Last year, Capital & Conflict sent you an inflation alert. Yes, ten months is a bit of an early warning. But there’s some vindication playing out at last.

Inflation has gone from being persistently low to persistently high in the UK since 2017. In fact, it’s a global phenomenon.

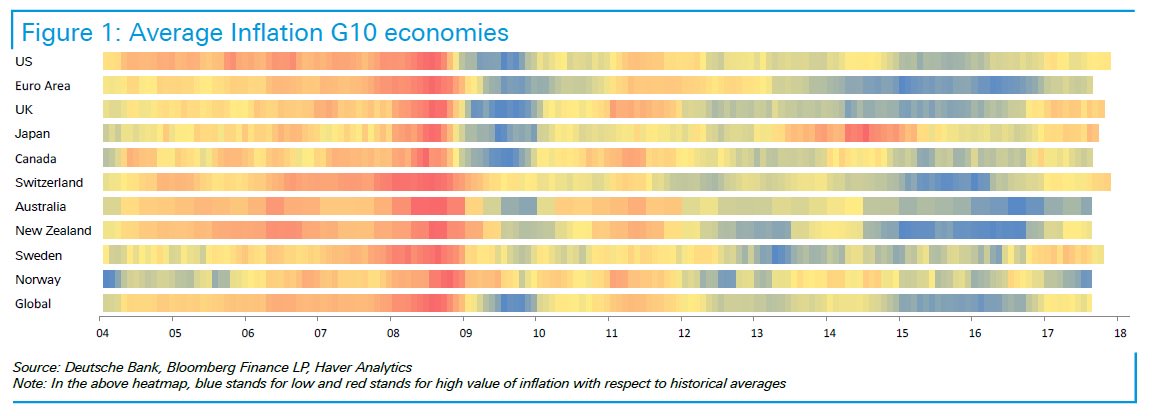

An Australian newspaper recently posted this chart showing inflation rates for the world’s major economies. It calls it the Inflation Sensation Heat Map. Years in red have unusually high inflation, years in blue have low inflation.

Source: Deutsche Bank and Business Day

Source: Deutsche Bank and Business Day

As you can see, Norway and Australia are the outliers. Most of the world, and the world as a whole, are experiencing rising inflation since I issued the inflation alert in 2017.

And January confirmed the trend is hitting the troubling levels I warned about.

Both the US and the UK posted higher than expected monthly inflation in the last few days. If the chart was updated now, a red tinge would be added on the ends.

In the UK, the cost of clothing pushed the rate of inflation to 3%. In the US, a similar figure was blamed on the rising cost of energy.

US senior economist Michael Pearce from Capital Economics told the Financial Times, “The most striking thing is that almost every category saw rising prices in January, which is pretty much indicative of across-the-board strengthening of inflation pressures.”

The inflation rate is of course important to your financial wellbeing. It erodes your purchasing power – a nightmare for retirement savings.

But there are even more dangerous effects to point out than inflation itself.

Pressure on the property market

For most retirees, their home is their most important financial asset. And they probably went through hell to acquire it. Reading about interest rates above 15%, house price crashes and questionable bank practices are enough to put me off buying a home.

And it’s not just me. The UK and US are both seeing mortgage applications tumble. The bond market sell-offs, triggered by higher inflation rates, are already generating higher mortgage interest rates. And people can’t afford them.

The Guardian:

Mortgage lending dropped in December to a near three-year low as the appetite fell among buyers for expensive properties in London and the south-east.

The Bank of England said new mortgages for house purchases were the weakest since January 2015 at 61,039, down by almost 6%, and remortgaging approvals fell by 14% to 46,475.

Reuters:

U.S. mortgage application activity fell to its lowest in five weeks as interest rates on 30-year fixed-rate home loans jumped to their highest in four years, the Mortgage Bankers Association said on Wednesday.

Keep in mind, this is before the interest rate increases kick in properly. In three different ways.

The bond market volatility of the last weeks will damage mortgage affordability. Mortgage rates are not just tied to central bank interest rates, but to free floating rates.

In the US, the ten-year Treasury yield can heavily impact borrowing. And the Treasury market is only indirectly under the control of the central banks. In fact, given central banks are trying to unwind quantitative easing (QE), they’re likely to put upward pressure on mortgage rates too.

Then there’s the coming central bank interest rate reaction to the high inflation rates. The UK and US central banks have yet to act on their promised interest rate increases.

The Federal Reserve is expected to hike rates three or four times in 2018. Odds are the Bank of England will raise rates in March and continue thereafter.

Even though the worst is yet to come, the effect is already playing out on mortgages and house prices. The Guardian reported on heavy discounting to secure a sale in the UK property market, including 10% in London.

Even if you think property is not overvalued, a cycle of rising interest rates makes property steadily less affordable. If the pending rate hikes are enough to sink the stockmarket, consider the property market is far more susceptible. The prospect of buying a house is looking downright dangerous.

Can you imagine what a property price crash would do to retirees in the UK? How much would a 20% drop in the value of your home set you back?

Suddenly inflation is a good thing?

If you’ve been reading Capital & Conflict as diligently as I have, you’ll be wondering how inflation suddenly became a good thing this week.

Last week, stockmarkets tumbled heavily. The reason was supposedly the prospect for inflation and the effect it would have on the bond market. If you’re going to be paid back the money you lent to the government in ten years, then you won’t be very happy if ten years of 3% inflation tore into the value in the meantime. That’s why bonds sold off.

But this time around, the actual inflation figure, despite coming in high in the UK and US, did not cause a stockmarket rout. In fact, the opposite happened. Stocks rose despite US bonds selling off to a new four-year high in their yield.

Even more strange is that the US stockmarket did initially drop. S&P 500 futures were down heavily before trading in actual stocks started, but surged to finish the day up more than a per cent.

It’s likely that last week’s sell-off was simply too far too fast. If inflation and interest rates continue to rise, you can expect more trouble. In the stockmarket and the property market.

History’s rhyme is only getting started

Analysts at Deutsche Bank compared the recent bond market trouble to previous episodes of a similar nature. That is, when rising interest rates in the bond market triggered volatility in other financial markets. The 1994 rate hikes and the 2013 Taper Tantrum were singled out as comparable.

The charts are a little obscure thanks to some alphabet soup. But the conclusions stand. 2018’s sell-off barely registers as a blip in terms of how much interest rates actually rose compared to 1994 and 2013. And yet, the crash in stocks already compares.

If rates continue to go up, it could be a real bloodbath.

Until next time,

Nick Hubble

Capital & Conflict

Category: Economics