Have you heard of a colour called Pantone 448C?

It’s also known as “opaque couché”. If you’re a smoker in the UK, you’ll probably have seen it by now on tobacco products, as part of a drive to “kill the glamour” associated with smoking.

Pantone 448C is supposedly associated with dirt and death, according to the marketing firm which picked it out. These associations are meant to help eliminate the desire smokers have for their favourite brand of smokes.

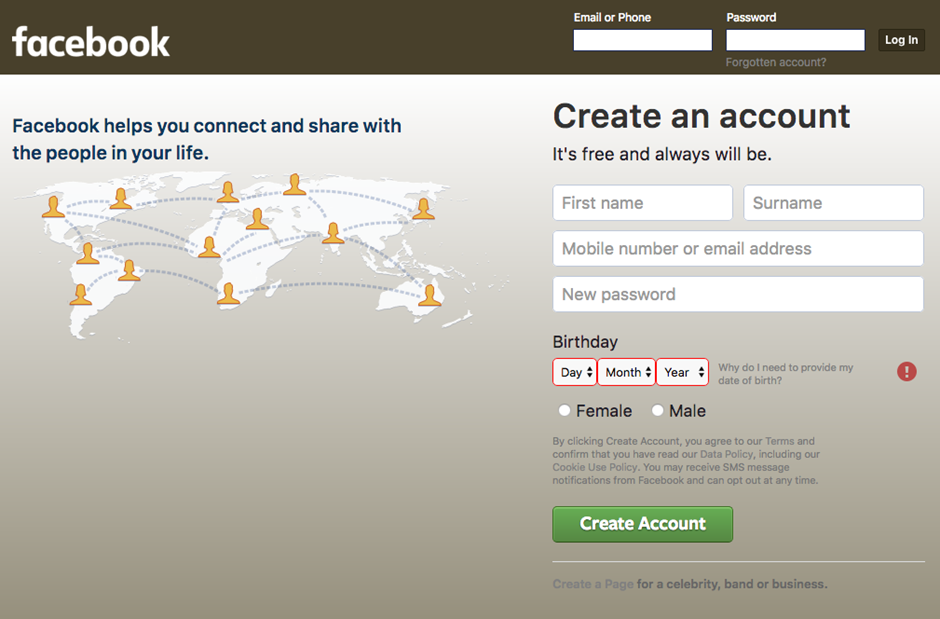

I was curious to see what the Facebook homepage would look like painted in it, as it’s also having its glamour killed these days.

The way things are developing, I wouldn’t be surprised if Facebook is forced to make opaque couché its official colour. Regulations and restrictions certainly lie in its future – but that’s not the only thing it shares with the tobacco industry, as we’ll come to in a second.

Facebook founder and CEO Mark Zuckerberg used to have “eliminating desire” listed on his Facebook profile as an “interest”. It seems he is getting what he wanted. Desire for Facebook and himself is certainly being eliminated these days. Not to mention desire for Facebook stock, which investors are now spitting out in disgust having coveted it for years.

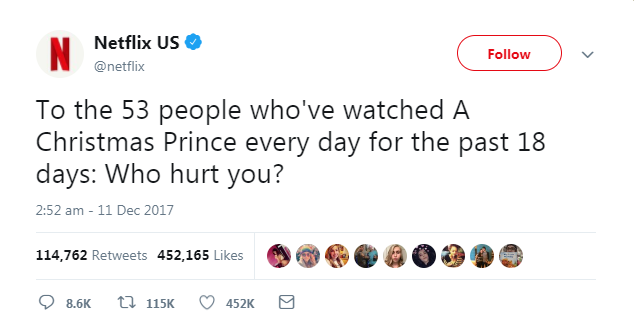

Why? Nobody seemed to care about the Machiavellian use of personal data by surveillance capitalists like Facebook in the past (something we covered extensively), even as tech companies rubbed it in everyone’s faces and were met with applause:

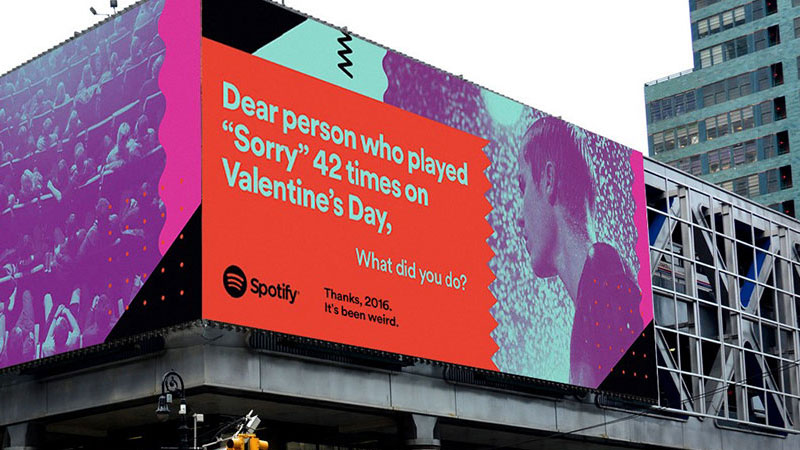

Music streaming service Spotify has gone even further, boasting of its insights into the lives of its users in its billboard advertising:

But something tells me you won’t be seeing more of such bragging. Companies which data harvest will want to keep their abilities and operations close to the chest in the future – because it has now become politically advantageous to target them.

Lose a referendum vote or presidential campaign? Just blame it on the companies profiling voters for your opponents (don’t mention that you were employing similar tactics). They barely pay any tax either, and the youngsters are hopelessly addicted to their services – prime targets for a political crusade.

In 2013 the front cover of the MIT Technology Review magazine boldly stated that “Big Data will Save Politics”. The Cambridge Analytica scandal splattered all over the press makes the idea seem laughable. But when you think about it, big data has saved politics… just not in the spirit that the headline intended.

Career politicians now have an enemy to rally the people against. Regulators have a fresh new industry to regulate. Bureaucrats can give themselves innumerable new tasks to and pretend to be productive. And all paid for by the taxpayer. Yes, big data has saved politics!

Facebook will be the first to be hamstrung with fines and regulations. Google will be next by my reckoning. And this trend will affect investors worldwide – even if you’re not invested in these companies directly. Let me explain.

Harvesting the addicts

The Economist claimed not so long ago that data is the new oil. There are certainly fair comparisons to be made: data has become (to an extent) commoditised, and those with access to the sources have grown into huge companies, surpassing even the oil giants.

In the context of companies like Facebook however, I like to think that data is not the new oil, but the new tobacco.

Tobacco companies used to be very popular in investor portfolios, particularly pension funds. Much of this was due to their incredible reliability in paying dividends year upon year. They had a key advantage in having customers that were addicted to their product.

Addicts make great customers; they just keep coming back for more, regardless of whether the product is “in fashion” or not. Little needs to be spent on researching and developing new products, as they’re only addicted to what they’ve already been given. Nor need anyone worry about one-off customers who never come back.

You need only listen to Facebook co-founder Sean Parker to see that the addictive nature of Facebook was not a coincidence, but by design:

The thought process that went into building these applications, Facebook being the first of them, was all about: ‘How do we consume as much of your time and conscious attention as possible?’

We need to sort of give you a little dopamine hit every once in a while, because someone liked or commented on a photo or a post or whatever. And that’s going to get you to contribute more content, and that’s going to get you more likes and comments.

It’s a social-validation feedback loop … exactly the kind of thing that a hacker like myself would come up with, because you’re exploiting a vulnerability in human psychology.

The inventors, creators – it’s me, it’s Mark Zuckerberg, it’s Kevin Systrom on Instagram, it’s all of these people – understood this consciously. And we did it anyway.

… God only knows what it’s doing to our children’s brains.

Data harvesters like Facebook have become a staple of investors’ portfolios, just as tobacco harvesters were. Not due to their dividends this time, but for capital gains as Facebook’s network and revenues grew, and the business became worth more. As the number of users expanded and the addicts spent more time on the site, they clicked on more adverts – and advertising revenues are how Facebook makes money.

It’s strange to think that “eliminating desire” was one of Zuckerberg’s interests, when the manipulation and creation of desire was key to the business he created – perhaps that’s why it isn’t listed on his page any more.

Market leaders up in smoke

As tobacco companies got bigger and bigger, they began to have larger influences on movements of the indices they were included in (like the FTSE 100) because they effectively took up more room. And so when they faced negative press, regulations and fines, not only would the tobacco stocks fall – the entire index would take a hit.

This is where the risk lies for investors in the stockmarket today. Tech has led the stockmarket rally of the last few years by a huge margin. When that momentum is put in reverse, the market as a whole will go down.

Since October 2015 the S&P 500 has increased in value by almost 40% – a massive increase. But this gain has been powered by the increase in value of just a few of its constituents, the so called FAANG stocks: Facebook, Apple, Amazon, Netflix and Google. These are up 137% over the same period and their inclusion in the S&P 500 is what has been pulling the entire index higher for the last few years.

All of these companies harvest data. Facebook is in the line of fire now, but once the politicos smell blood it’s open season for fines and regulations. These will reduce revenues and reduce trust in their user base, and the stocks will suffer as a result.

When the stocks suffer, the S&P will suffer. This will not only affect those passively invested in index trackers, but the broader asset markets, as a falling S&P breeds negative sentiment among market participants, no matter the cause.

As my colleague Tim Price commented recently in London Investment Alert,

The FAANGs are just about the only companies that have been driving US stockmarkets higher over the past year. Market breadth has been abysmal, leading to an ever narrower number of companies dragging the entire index up with them. Now that there are question markets over the sustainability of the momentum of these stocks, cautious investors should start to look out below. There’s an old City saying: if you’re going to panic, panic early.

With the only thing that has pushed equities up now in the sights of political forces hungry for blood, what will keep the upwards momentum in equities going? Perhaps Zuckerberg has succeeded in “eliminating the desire” that has driven this entire bull market.

Until next time,

Boaz Shoshan

Editor, Southbank Investment Research

PS Tobacco companies have since fallen out of favour with pension funds due to pressure over the ethics from multiple angles, which is still continuing. There’s now a not-for-profit called the Tobacco Free Portfolios organisation which aims to reduce global pension fund tobacco investment to zero.

But my colleague Eoin Tracey sees an incredibly bright future for “Big Tobacco”. In fact, he’s even said that in a few years, doctors could be asking patients, “Are you smoking enough?”

Interested? Keep an eye out for his analysis in the coming days.

“Nothing shocks this market…”

Category: Geopolitics