Your regular Friday editor Boaz Shoshan is busy finalising a series of reports. Word is, you’re going to need them to evade a coming government crackdown. Hence the rush. But that’s all he’s giving away.

Today, we take a look at the first sign of stockmarket fragility in months.

Recent events have me questioning my views. Am I wrong about the serenity of markets? Are central bankers, politicians and plunge protection teams around the world not nearly as powerful as I assume?

Those of you who doubt me, including myself to some extent, certainly got a boost yesterday. Or should I say slump, given it was a tumbling stockmarket that has me questioning my conclusions?

Then again, as you’ll see, the drama that unfolded only reinforces my views in the end. But what happened?

The Japanese Nikkei index was up more than 2% to another record high by mid-morning yesterday. All was as it should be.

Next thing, it was down 1.7%, a terrible lurch of more than 3.5%.

That’s unheard of these days

But then it recovered most of its losses in the hours that followed. Only to lose them again today.

It wasn’t quite a flash crash. But the whole drama was enough to spook markets in much of the world. Wall Street and European indices were down too. It shows that you only need a little volatility to upset a world based on low volatility.

Everyone and their mother attempted to explain the action in the Japanese market. But nobody could convince the media with their particular narrative.

The most cynical explanation is that Japan’s plunge protection team and central bankers must’ve had an early lunch together, leaving the stockmarket unsupervised. That gave equities a brief time to reflect a cold and hard reality: Japan’s booming stockmarket is rising thanks to manipulation, not fundamentals.

When they got back, the money printers and stock pumpers found they had a bit of work to do.

But they recovered much of the lost ground

This is an unlikely explanation given everyone in Japan goes to lunch at precisely the same time. This leads to suited flash mobs that take unsuspecting tourists by surprise. They even close the stockmarket for lunch.

I think there’s a far better explanation for the jumpy market action anyway. It’s all to do with a golfing mishap.

On Sunday, President Donald Trump and Prime Minister Shinzo Abe went for a round of golf together. Trump drove over the green in his buggy, which is a no-no. Luckily he owns it (the golf course and probably the buggy too), so it didn’t turn into a diplomatic incident.

But it’s what happened next that made equity traders realise just how fragile the Japanese stockmarket is.

Abe, having escaped a particularly slippery sucker of a bunker, did an unscheduled backflip while trying to get himself out of the hole. Having sent his ball on its way, he ran up the lip, slipped, and completed an unknown parkour manoeuvre on the way back down to the bottom of the bunker.

As ever with Japanese mishaps, it all happened when nobody was looking. They’d all trundled off towards the green, unaware the prime minister was rolling in the sand behind them.

Except for the Japanese news crew sitting in their helicopter above the course. They saw everything. And got it on camera.

One slip up and the market is toast

The video went viral and must’ve hit Nikkei traders’ desks on Thursday. Realising that nobody in charge of keeping the stockmarket afloat was watching the stockmarket, because everyone was watching Abe play in Trump’s sandbox, they panicked and sold, big time.

The point of my speculation over what happened is that markets are reliant on manipulation. And manipulation is less temperamental than the free market. But it does have its own human flaws. Such as poor footing on the edge of a bunker.

You can mark my words that someday a human error on the part of some central banker or plunge protection team member somewhere will trigger the downfall of the market.

Then again, maybe Trump is the one responsible for the disastrous day’s trading. The last time Japanese stocks tumbled comparably to yesterday was on the announcement of Trump’s election victory. Exactly one year ago, to the day.

Human error, like I said.

You’re not just turning Japanese

But why do you care about Japan’s stockmarket?

Well, it was the first country to go through the demographic change all Western nations face. Its demographics and stockmarket both peaked in 1990. Our demographics peaked around 2008.

And the Japanese are world leaders when it comes to quantitative easing in a variety of ways. Alongside the Swiss, they buy vast amounts of shares, not just government bonds and obscure assets.

But perhaps the main reason to pay attention is that you probably own a chunk of the stocks plunging in the news. The Japanese Ministry of Finance says that foreign investors made their largest ever investment in Japanese stocks last month, coincidentally before the plunge yesterday. The statistics go back to 2005. And big pension funds and fund managers are among the buyers, almost certainly including UK-based ones.

You probably have a stake in the crazy Japanese monetary experiment. Even if only because we’re all copying it.

The pin to pop Australia’s housing bubble

Australia’s property market has a worldwide reputation for all sorts of things. Odd marketing campaigns, including drone-shot videos of filled bikinis, free flowing champagne and infinity pools. Then there’s the money laundering potential for international investors, especially those in countries with strong capital controls. And now it’s foreign student buyers.

It sounds odd that foreign students can afford to buy the world’s most overvalued property in a country that bans foreigners from buying. But it turns out that foreign students are one of the few exceptions to the rule. And wealthy foreigners generally are taking advantage of this loophole by sending a token student to open it for them.

It works a little something like this. A wealthy family in a country that periodically restricts capital flows wants to diversify their wealth overseas to protect it from greedy rulers. And they also want their firstborn to get an English-speaking education. The obvious solution is to send their child to university in Australia and to buy a house there.

The result is that Australia is seeing housing booms in the cities that have first-class universities with international reputations. About 17% of new apartments and 11% of new houses are bought by foreigners in Australia.

A report by Industry Super Australia (ISA), a type of private pension fund, argues that the foreign student loophole is a large source of the unaffordability problem:

The significant uptick in Chinese ‘family’ purchases of established property, funded from offshore, driven by safe haven motives, perhaps explains a significant portion of housing demand near centres of secondary and tertiary education from 2015 perhaps to the first quarter of 2017.

The report, follow-up articles in newspapers and radio coverage all suggested closing the loophole. Australians, not foreigners, should be buying local property.

The thing is, doing so could be the pin that pops the Australian housing bubble. Pulling 10-15% of the demand out of the market is a big marginal change. Anecdotal evidence suggests the proportion is vastly higher, and concentrated in just a few cities, by the way.

Australia’s banks remain heavily overexposed to property lending and the Australian stockmarket and economy remain overexposed to banks.

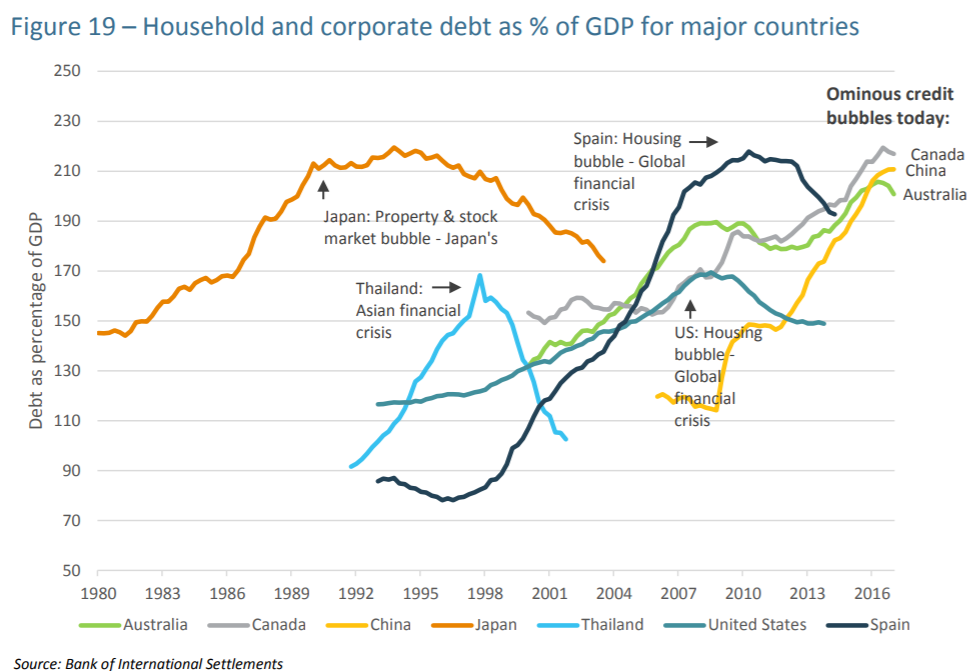

Using data from the Bank of International Settlements, the report from ISA goes on to illustrate why the Australian housing bubble matters to you. All the similar bubbles wreaked havoc on our stockmarket in the UK too, no matter how far away they were:

Source: Industry Super Australia

Back in 2008, Australia and China escaped the worst of the crisis. Canada was drawn in thanks to the US’s woes, but the housing sector survived intact. Australia didn’t even have a recession.

Perhaps it’s their turn for trouble now. What could we name the China, Australia, Canada bubble, I wonder?

Until next time,

Nick Hubble

Capital & Conflict

Related Articles:

- Time to buy energy stocks

- Every time they try this, there’s a crash

- Paradise palaver and the War on You

Category: Economics