“A lethal dose to anyone within ten yards. Get it while it’s hot!”

– Edge of Darkness (1985)

NEW TOWN, EDINBURGH – Do I count any nuclear bulls amongst the readership? Anyone stacking uranium rods at home, or stuffing them into their ISA?

I ask, not only as our Beyond Oil Summit on the future of energy is now in full swing, but as a reader recently raised the subject following Nickolai Hubble’s all-out assault on green energy on Monday.

Here’s what they had to say…

It’s an interesting take, but seems to miss out that carbon-based energy depends on government intervention to manage the consequences of pollution and its impact on the population.

In a free market, everyone would have to pay their own costs… nuclear industries would be responsible for their own clean-up costs, big oil would be responsible for their own clean-up costs, and solar panels and windmills would be responsible for their own clean-up.

However, information about the consequences of big oil were suppressed for decades through a combination of hiding records, mis-information, lobbying lawmakers, and straight out misleading the public. Therefore, they didn’t pay their fair share.

Oil is in effect promoted by government, and subsidised. Those that get rich off big oil do so in the certainty that it won’t be them who pay the price, they will probably be dead (although we are now beginning to pay that price have you looked at how inaccurate weather forecasts are at the moment?)

Information about nuclear is largely unknown. The clean-up costs are estimated, and at the top end of the band because of a few disasters. Therefore nuclear struggles to get a look in. Whereas it’s probably quite a good solution.

The costs of wind, solar, [tidal energy] are endlessly pored over because big oil has the time, economists, lawyers and publicists to do this.

So I think it’s good that Southbank Research is having a bit of a debate on the subject, and as always there are merits on both sides.

I’d question the statement that “information” about nuclear energy is “largely unknown”. But nuclear certainly gets a bad rap these days – from both politicos and investors.

I was introduced to the subject of nuclear energy when I was a kid through the 1980s TV series Edge of Darkness. Ronald Craven’s hunt for his eco-terrorist daughter’s murderer, culminating with a Harrods bag full of plutonium at Gleneagles made quite an impression. And not a very positive one when it came to the nuclear industry.

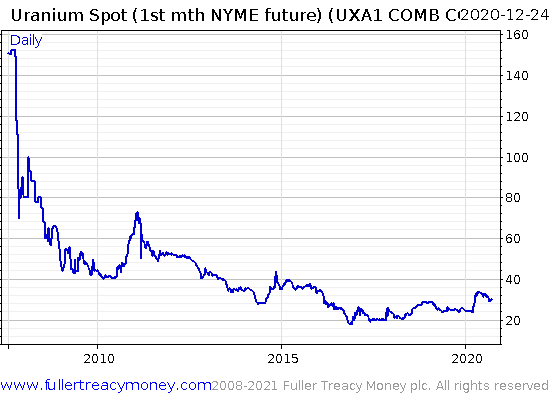

It would appear that this old BBC production has become very popular amongst investors over the past decade, for uranium has become one of the most hated commodities around:

It’s worth noting that spike higher on the bottom right of the chart, which occurred immediately after the March crash last year. The WuFlu lockdowns created a sudden shortage of supply for the metal, and nuclear power plants (the primary consumers of uranium) aim to run at full capacity regardless of demand for the electricity they produce. They need a consistent supply of the metal, and try to secure it well in advance (often years) for understandable safety reasons, and the uncertainty of when mines would go back online amid the WuFlu caused a surge in buying.

You can see that the price has cooled off somewhat. But I wonder if we’ve just witnessed the beginning of a new trend upwards, with investors warming to the nuke sector once again.

If we look at the UK-listed and aptly named Geiger Counter fund (ticker: GCL) which invests in the exploration, development, and production of uranium, you can see that demand for the sector from investors has increased significantly over the past six months:

Might we be standing in the foothills of a new nuclear age? Or at least, a new nuclear bull market? Considering the desire to move Beyond Oil, I wouldn’t be surprised in the slightest…

All the best,

Boaz Shoshan

Editor, Capital & Conflict

PS I’ll be working with Nickolai Hubble and the team over at Fortune & Freedom much more in the near future – sign up here to keep abreast of the latest developments.

Category: Economics