“Money, capital, has a life of its own. It’s a force of the nature. Like gravity. Like the oceans. It flows where it wants to flow. This whole thing with the Arabs and gold is inevitable – we’re just going with the tide…”

|

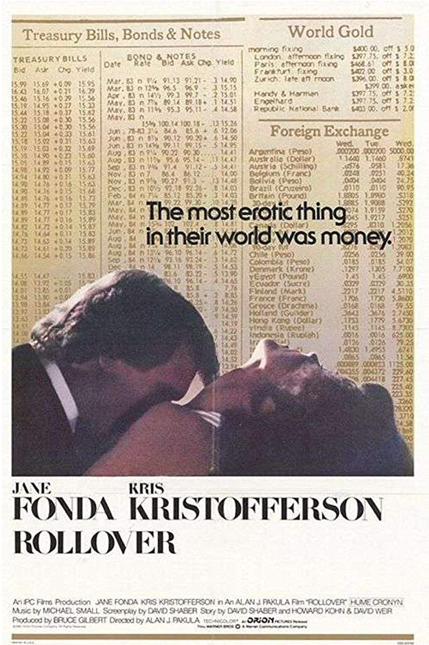

| Considering getting this poster for the office |

I finally got around to watching Rollover, a film my colleague Tim Price over at The Price Report recommended to me some time ago.

Tim has a theory that the film isn’t shown on TV any more because it depicts a banking crisis which spirals into a full-blown currency collapse. It’s not in the interests of the state to indulge the public’s imagination in this area, which may explain its absence from TV, and even in the “financial films” category.

But with confidence in paper currencies so tenuous since the credit crisis, and ever more so these days for reasons we’ll go into, the film is prescient today (spoilers ahead).

It was released in 1981, starring Jane Fonda and Kris Kristofferson with the perhaps deceptive tagline, “The most erotic thing in their world was money.”

A shrewd financier (Kristofferson) takes the reins at a bank in Manhattan, only to find upon looking through the accounts that it’s nearly insolvent. The bank needs cash, and soon, so he looks to broker a large loan between some Arab oil Sheikhs to a former actress and investor (Fonda), who wants to acquire a chemical processing plant. The commission the bank will receive for brokering the loan will keep its fortunes afloat.

But in the process, he discovers that the Arabs have begun to distrust the value of the US dollar. Slowly but surely they’ve been dumping all of their paper currency for gold through an innocuous foreign exchange account.

When the Arabs discover they’ve been rumbled, they accelerate their plan, pulling their money out of the US financial system and selling all their dollars for gold all at once. What begins as a run on the banks (similar to what’s going on in Switzerland) becomes a run on paper currency itself, and the global economy collapses.

Petroactive

“You’ve got billions coming in on a regular basis from Arab and OPEC accounts… You’re moving the Arabs into gold. You’re taking them out of the dollar…”

The petrodollar system, where oil-producing nations like Saudi Arabia only accepted dollars for their oil, and then loaned their dollar profits to the US Treasury, has allowed the US government to borrow cheaply and spend beyond its means since the mid-70s. It’s also what kept the US dollar as the world’s reserve currency after President Richard Nixon took the dollar off any form of the gold standard in 1971: all countries importing oil needed dollars to buy it with, forcing global demand for the greenback.

It’s the explosive end of this system that Rollover imagines, no doubt inspired by the huge bull market in gold in the late 70s and the political rise of Saudi Arabia.

Today there are signs on the fringes that this system is either in decline, or under threat of replacement. Central bank purchases of gold have just hit a 50-year high, while overall central bank holdings of US government debt have declined since 2013.

China wants to create a “petroyuan” system, to gain the same benefits the US did. China wants to print its currency in exchange for oil and other commodities the same way the US can. And slowly but surely, it seems to be having success.

The Saudi Arabian government recently announced it’s considering borrowing billions of pounds’ worth of yuan, by issuing yuan-denominated bonds. How will the Saudis get the yuan required to pay those loans off, if they don’t begin selling oil in yuan? The list of other goods the Saudis could export to pay it off is exceedingly short…

Meanwhile, the financial plumbing required to support a petroyuan system is steadily being laid. In London, the yuan is traded more and more, now with almost £2 trillion worth of yuan changing hands every day. And last month, German and Chinese officials signed agreements to further develop the market for the yuan in Frankfurt.

The US won’t give up the privileges it’s enjoyed under the petrodollar system easily. In fact, China’s attempts to replace it is yet another contributing factor to Cold War II…

More on that to come. In the meantime, if you get the opportunity, Rollover is worth a watch. While Kristofferson won a Razzie Award for his performance (worst actor), the film imagines a future that the state would probably prefer you didn’t see.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Geopolitics