VARNA, BULGARIA

For a moment, think of Capital & Conflict (and the other Southbank Investment Research publications) as a kind of prism.

If you look through that prism, you will see the world of investment a certain way.

The world will look like a very modified version of the famous cover from New Yorker magazine with a cartoon that shows Manhattan at the centre of the world.

The Capital & Conflict prism would have Southbank Investment Research’s office – on the south bank of the Thames – in the foreground: the City of London and Canary Wharf would also clearly be visible, along with hedge funds in Mayfair.

The Bank of England and HM Treasury would be disproportionately large in that part of the picture.

A little further away, you would see the rest of the UK (with Boaz in Scotland) and the richer countries of the European Union (EU): the European Central Bank (ECB) would be biggest institution that is visible.

Across a very narrow Atlantic Ocean, you would see key features of the United States, such as the financial district of New York, Washington DC (including the White House, Congress, the US Treasury and the US Federal Reserve), Silicon Valley, Hollywood and a number of manufacturing places.

The rest of the world would be a blur.

However, you would see that China represents a large part of it.

You would also notice semi-conductor factories in Taiwan, as well as gold mines in Australia, Canada and several other locations.

A large signpost would point to the crypto world, which lies just outside the picture.

Taken together, the picture would summarise many of the views of Southbank Investment Research’s editors:

- Think of financial history, and you will get a lot of insights that are relevant today.

- Inflation is coming – and gold will be one of many beneficiaries.

- The world will use oil and gas for a while yet: nevertheless, the green energy transition is possibly the biggest megatrend ever.

- Solid investment opportunities come from large and established companies that are based in developed markets (i.e. rich countries with large, long-established and easily traded stock markets).

- Technology is at the centre of many of the businesses of the world’s most exciting new companies.

- A global shortage of semi-conductors (computer chips) currently provides opportunities.

- Many of the interesting technology-related companies are also based in the developed markets.

- Government involvement with economic activity (and investment) is a mixed blessing.

- It makes sense to have a properly diversified portfolio.

- The crypto world is a parallel universe which could have a huge impact on the world of investment.

Now, suppose that you looked at the world of investment through a different prism.

Imagine that, instead of focusing on developed markets, you concentrated only on emerging markets and frontier markets.

As yesterday’s edition of Capital & Conflict explains in some detail, emerging markets are in poorer countries than the developed markets: they also tend to have less developed stock markets.

Frontier markets are like emerging markets, except that they are far harder for foreign investors to access.

MSCI is a company that compiles and calculates indices which define stock markets around the world.

These indices are widely used by investors as benchmarks to measure investment performance.

MSCI is possibly the best-known arbiter of exactly which countries are included in the developed markets, emerging markets and frontier markets.

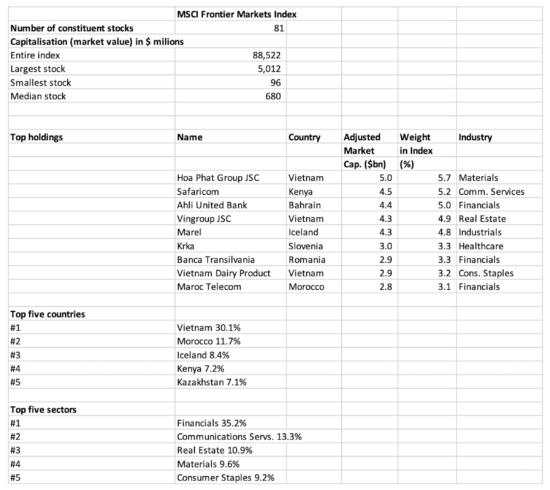

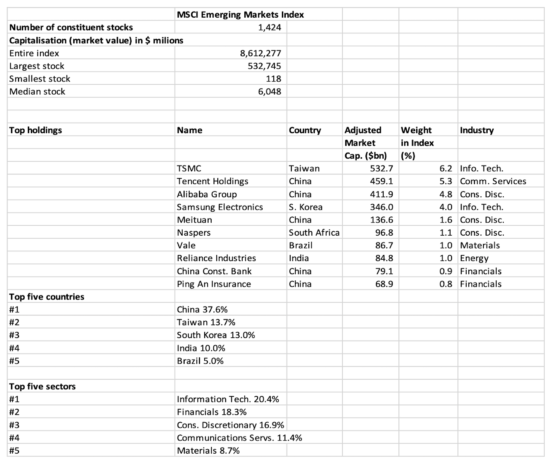

The tables below show what were some of the key features of the MSCI Emerging Markets and the MSCI Frontier indices as at the end of May 2021.

Source: MSCI Inc. All figures as at 31 May 2021.

Source: MSCI Inc. All figures as at 31 May 2021.

(Click to enlarge)

In order to put all the facts and figures into context, remember that the MSCI World Index, which is a widely used measure of the investment performance of developed markets, includes 1,562 stocks with a combined market capitalisation of $57,083 billion (i.e. just over $57 trillion).

A glance at the leading stocks in the MSCI Emerging Markets Index will tell you the following:

- China’s listed companies are, individually and collectively, enormous by world standards.

- To a certain extent, whether or not emerging markets are attractive depends a lot on your view of China (or “Greater China”, which includes nearby economies such as Taiwan and South Korea).

- The five largest companies (TSMC, Tencent, Alibaba, Samsung Electronics and Naspers) are linked to technology, semi-conductors and/or the rise of the Chinese consumer.

- Past growth in China’s financial services sector – thanks in part to liberalisation at a measured pace – mean that China Construction Bank and Ping An Insurance Group are already giants in global terms.

- Materials companies (like Brazil’s Vale), which should benefit from higher inflation, are well represented in the Index.

- Energy companies also have a significant presence.

And a glance at the MSCI Frontier Markets Index will highlight the following:

- These “candidate emerging markets” are a diverse bunch, but are dominated by just two countries – Vietnam and Morocco.

- Some frontier markets are countries with high per capita incomes – such as Iceland and Slovenia.

- Development/liberalisation of local financial services is, or at least has been, a major trend in many places.

- This probably accounts in part for the importance of Kenya’s Safaricom – given the growth of m-commerce (i.e. e-commerce, virtual wallets and payments that are handled entirely by mobile phones) in parts of Africa.

- Some leading companies will be relatively protected against inflation because of their involvement with raw materials, energy or real estate.

The bottom line is that many of the ideas that are front of mind for Southbank Investment Research’s editors can also be seen in the emerging and frontier markets.

But, where are the actual and potential opportunities?

This is a question that will be looked at in detail in the coming weeks and months by many of our editors in Exponential Investor.

Andrew Hutchings

Managing Editor, Southbank Investment Research

Category: Economics