I’ve no edge when it comes to India-Pakistan relations, so I’ve no insight as to how the two countries will behave now that violence has erupted between them.

All I know is, 1: You’ll be able to cut the atmosphere at their world cup cricket match in June with a knife (provided we haven’t been incinerated in a nuclear war that they begin by then, of course).

2: Somebody at Lockheed Martin will have popped open the champagne/lit a cigar/cracked open a six-pack/all of the above when the news broke.

The incident on Wednesday illustrated in munitions a problem that’s been on paper for some time: if India wants to assert itself on the global stage and take its place as a major power, it needs a modern military.

One of the Indian aircraft shot down yesterday was a MiG-21, a breed of aircraft designed by the Soviets and first flown in 1956. They’re clearly no longer up to scratch, but what will replace them?

With impeccable timing, Lockheed Martin just a week ago presented India with a modern fighter jet designed specifically to meet the needs of the Indian air force, the F-21. And importantly, these will be made in India:

Note: According to Lockheed, the F-21 contains gear from the F-22 Raptor, which the US government banned from being sold to foreign countries to prevent secrets of its stealth technology becoming known. Who knows what components are actually shared, but this is being used to market the aircraft.

The Indian government gets custom tailored military tech, the seeds of an advanced military industrial base, and a load of jobs.

New jobs buy votes for those still in power. And revamping the military stirs the soul of the patriots. All in all, that’s a mighty appealing deal for Prime Minister Narendra Modi, who is up for election in May.

Not to mention the long-term strategic value of building a domestic defence base within India. While the Indian government ordered 36 Dassault Rafale fighters from France a few years back, the first of which will arrive later this year, they were bought “off the shelf”, manufactured abroad.

There are still 114 empty slots in the air force that must be filled, which the government has dictated must be made domestically. Lockheed pledged it will move its F-16 production plant from Texas to India if it took up the F-21 deal, and then use it as a base for exporting its fighter jets globally.

The decision as to which jets would be selected was expected to be made after the elections, but with dogfights in the air and an election in the crosshairs, I’m flirting with the idea that a decision will be made much sooner in favour of the F-21.

Great news for Lockheed Martin ($LMT) – that’s a $15 billion dollar deal if it can take it, which will no doubt be a positive for the stock. And it would put India more firmly in the US’s camp as we go further into Cold War II, which could mean no capital controls will be placed on it when things get really hairy – a Cold War oasis for investors perhaps.

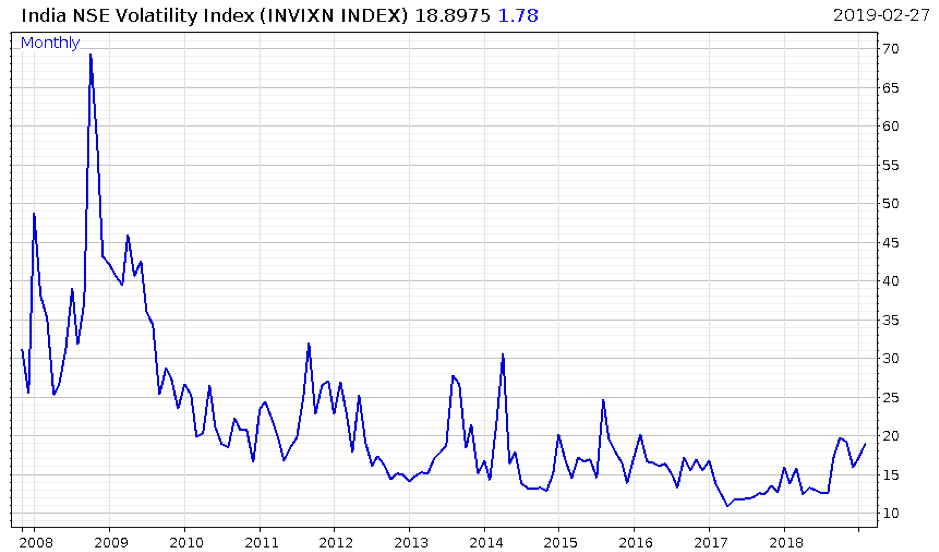

Moving on. 3: Volatility in the Indian stockmarket has plenty of room to take off and turn on the afterburners if the tensions don’t de-escalate:

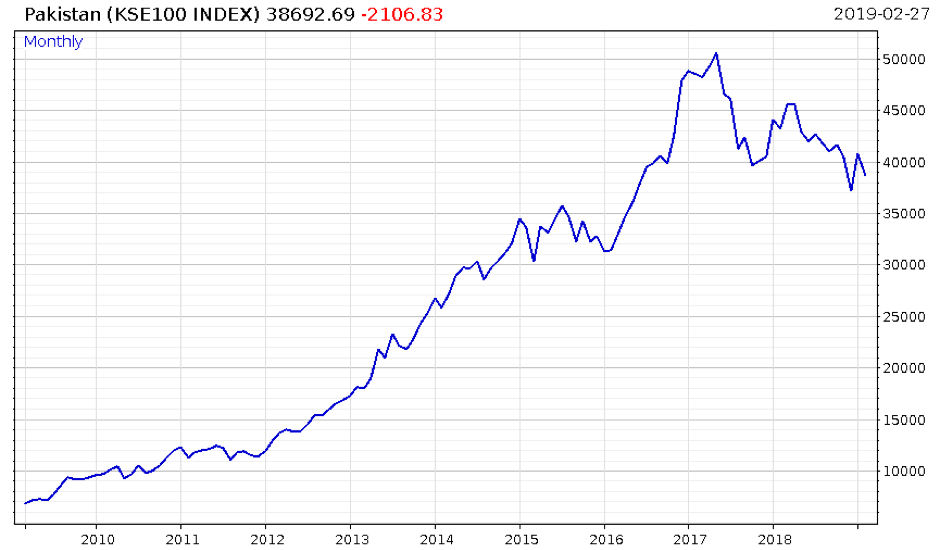

4: The Pakistani stockmarket has plenty of recent gains to give up should this get worse:

5: And there’s a hell of a lot of room for gold to rise if this conflict escalates and causes deeper rifts within Asia and then across the world. The second episode of The Gold Summit is now online for 24 hours only. Today, we’ve got Grant Williams and Ronald-Peter Stoeferle in – two market veterans with deep insights to share on what’s at play in the precious metals market and the global economy. Geopolitics has a strong role to play in both – make sure you don’t miss today’s episode.

All the best,

Boaz Shoshan

Editor, Capital & Conflict

Category: Geopolitics