Yesterday ended with more unsolicited bitcoin commentary. It seems restaurants have become bitcoin forums.

A young man sitting near us suggested criminals are using bitcoin to pay for transactions within prisons. His dad had returned from some sort of research in one.

With bitcoin commentary everywhere, I’ve had enough of it here in Capital & Conflict. At least for now. So what should we cover today instead?

There’s no need to write about North Korea’s latest missile test. President Donald Trump says he’ll “take care of it”. That’s that, then…

As for the supposed agreement on the Brexit bill, don’t forget that “nothing is agreed until everything is agreed”. So, despite the agreement, nothing is agreed. No news there, then. Although it is worth noting it’s odd to agree on the bill before you know what it buys you…

A record high stockmarket in the US is hardly news these days either.

Volatility continues its record breaking run of lows. Nothing new.

The pound is rallying too. No doubt commentators will soon blame the damage of an excessively high pound on Brexit. But for now they think it’s a good thing.

In fact, everything is good news these days. What could possibly go wrong?

There’s no shortage of crises to choose from. Perhaps Trump will trigger nuclear Armageddon when China backs North Korea in a war again…

But it’s more likely that there’s something fishy about all this good news. If you begin to ask questions, you won’t like the answers.

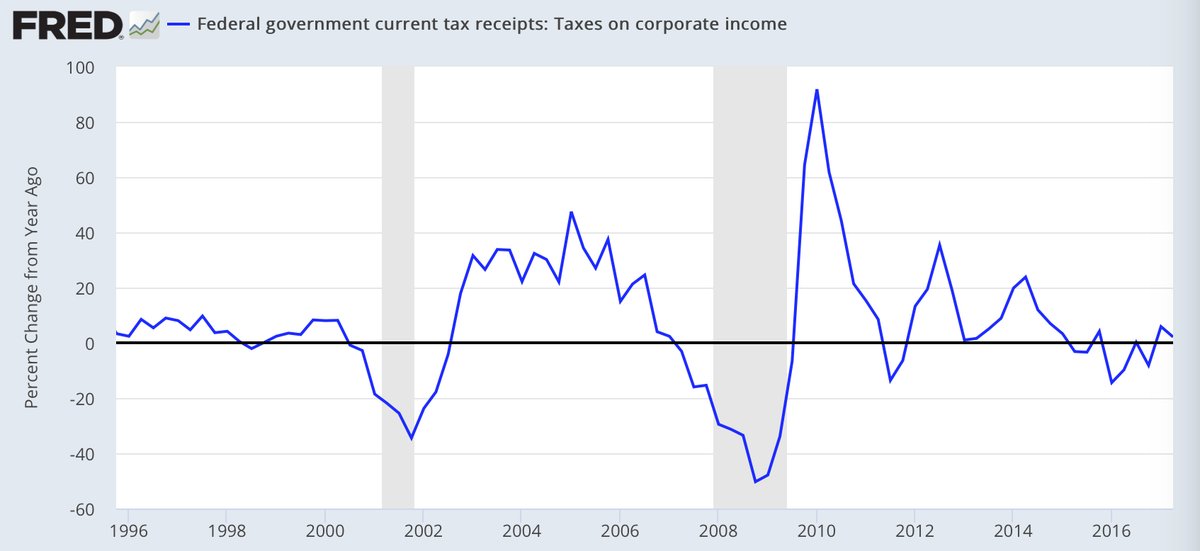

For example, given the booming economy, low unemployment rate and vast corporate profits in the US, how do you think government tax receipts have grown?

Barely. This chart from the Federal Reserve Economic Data shows corporate tax revenue falling for much of the last two years. Personal tax revenue is barely growing. As the investigator in the film V for Vendetta says, the only reliable government records are the tax records…

On Brexit, the whole drama is artificial, hiding the true risks. Free trade and other cooperation does not stop being mutually beneficial when a country leaves the EU. Any resistance from the EU is self-harm. But then, most of what the EU does is self-harm. Without Britain, the EU is in all sorts of trouble. That is the true risk of Brexit.

Then there’s the simple truth that stability breeds instability. This means market participants are lulled into a false sense of security and profitability. They are unable to withstand the eventual problems, making the instability worse.

Today, let’s look at the antidote to all this. Gold.

Gold-plated insurance

Did you know the global financial crisis was coming? Did you know Brexit was coming?

Those are the wrong questions to ask. Instead, simply ask whether you owned gold.

If you own the stuff, you’re protected from events like Brexit and the financial crisis. The best part is, you don’t have to predict what they’ll be. Let alone the timing.

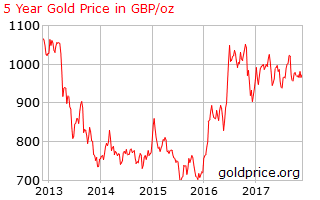

Gold rallied from £700 to over £1,000 in anticipation of the Brexit vote. It doubled during the financial crisis.

Clever readers will note this was as the pound tumbled in both examples. During the global financial crisis, from over $2 US dollars to below $1.4. How much the pound fell thanks to Brexit is still a popular debate. Either way, the weaker pound supercharged the rising US dollar gold price.

But that only strengthens the argument for UK investors to own gold. During crises, the US dollar rallies alongside gold, improving profits for everyone outside the US. Ironic given much of the coverage about gold as a safe haven comes from the US…

So where is the gold price now? This five-year chart shows a wedge formation in the gold price since Brexit.

Any breakout from this wedge suggests a sharp upward or downward movement is in the cards.

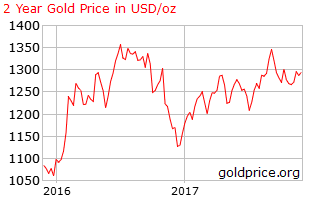

In US dollar terms, gold established the beginnings of an upward trend in 2017, which failed to break 2016 highs.

Perhaps the most important indicator is that gold seems to be out of the news entirely. They say “buy when there’s blood in the streets”. For gold, it’s the opposite. You buy when there is no blood in the streets. In periods of false stability. Like now.

After all, who knows what the coming crisis will be?

Until next time,

Nick Hubble

Capital & Conflict

Related Articles:

- Why Brexit will slowly die

- Another €20 billion in aid to the EU

- Financial World is jumping on Bitcoin bandwagon

Category: Geopolitics