THE ARDBEG EMBASSY, STOCKHOLM – Turns out the Swedes aren’t half bad at distilling whisky. What they are bad at is charging an affordable price for it.

Though perhaps I shouldn’t blame the Swedes. This establishment is after all owned by Ardbeg, a Scottish distillery which is in turn owned by French luxury conglomerate LVMH. It would be fashionable to blame the “the wolf in Cashmere”, its billionaire CEO… though I expect the real culprit is the teetotaller lobby in the Swedish government who aspire to purge the water of life from the country with the rod of taxation.

But enough booze for the moment – it is only Tuesday. Back to the markets…

If you’re interested in trading, and haven’t yet signed up for our “Power Hour” market event, do so here now, and pronto! A hedge fund veteran has recently joined our ranks, and he’ll be going live with his next big trade on Thursday – you’ll walk away with the name of the asset in question, it’s ticker, and his rationale behind it. Don’t miss it.

The recent action in bitcoin has drawn me back into the crypto/digital asset space. It’s nice to be back – the furniture is familiar – but boy does this sector evolve fast. Within moments of logging on to a couple of my old accounts on crypto exchanges, I found entirely new breeds of assets and means of trading them. A development which had passed me by was the rise of leveraged tokens which when bought, amplify your exposure to certain cryptos several times over (for lunatics who find the existing volatility in the sector not high enough).

The structure is just like those of leveraged ETFs in the “legacy” financial system, which can amplify your exposure to the likes of oil, gold, tech stocks, etc. Similar to those “Ultralong” and “Ultrashort” ETFs, the leverage they grant the owner is created using futures contracts structured within them – in this case, futures on the crypto asset in question, like bitcoin or Ripple.

Except these aren’t shares, they aren’t securities – they’re digital tokens. They don’t have the same legal backing as traditional financial instruments – instead, these are backed by the crypto exchange which issues them, and the smart-contracts programmed into them. Exchanges like Binance have consolidated their power and become mighty forces since 2017 – effectively institutions – ploughing significant capital into deepening their range of services.

While investor interest in the space dimmed after 2017, the true believers, the developers, have carried on building out the digital infrastructure – and the result is a significantly more evolved market today than just a few years ago. It’s like a digital version of the City’s Big Bang in the 80s, but purely online.

The question is when the big bucks arrive and these newly laid digital railroads start carrying significant levels of cash across them… and there are hints that this has begun. Our own Charlie Morris over at The Fleet Street Letter Wealth Builder published an article in the City’s own paper last week titled “Billionaires Buy Bitcoin” – here’s a snippet.

From City AM:

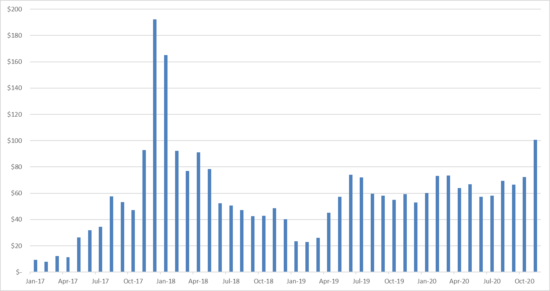

This recent strength [in bitcoin] is neither a bubble nor a frenzy; it is backed by real money. Back in 2017, the [bitcoin] network grew too quickly. There was $9 billion of transaction traffic in January growing to $192 billion by the year end. Too much, too soon for sure. The network has since readjusted and traffic has settled down to $60 billion (on average) over the past 18 months. This has been building over the summer, and ByteTree data forecasts $100 billion of Bitcoin network transaction value traffic for this month.

Network traffic back on the rise

Source ByteTree.com: monthly transaction value on the bitcoin network since 2017

Source ByteTree.com: monthly transaction value on the bitcoin network since 2017

Interestingly, that higher network demand doesn’t come through in the number of transactions, which has remained fairly stable around 2.1 million per week. That means recent transactions have been larger. Obvious you might say, given the higher price, but that would inflate all transactions. ByteTree data shows how the whale dominance has risen. This tells us that the largest transaction quintile by value, is rising relative to the lower four quintiles. The implication is that big money is entering the network, which is bullish.

Whale dominance drives the price higher

Source: ByteTree.com – bitcoin price $ (black) and the ByteTree Whale Dominance ratio (purple). Largest transaction value quintile relative to the lower four quintiles. Since September 2020.

Source: ByteTree.com – bitcoin price $ (black) and the ByteTree Whale Dominance ratio (purple). Largest transaction value quintile relative to the lower four quintiles. Since September 2020.

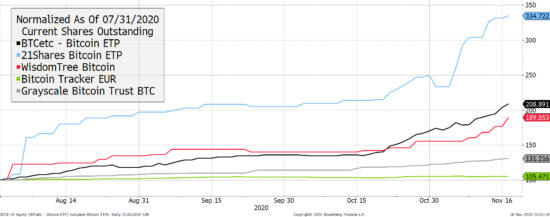

The network is growing again. More on-chain activity is being driven by the big money, but it’s not just the billionaires driving the price higher. The funds open to the public, outside the UK at least, are growing rapidly. The Grayscale Bitcoin Trust (GBTC) is valued at a whopping $10.8 billion, but trades at a 20% premium to net asset value. The European Exchange Traded Products (ETPs) are listed in Germany, Switzerland and Sweden and trade at par. They are smaller than Grayscale but growing rapidly as seen by the increasing number of shares outstanding.

Bitcoin growing over the exchange

Source Bloomberg: Bitcoin funds shares outstanding since August 2020

Source Bloomberg: Bitcoin funds shares outstanding since August 2020

I suspect these funds will see significant growth from here. I keep hearing how complex and risky it is to buy Bitcoin, and these funds solve the problem. Especially since most people have their liquid wealth tied up in their retirement plans…

I showed you a chart of Google searches for the word “bitcoin” last week (“This market is quiet… too quiet” – 16 November). It was almost totally flat, and nowhere near the frenzied levels of 2017, which tells me that it’s not the everyman driving this rally. That chart has picked up by a fraction, but we’re an awfully long way off.

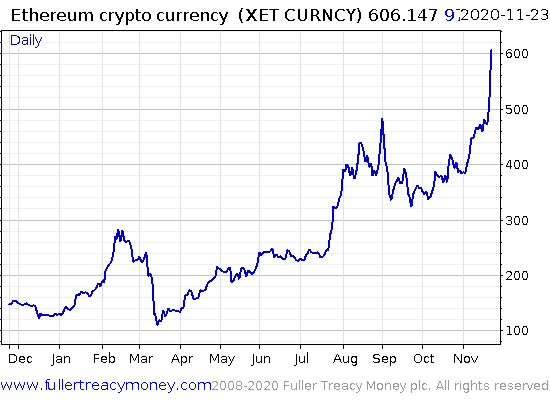

But somebody out there is chasing leverage to the move in BTC. Ethereum, the second largest digital asset which peaked at nearly $1,400 at the end of the last big bull run, is off to the races once again…

The period when cryptocurrencies other than BTC outperform are called “alt-seasons” (alt = altcoin = alternative to bitcoin). It’s this period when speculators can earn megabucks and can turn pennies into fortunes. Could we be at the beginning of one..? I wonder…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

PS He ran a successful hedge fund…

He advised traders at Goldman, HSBC, Credit Suisse, and more…

And now, he’s coming out of retirement to show you how he did it. .

Category: Investing in Bitcoin