GUALFIN, ARGENTINA – Pssst… Dear reader…

Want to make some big money, fast?

We’re not gamblers. We’re not speculators. And we’re no good at predicting the future.

But we see what looks like an RSP, a Really Simple Pattern, that may pay off.

We summarize in poetic terms: It is always dawnest before the dark.

Dangerous Complacency

We refer to something that hasn’t happened in nearly a quarter-century – a dawn so bright, it is blinding investors to the risk they face.

Not that we know what will happen. But we know an RSP when we see one.

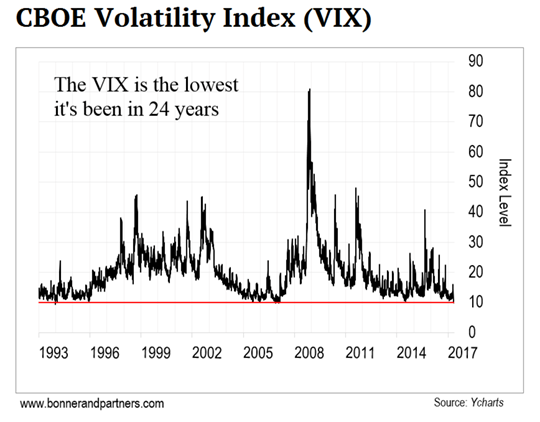

Specifically, we’re talking about Wall Street’s “fear gauge,” the CBOE Volatility Index, or VIX. It measures the level of volatility – aka price swings – investors expect for the S&P 500 over 30 days.

Over the past 24 years, the average level for the VIX has been 19.65. On Tuesday, it dipped below 10 – something we’ve seen happen only nine times since 1990.

That reading was the lowest it’s been since 1993.

Investors often substitute volatility for “risk.” But it is a completely different thing. Typically, when the VIX is this low, it marks a dangerous complacency, not the absence of real risk.

What is interesting about this period in our history is that, despite a high level of complacency among investors, there are plenty of things investors aren’t fretting about… and plenty of reasons for the VIX to spike higher.

You’re Fired!

This week, President Trump fired the director of the FBI, James Comey.

Why?

We don’t know. But The New York Times says it was because Comey was investigating whether the Trump campaign colluded with the Russians.

Fake news? Claptrap?

Most likely. But it’s a serious charge by a serious fake news outlet. It could turn nasty.

Meanwhile, smart insiders are telling us Trump may be doomed.

They say the entire Washington Establishment, the universities, elements of the Deep State, Democrats, and many Republicans are against him.

Every time the media report on him, they try to make him look stupid. Photos make him look ugly. They’re out to get him.

Like Nixon in 1973, he may not be able to hold on. Nixon lasted only 19 months after the Watergate break-in. We doubt Trump will be shaken loose so easily.

He has hardcore support in many areas of the country. And he’s more of a fighter, with less integrity and less of a sense of shame. He won’t exit gracefully or readily.

Again, we don’t know what will happen.

For today’s purpose, it hardly matters which way it goes. The point is: There will be trouble.

Polished Ice

Meanwhile, Mr. Trump is commander-in-chief of the most lethal and most stretched-out imperial army in history.

He is also perhaps the most reckless and impulsive leader ever to be in such a position.

Huge warships prowl the seven seas. Drones, missiles, fighter planes, and high-altitude bombers crisscross the air. And underground, hundreds of intercontinental ballistic missiles (ICBMs), like dogs in a kennel, wait to hear their master’s voice.

Could something go wrong?

Hey… what do you think? (Note that recklessness and impulsiveness are probably not what you want in a leader… unless you are long the VIX!)

And U.S. stocks are trading near the tippy top of their range. Every step they take is on polished ice.

Investors have added nearly $2 trillion to the value of the S&P 500 in the last three years. Yet the 500 companies represented in the index, on average, made less profits per share last year than they did three years ago.

In other words, investors are paying up for “growth” that isn’t there.

Also, more than half the increase in the S&P 500 has come from just five stocks. This kind of narrowing of “market breadth,” too, is a classic warning sign of a bubble peak.

Reflation Trade

Why would investors buy such expensive stocks?

Well, some analysts believe they were just taking part in the Trump “reflation trade.”

The president pledged to slash taxes, cut Wall Street regulation, and splurge $1 trillion on infrastructure. This would lift corporate earnings, and stock prices, analysts calculated.

But there will be no major tax cut. No major infrastructure program. And no significant cuts to regulation.

Why not?

Because at this point, the confusion, contradictions, and contrasting agendas embedded in the White House and the Republican Party make any major legislative victory nearly impossible.

Again, we don’t know what will happen. And for this opportunity, it doesn’t matter. We won’t be betting on any particular outcome. We’ll just be betting on an increase in fear.

The current “expansion,” weak as it is, has been going on for 112 months. The average post-World War II expansion lasted only 58 months. This one is due to take a breather beside the road… or run into a ditch.

Which brings us back to our RSP.

To us, the situation looks like it will soon need the attentions of the bomb squad. But the VIX is telling us things haven’t been so calm since 1993.

Which is another way of saying buying the VIX below 10 in 1993 – and betting on more volatility ahead – turned out to be a good trade.

It didn’t drop to such low levels again until 24 years later.

Regards,

![]()

Bill

P.S. Buying the VIX is a speculation. It is for gamblers who are braver, smarter, and faster than we are. And if they are lucky, perhaps this bright dawn of complacency will be followed by a total eclipse.

Category: Economics