In Cold War II, where will the UK stand? To whom will Britannia pledge her trident: the US, or China?

A quick recap. My thesis that Cold War II will occur runs as follows: to remain a superpower, the US must be capable of waging a conventional war against virtually any other country. China has severely damaged the ability of the US to do this, by taking away the US manufacturing and industrial base. China has done this deliberately to weaken the US and become a superpower in its own right.

American defence capabilities now rely on Chinese industry, an impossible relationship were the US to fight China. To remain a superpower, the US must take back its manufacturing and industrial base, or at least the parts of it that are vital to defence. In this way, waging a trade war against China is a matter of US national security. But for China to lose its trade advantage would mean curbing its ambition to become a superpower. And so, to quote Graham Allison, US/China relations are “destined to get worse before they get worse.”

But back to the question at hand. If I am correct in my prediction, where does the UK factor into this confrontation?

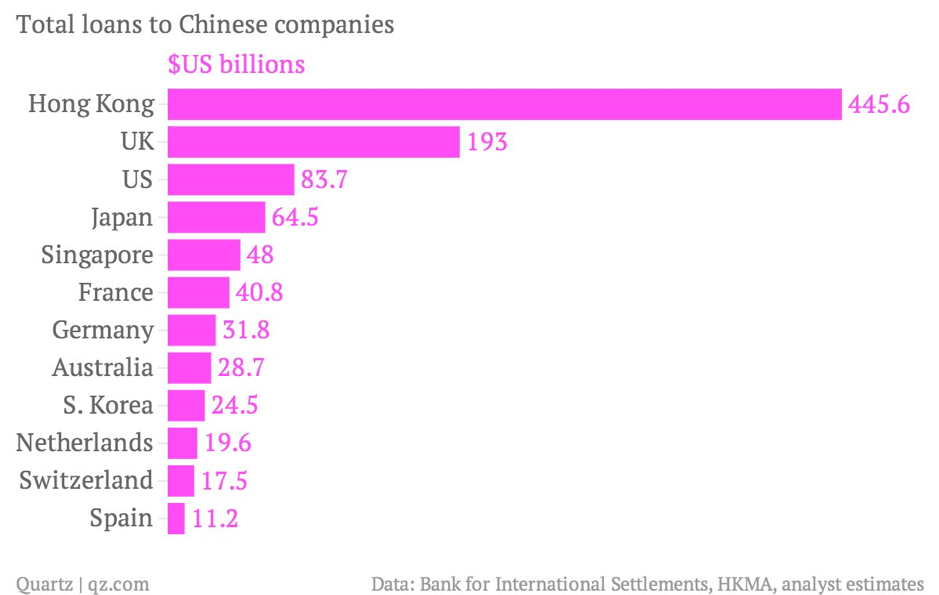

While our “special relationship” with the US held strong through the last Cold War, the landscape is a little different this time. For example, last time around, British banks didn’t have 150 billion quid in USSR debt on their books:

Note: many of Hong Kong’s loans to China are through HSBC, increasing total UK exposure to China

Even without a Cold War scenario, our financial exposure to China is worth keeping an eye on. A contraction in the Chinese economy, which has been expanded with increasingly enormous quantities of debt, will have a negative effect on our financial system.

(Readers may recall the similar situation playing out in Europe, where French banks own huge amounts of Italian government debt, similarly risking contagion in the event of a default.)

Should the UK take the side of the US in Cold War II, the problem of Chinese debt becomes much worse. The debt would likely need to be written off, doing serious damage to bank balance sheets. Even if the Chinese companies wanted to maintain their credit ratings, paying back the debt may be made impossible by the Chinese Communist Party to exert influence on the Western financial system.

To go against China would have consequences for the UK financial system, which may pressure the politicos into siding with China. Of course, going against the US will have financial consequences too, but there are other, more insidious forces which may ally us with China.

The web of intrigue

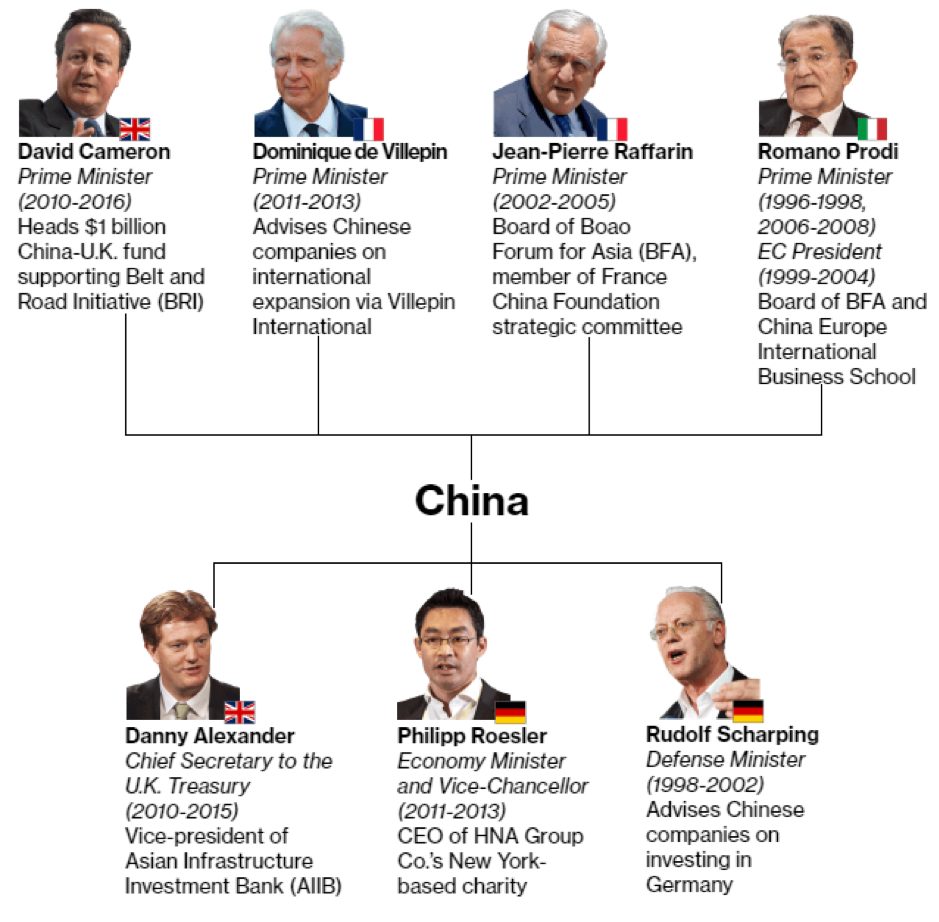

China’s network of influence across the globe is incredibly vast and well beyond the scope of this letter (I’m going to try and scratch the surface in an issue of Zero Hour Alert). But for the moment, take a look at this graphic from Bloomberg:

China has dug deeply into Europe’s channels of power, giving it significant leverage. The landscape is again dissimilar from the last Cold War. We certainly didn’t have a former secretary to the Treasury working for the USSR last time, let alone a former prime minister leading a USSR investment fund in the UK…

It’s also worth bearing in mind that David Cameron is rumoured to be after the role of foreign secretary in a post-Theresa May government. Considering his pivot to China while he was in power, it’s clear which direction he’s facing, and it isn’t West.

I’m still trying to figure out how the chips will fall in the UK in the event of a major confrontation between the US and China. Where do you think we will turn in Cold War II? East or West? I’d love to know your thoughts: [email protected].

My colleague Akhil Patel over at Cycles, Trends and Forecasts wrote about the possibility of Chinese alignment with the UK a year ago. I’ll leave you with a snippet from that issue before Nick Hubble takes over Capital & Conflict for the rest of the week.

Perfidious Albion?

… as China’s currency takes on more of a global role this could undermine the dollar’s supremacy. I don’t think the US will be too happy with its currency’s cherished status being undermined by one of its most important allies. This could potentially pit these two countries against one another.

Do you think this unlikely? There are already signs that the UK might choose to realign itself. You may recall the UK’s decision to join the Asian Infrastructure Investment Bank (AIIB) in 2015 against the explicit wishes of the Obama White House. The AIIB was set up to finance infrastructure initiatives in Asia – particularly in support of the Chinese BRI.

The UK knew it was taking a huge chance given that it didn’t bother to tell its friends in Washington until the day it made the announcement publicly. This then caused a domino effect leading to all other Europeans scrambling to join, having initially accepted the US wishes that Western countries should not join.

Make no mistake, initiatives such as these, linked as they are to the BRI, are a tool of Chinese foreign policy – in the same way that the World Bank and IMF have been of US and Western foreign policy over the decades.

Other evidence of the UK’s realignment includes its (inexcusable) failure to publicly rebuke China’s effective annulment of the Sino-British Joint Declaration. This declaration was put in place to guarantee democracy in Hong Kong for 50 years following reversion to Chinese rule in 1997.

The idea of the UK “betraying” the US may seem speculative at the moment. But we have to be alive to the possibility and see how things play out. These periods of intense international competition turn the world as we know it upside down…

All the best,

Boaz Shoshan

Editor, Southbank Investment Research

Category: Geopolitics