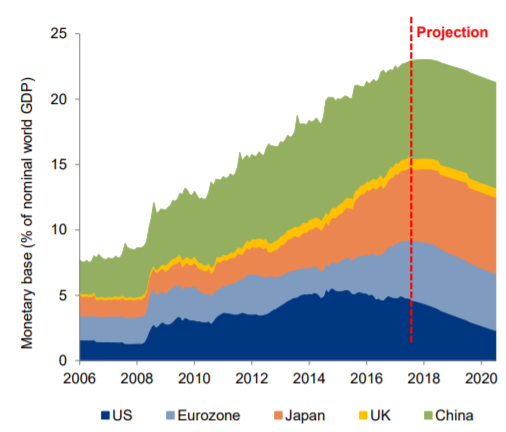

The Currency Wars are over. Having tripled the monetary base as a per cent of GDP, the world’s major central banks are now winding up. No more quantitative easing. No more attempts to devalue the dollar, euro or yen.

This chart from German insurer Allianz summarises just how much money was created. And how fast it’ll disappear again given current projections.

Source: Allianz (Dec 2017)

Source: Allianz (Dec 2017)

But as everybody knows, after the Currency Wars come the Trade Wars. That’s how it went down in the 1930s. That’s how it appears to be playing out today.

The first to change course on monetary abuse was the US, in dark blue above. And so now we’re seeing the Americans lead the way into the Trade Wars too.

President Donald Trump has already put tariffs on aluminium foil, washing machines and solar panels. Steel and aluminium might be next.

What really has the world worried is that Trump as president has power over trade policy. He doesn’t need the same sort of support from Congress as on other issues. He can go rogue.

Of course Trump claims he’s only retaliating. As Barack Obama explained when he put similar tariffs on Chinese solar panels in 2012. For too long, the US has tolerated the subsidies of other nations at the expense of American industry. Now the Americans are going to level the playing field.

They’re right of course. Europe, China and others have been abusing the US’ comparatively free trade policy with their own trade barriers and subsidies. But he’s also wrong if he thinks a level playing field will make the world better off. Not just because reducing trade is a bad thing. But because of what Trump will trigger – retaliation.

The Chinese and Europeans immediately threatened to put their own tariffs on US goods if Trump goes ahead with his plans. The beauty of this sort of standoff is that both sides can claim to be retaliating. It’s the perfect set-up for all this to spiral out of control.

The Europeans know where to hurt the US most – Harley-Davidson and Jack Daniels. They want to raise trade barriers in a targeted way. These are major industries in the home states of the US’ key politicians and Trump supporters.

Targeting individual companies with trade barriers to influence American politics is of course rather unconscionable. But it’s pretty standard policy in a trade war.

It’s not just Trump who is causing trouble though. Our own Brexit is turning into a trade war too.

The UK still hasn’t figured out what it wants from Brexit, because nobody can agree. Not to mention people changing their minds. The EU has been clear though. It wants to punish Britain for its political faux pas with economic sanctions on trade.

The result is total confusion.

Germany’s Spiegel newspaper has a hilarious article about Scotland’s Scotch whisky industry. 90% of Scotch is sent overseas. It’s a fifth of Britain’s food exports. And the industry employs 40,000 people. That made Scotch a huge player in the Remain campaign.

Until recently, that is. These days the Scotch producers don’t want anything to do with the EU. Not even the customs union. Believe it or not, they don’t even want a trade deal! The reason why is simple. And it exposes the bizarre nature of Brexit and the EU nicely.

Without a Brexit trade deal, Britain and the EU would fall under World Trade Organisation rules when it comes to trade. And those specify 0% tariffs on Scotch! Which means the Scotch industry is safe. And doing rather well from Brexit given the pound’s tumble.

Clearly the Europeans learned from their American colleagues when it comes to Cuban cigars. No matter how Brexit goes down, Scotch imports will not be risked.

These days the Scotch industry is supporting a hard Brexit. Remaining inside the customs union but outside the EU would leave British traders at the mercy of EU regulators without the power to shape those regulations in Brussels. That’s terrifying, one Scotch industry representative told Spiegel.

It’s funny how a devoted Remain campaigning industry turned out to be one of Brexit’s biggest beneficiaries. And it should make you question everything you think you know about Brexit.

Over in India, Bloomberg reports on the divergence between rhetoric and policy when it comes to the Trade Wars:

At Davos in January, Indian Prime Minister Narendra Modi said India was open for business and even likened protectionism to terrorism. This month his government raised tariffs on nearly 50 product groups, from clocks and kites to TV and auto components. The measures follow new duties imposed in December on electronic goods such as mobile phones and microwave ovens.

So even free trade’s advocates are betraying the cause.

Where will this leave the world?

Currency wars, trade wars, shooting wars

Since 2008, we’ve seen competitive currency devaluations. But that’s only one way to implement mercantilist policy. Trade barriers are the other. That’s the phase we’re in now.

The problem isn’t just what this will do to the global economy. Trade works by allowing us to produce more with less. Going against trade means you’re in favour of producing less with more.

Only in a politician’s mind does this make sense – because of the link to jobs. Being inefficient supposedly leads to higher employment rates…

The problem is, it doesn’t lead to higher material wealth. Each nation which imposed autarky on itself fell behind.

But the real issue is political. If the economic pie is shrinking, and economic policy is competitive between countries, you have the conditions for war. A proper one.

And that’s where Trump at the helm becomes properly scary.

Until next time,

Nick Hubble

Capital & Conflict

Category: Economics