Volatility as a concept is widely misunderstood. Volatility is not fear. Volatility is not the VIX index. Volatility is not a statistic or a standard deviation, or any other number derived by abstract formula.

Volatility is no different in markets than it is to life.

Regardless of how it is measured volatility reflects the difference between the world as we imagine it to be and the world that actually exists

We will only prosper if we relentlessly search for nothing but the truth, otherwise the truth will find us through volatility.

– Chris Cole, Artemis Capital Management

Volatility as a servant of truth – quite a thought. If this is the case, is the value of volatile assets constantly changing, or has their true value just not been revealed yet?

Are volatile relationships and situations only volatile because they do not reflect the truth?

I’d be interested to hear your thoughts: [email protected]

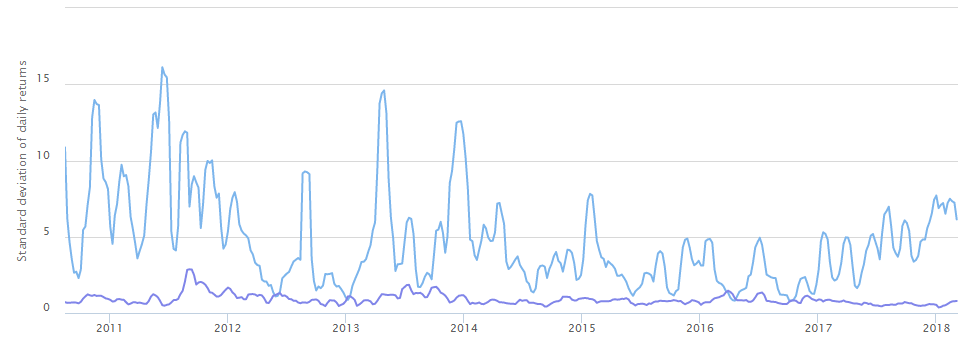

The chart below shows the price volatility of bitcoin (blue) in US dollars. The volatility of gold is shown in purple for context.

If volatility is what reveals truth, the true value of Bitcoin (in dollars, at least) is a long way from being revealed.

If the volatility were to subside, what true value would Bitcoin be revealed to be? Sam Volkering is optimistic.

Volatility plays a huge role in managing investment risk these days. But volatility and risk are quite different, and he who conflates the two is, ironically, making a risky decision.

As Oscar Wilde once wrote, to define is to limit. And those who define risk as volatility limit their understanding of how much risk they are actually taking on…

Have a great weekend!

The lie at the heart of modern investing – Tim Price

If asked to identify the person who had singlehandedly done most damage to the investment profession, I would have little hesitation in putting forward my candidate: Harry Markowitz. Markowitz, in an article entitled “Portfolio Selection”, published in the US in March 1952 in the Journal of Finance, has probably done more to influence modern portfolio theory than anyone.

Markowitz, at the time, was a young mathematician with no experience of investing. His central premise was that a diversified portfolio is always preferable to an undiversified one. This is itself debatable, but then everything about modern portfolio theory is debatable. His argument was, in turn, based on the presumption that “variance of return [volatility] is an undesirable thing”. His mathematical proof was that variance of return could be reduced within a portfolio of stocks and shares by holding a number of different shares.

Although Markowitz did not explicitly claim that risk and volatility (variance) were the same thing, that was what the financial services industry heard. Investment professionals would go on to treat volatility and risk as essentially the same.

Older economists than Markowitz knew better even than to attempt to define risk. Although the topic was keenly discussed among economists before World War One, there was unanimous agreement among them that whatever risk was, it was probably too complex a thing ever to be fully understood. Crucially, it was also agreed that it could never be mathematically calculated.

One of the books that has most influenced me as an investor is Peter L. Bernstein’s Against the Gods, which is a history of risk. Bernstein gives Markowitz short shrift:

Markowitz had no interest in equity investment when he first turned his attention to the ideas [in his research note]. He knew nothing about the stock market. A self-styled ‘nerd’ as a student, he was working in what was then the relatively young field of linear programming…

One day, while waiting to see his professor to discuss a topic for his doctoral dissertation, Markowitz struck up a conversation with a stock broker sharing the waiting room who urged him to apply linear programming to the problems investors face in the stock market. Markowitz’s professor seconded the broker’s suggestion enthusiastically, though he himself knew so little about the stock market that he could not advise Markowitz on how or where to begin his project.

After Markowitz, the world of finance cheerfully adopted the volatility of historic returns as a proxy for risk. Based upon this idea, the capital asset pricing model (CAPM) was born. CAPM would go on to spawn the efficient market hypothesis (EMH) – the idea that financial markets are ruthlessly efficient and therefore can never be beaten. One quote alone is required to refute EMH, and it comes from Warren Buffett:

“If the markets were always efficient I’d be a bum on the street with a tin cup.”

The markets are clearly not always efficient, and Warren Buffett is plainly not a bum on the street with a tin cup.

The CAPM model is still being taught to financial professionals, despite the fact that it is unfit for purpose. But then most of modern economics is.

CAPM can be defined by the following equation:

r = Rf + beta x (RM – Rf)

where

- r is the expected return on a security

- Rf is the risk-free rate

- beta is the overall market risk (volatility)

- RM is the return from the appropriate asset class.

You can now drive a coach and horses through the assumptions of the CAPM model.

The so-called “risk-free rate” can be defined either as the interest rate generated by a riskless bank deposit (no, you’re right, such things don’t exist) or by a riskless government bond (ditto). And quantitative easing (QE) has in any case killed off the idea of getting a positive real return from such assets.

It is entirely debatable whether beta is an appropriate, accurate or even measurable proxy for market risk. What do we even mean by risk, anyway? I define risk as the possibility of a permanent capital loss. The regulator, and the investment industry, would, if pushed, typically define risk as volatility, which is not the same thing.

We can also debate whether CAPM should ever be used given the additional assumptions that the theory requires, namely:

- All investors are identical

- All investors are equally risk-averse and profit-maximising individuals

- All investors enjoy equal access to all available information about the market simultaneously

- Market returns obey a model of normal distribution (the bell curve)

- Information and trading has no cost, and borrowing and lending rates are all identical

- There are no such things as taxes, regulations or restrictions on short selling.

Building on the work of Markowitz, the CAPM was the creation of Jack Treynor, William Sharpe, John Lintner and Jan Mossin. Sharpe, Markowitz and Merton Miller would go on to receive the 1990 Nobel Memorial Prize in Economic Sciences – always a dangerous sign – for their contribution to financial economics. Fischer Black and Myron Scholes would go on to develop the so-called Black-Scholes model for derivative pricing in 1973.

Bad economics. Overly crude modelling. Widespread adoption within the financial services industry. What could possibly go wrong?

All the best,

Boaz Shoshan

Editor, Southbank Investment Research

Related Articles:

Category: Economics