The Tech Wreck is a pretty cool name for a stockmarket wipeout. Sub-prime Crisis sounds snazzy too. But nothing beats the coming crisis. It’ll be known as the Recession of the Zombie Apocalypse.

Now I don’t know much about zombies themselves. But it’s the financial zombies that’ll unleash the recession. And even the Bank for International Settlements (BIS) is aware of them.

A zombie firm is one that doesn’t have the profit to cover its interest expense. From there on in, the definition becomes a little flexible.

But how does a zombie firm survive? A company that can’t pay its creditors goes broke, right?

Not in the world we live in. Interest rates are so low and financing is so available that firms manage to hide their lack of profit with more borrowings. They roll over their debt by paying one loan off with another. Zombie firms are more like Frankenstein’s monster, with central bankers keeping the clockwork going.

But how many zombie firms are there?

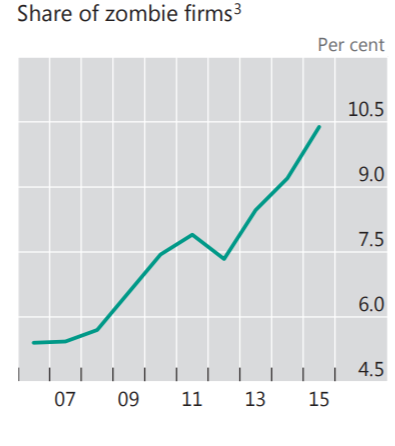

The BIS did the numbers for a selection of developed economies in June. Its definition of a zombie firm is one that is at least ten years old and can’t cover interest expenses at current interest rates. In other words, it’s a very conservative estimate.

The result was this chart, which shows a terrifyingly high percentage, and the even more terrifying rate of zombie infections:

Imagine if 10% of the UK population were zombies… Well, economically that’s the case. But it’s probably far worse by now.

A more interesting version of the zombie company idea is a firm that could not survive under normal interest rates. If the Bank of England hiked rates to a historical 5%, say, what would happen to the thousands of firms barely surviving?

You can see the potential for a Recession of the Zombie Apocalypse.

Zombies kill off the living

The true problem here is that these zombie firms are sucking up the capital needed to finance successful and growing companies. That’s what the academics claim, anyway.

Our low unemployment rate, low productivity, low economic growth and low inflation suggest it’s the sluggish zombies, neither alive nor dead, but certainly not growing, that keep the UK economy rolling along placidly. An economy of the undead isn’t very productive.

Plenty of commentators are calling for a zombie cull. To get back to growth, we need to free up the capital and assets that zombified companies are clinging on to.

Recessions and business failures usually free up the economy to grow again. They’re a transition phase, not a downturn. A realignment or reallocation of capital.

Back in 2010, a Japanese economist explained the dangers of forgetting this. He’d just lived through two decades of the consequences, after all.

“Bad debt is the root of the crisis. Fiscal stimulus may help economies for a couple of years but once the ‘painkilling’ effect wears off, U.S. and European economies will plunge back into crisis. The crisis won’t be over until the nonperforming assets are off the balance sheets of US and European banks.”

Keiichiro Kobayashi mentioned fiscal stimulus as the force which papers over the zombie problem. What he didn’t realise at the time is that it was monetary policy that’d play the main role here. It’s interest rates near zero that keep the zombies from failing.

Clearly the central bankers didn’t know what they’re letting themselves in for…

Zombies get loose in the lab

The central bankers have been so busy rescuing zombies that some got loose in the lab. But nobody knows how many.

The alarm went off a few weeks ago when a South African retail company, which owns Poundland and other European retailers, saw its bonds plunge. Accounting irregularities left the supposedly high-quality bonds trading at half their par value. The European Central Bank (ECB) owns an undisclosed amount, having bought them under its corporate bond purchase programme.

The impending junk rating and potential conversion to equity left the ECB in a difficult position. Selling the bonds would realise the losses, kick the company while it’s down, and reverse monetary policy. Not selling risked leaving the ECB in breach of its rules for what it’s allowed to own.

In the end, the ECB just mumbled sweet nothings and refused to elaborate on what it would do. ECB president Mario Draghi explained the problem was “by and large exaggerated by a factor of 10” in the media and “I cannot elaborate a lot about what we are going to do next.”

Having realised there are zombies lurking behind his doors, Draghi is now trying to hold them closed while reassuring us all that everything is under control on the other side.

The hidden zombies among us

It’s not just companies that turned into zombies these last few years. The household sector did too. Despite a boom in the level of debt, interest rates have reduced the cost of servicing this debt. So people borrowed even more.

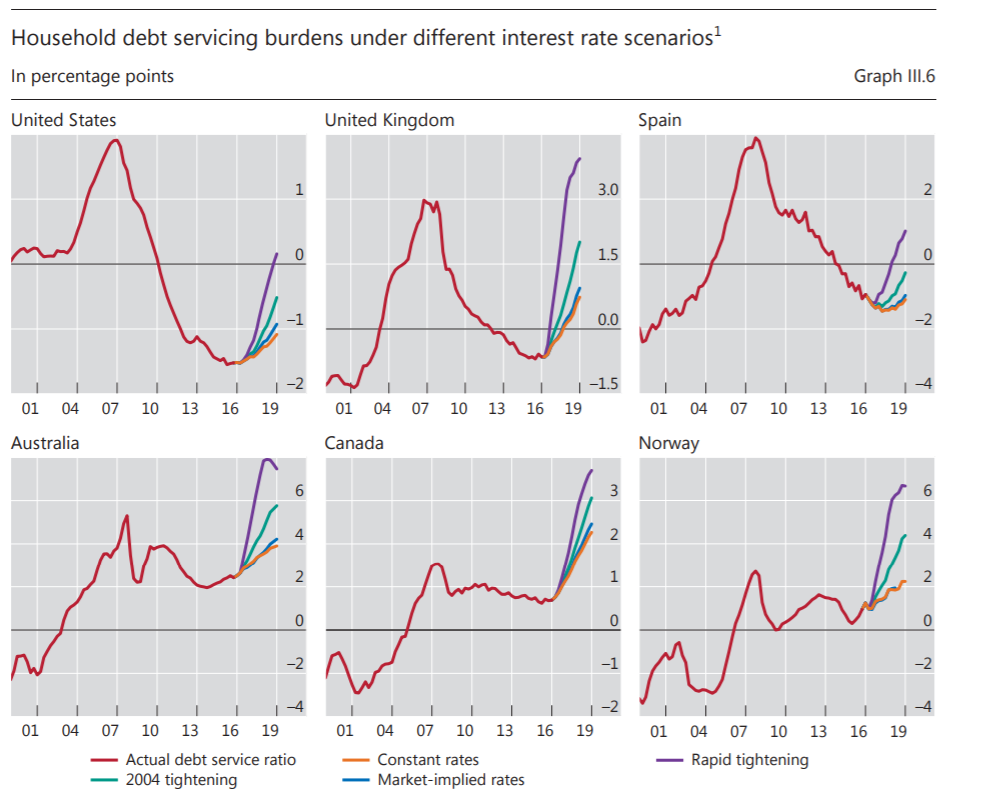

In its June quarterly update, the BIS modelled how a return to normal interest rates might look like in several countries. The charts show the proportion of income needed to service household debt.

Much like yesterday’s Capital & Conflict, this analysis shows how countries which went through a crisis are now better off, having unloaded some of their debt.

The issue everyone is worried about is not a crisis from skyrocketing interest rates. It’s unlikely inflation will surge, so there is no real reason for central banks to trigger a recession with tight monetary policy.

The real problem here is where economic growth will come from. You see, you don’t just need low interest rates to service debt. You need economic growth too.

The debt growth we have been using to create economic growth will come to an end eventually as more debt becomes more expensive.

That’s when we’ll have the Recession of the Zombie Apocalypse.

Until next time,

Nick Hubble

Capital & Conflict

Category: Economics