How long must we benefit from something… before we take it for granted? A week? A year? A decade?

Stock prices are built on many layers of our assumptions. Investors assume many conditions will stay the same or will move in the same direction they did before. The longer conditions stay the same, the less we expect them to change – and the more we take them for granted.

Part of our business here at Southbank Investment Research is to figure out when the assumptions of investors are flawed. For when investors realise they’ve made a mistake, the change in the market can be sudden – to the upside or the downside. The assumption that the US property market only went up in the run-up to the financial crisis is a prime example.

So what are investors taking for granted now? Quite a lot, it turns out. Let’s start with an old chestnut – central banking – and then delve into the new Cold War that is starting.

No central saviour?

Investors are beginning to challenge their assumption that central banks will always be there to support the price of stocks. The idea was that you didn’t need to buy insurance on your stocks (“put” options) as the central bank already provided you with a “central bank put”.

Alan Greenspan, former chair of the US Federal Reserve, created this assumption by always lowering rates in response to crises. Markets would crash, and then the Fed would lower rates and markets would go back up again. No insurance (no put options) required – you just had to wait.

This assumption remained after Greenspan left the Fed, when his successors followed his example: the “Greenspan put” became the “Bernanke put”, which then became the “Yellen put” as for three decades the Fed lowered interest rates in response to financial crises. This has bred a generation of traders and institutional investors who have never known anything but free stockmarket insurance. Should Jerome Powell refrain from lowering rates, investors, slobbering madly like Pavlov’s dog, will be crushed.

Another assumption lurking dangerously in the markets subconscious is that government debt in developed markets is risk free. Thanks to quantitative easing, governments and investors alike have taken cheap borrowing costs for granted – you’ll need to read Nick Hubble’s book to see how deadly that assumption will prove to be.

The splintering of world order

Further to my call that Cold War II is upon us (see here for last week’s piece), I believe investors are taking globalisation, and the financial plumbing that comes with it, for granted.

Investors today assume that they can invest in pretty much anything if they have the right broker, from Chinese tech stocks to Nigerian real estate. They assume cheap labour will continue to be available in the East to Western companies. They assume that the globe will grow ever more connected through the internet.

If my thesis is correct, all of these conditions (and more) that have allowed markets to float ever higher, that are “a given”, are under threat. Should things continue as they have begun, all of these assumptions will go out the window – and asset prices will need to be revalued accordingly.

As I explained in detail in this month’s issue of Zero Hour Alert, it has become a matter of national security for the US to wage a trade war with China. Conversely, it is a matter of national security for China to maintain its advantages over other nations in trade. The resulting pressure from the two tectonic plates of East and West grinding together will result in a new Cold War, with all the bells and whistles the last one had.

Should China and the US continue to square off against each other – something I believe is inevitable for the reasons above – capital controls will become a weapon of war. As a result, in Cold War II, investing in Asia may become as laughable as investing in the USSR last time around.

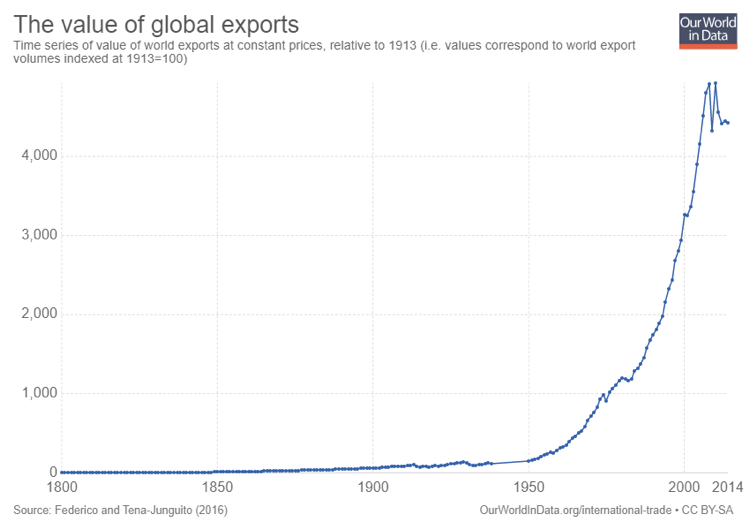

The rise of populism is just one of the many hints that the multi-decade period of globalisation is coming to an end. As you can see in the chart below, global trade having roared into the millennium appears to have peaked around 2008, and despite a bounce afterwards has flatlined.

The internet, a key driver of globalisation, is not immune to the balkanisation of the world. Eric Schmidt, the former chairman of Google (“We know where you are. We know where you’ve been. We can more or less know what you’re thinking about”), has predicted a similar fate for the digital world. He predicts that all the countries involved in China’s One Belt One Road infrastructure initiative will adopt China’s censored internet as well. The result would be a grand divide in the internet between East and West – a cyber Iron Curtain.

This is clearly not a belief shared by the market – not yet anyway. Social media companies are still beloved by investors and are trading at high altitude. But their revenues come from their user base – and should this “splinternet” scenario play out, that user base will be split in half, or worse.

“Past performance is not indicative of future results” is repeated endlessly in the investment business. I think the statement is especially applicable today – this is no time to be taking anything for granted.

All the best,

Boaz Shoshan

Editor, Southbank Investment Research

Category: Geopolitics