how suddenly we’ve got to it.

I spoke to Charlie Morris over at The Fleet Street Letter Wealth Builder about bitcoin a couple of days ago. He’s made some terrific calls on BTC over the years, and I wanted to know his read on it. He told me the market is getting so frothy, he’s beginning to lose interest – and that was on Tuesday, when the price was $30k (or $32k, depending on the time).

As he wrote yesterday “… the market is a little overcooked and would benefit from a bucket of cold water.” I’d certainly be relieved if bitcoin got the aforementioned ice bucket… but the thing about BTC is that it doesn’t do anything in half-measures, and it can charge hard into higher valuation territory for a long time before it runs out of breath and takes a dive.

Taking a look under the bonnet of BTC, and the network is certainly running on all cylinders. As the price has increased, some fascinatingly large transactions have taken place.

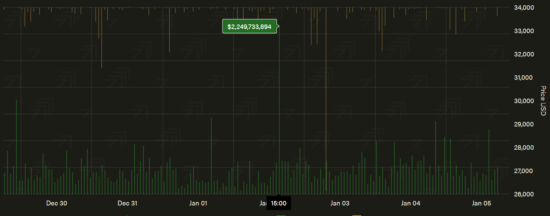

On the chart below, the green bars represent the amount of BTC being transacted across the network per hour, measured in dollars at the exchange rate at the time.

On Saturday at 3pm, nearly $2 and a quarter billion dollars was suddenly exchanged across the network:

Note the smaller green bar on the left – on New Year’s Day at 4pm, over $1 billion in BTC was transacted. But that was when the price was “only” $29k – whoever was on the receiving end of that transaction is probably feeling pretty good right now.

The yellow bars at the top represent miners selling their newly minted BTC. That tall yellow bar reaching all the way down from the top on 3 January was when a miner moved a significant quantity of freshly minted bitcoin they’d earned – the lion’s share of $49 million. They were likely moving it to an exchange, to sell it (gotta pay the bills – especially the electricity).

There were some even more curious events going on right before New Year. On the evening of 28 December, $3 billion in BTC transactions suddenly washed across the network at the same time as a miner dumped a $270 million slice of their BTC hoard which they’d been holding on to since March.

That’s quite a Christmas bonus. But if they’d held on for just ten more days, it would have bought a lot more goodies: BTC was a “mere” $27k back then…

That $3 billion transfer coinciding with the miner selling interests me. Who wanted $3 billion in BTC right before New Year’s? Did some billionaire have a revelation at Christmas? Did a bitcoin miner convince a plutocrat on the merits of bitcoin… and then sell a load of their stack on the sly once they knew they’d bought?

All conjecture of course. It may just have been a crypto exchange stocking up for the New Year from a bitcoin whale (an early investor who hoovered up plenty of supply). The miner may have misinterpreted the vast amount of BTC transactions as a large player beginning to sell, and decided not to take any chances with the BTC they’d been sitting on since March. Who knows?

But no doubt about it – there’s wealth a flowin’ through the bitcoin monetary network. Bitcoin is not some inanimate collectable that is just having money thrown at it. It’s not a rare set of baseball cards, or tulip bulbs, or a set of Picasso sketches. It is the internet discovering how to transact value with itself…

… and people are currently paying a fair bit of money for that.

“The market can remain irrational longer than you can remain solvent” is a line attributed to Keynes you’ll hear repeated often in the financial press. Dave Collum, an especially wry market commentator, put a twist on it a couple years ago when he said that “Mr. Market will coax everybody back into the pool before he tosses the toaster oven in.”

When it comes to bitcoin, I think I’d say that “the bitcoin price will go up until you FOMO into it”. The main lesson I’m taking from this BTC bull run is the value of pound-cost averaging into assets you like over a period of time. With something as volatile as bitcoin going in all at once, it can gild you as easily as ruin you, and while that may sound glorious and exciting, it’s not a healthy approach to take with your wealth.

And on that topic, I was intending to tell you what I see as a big risk to bitcoin – one which I think is very underappreciated at the moment. But I’m afraid I’m all out of time for today, so it’ll have to wait – the price action has done a great job of distracting me. Tomorrow, to close off the week I’ll tell you what it is, promise.

Until then,

Boaz Shoshan

Editor, Capital & Conflict

PS Got questions about bitcoin? My colleague Sam Volkering hosted a little Q&A on the matter yesterday over at Exponential Investor – if you’re curious about BTC you may find it informative. Click here to give it a gander.

Category: Investing in Bitcoin