We’re going to talk about an asset class. One that you’ve probably never heard of… but which actually affects you every single day.

In fact, some say you trade this asset all the time, without even knowing it.

And the current state of this asset class has some financial analysts yelling the alarm, seeing a coming catastrophe on the horizon.

A little background first. How many asset classes even are there?

I was taught that there were four: stocks, bonds, property and cash. Around these four however, some argue there are more, which should be given more attention by investors and speculators.

Akhil Patel argues in Cycles, Trends and Forecasts that land is a forgotten asset class and that its deliberate deletion from economic theory has led to gross distortions in the markets. However, those who understand its true value can use it to their advantage.

Meanwhile, on the other side of the spectrum, Sam Volkering argues that we are witnessing the birth of a brand new asset class in cryptocurrencies, and those that recognise this stand to gain hugely from the coming global upheaval.

Tim Price of London Investment Alert sees commodities, specifically the monetary metals of gold and silver, as a crucial asset class for defending your portfolios against the agenda of the elites – more on that here.

But today, let’s look at a different asset class. Some even go so far as to claim that this is the only asset class: volatility.

Just as some people trade equities and some trade bonds, others trade volatility itself. They don’t care how expensive the FANG (Facebook, Amazon, Netflix and Google) stocks are, or how low bond yields are – they just trade the volatility of their prices.

Endless stability

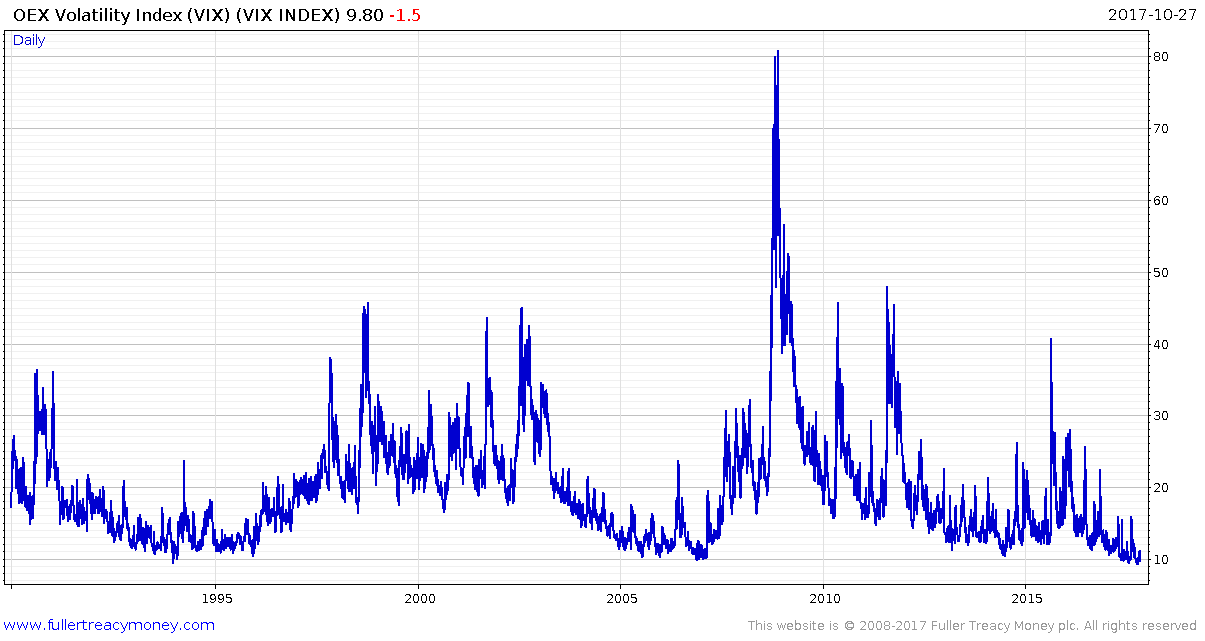

The more asset prices fluctuate, the more “volatile” those assets are deemed to be. Various market indices exist to display market volatility, the most common of which is the VIX, or “Wall Street’s fear gauge”.

While a stockmarket index like the FTSE 100 tracks the changes in value of the top 100 stocks on the London Stock Exchange, the VIX tracks the prices of options placed on the S&P 500 index in the US.

Institutional investors use options to hedge risks, almost like insurance – the more volatile market prices are, the higher it goes.

As you can see below, the VIX is currently at all-time lows – this insurance is now very cheap:

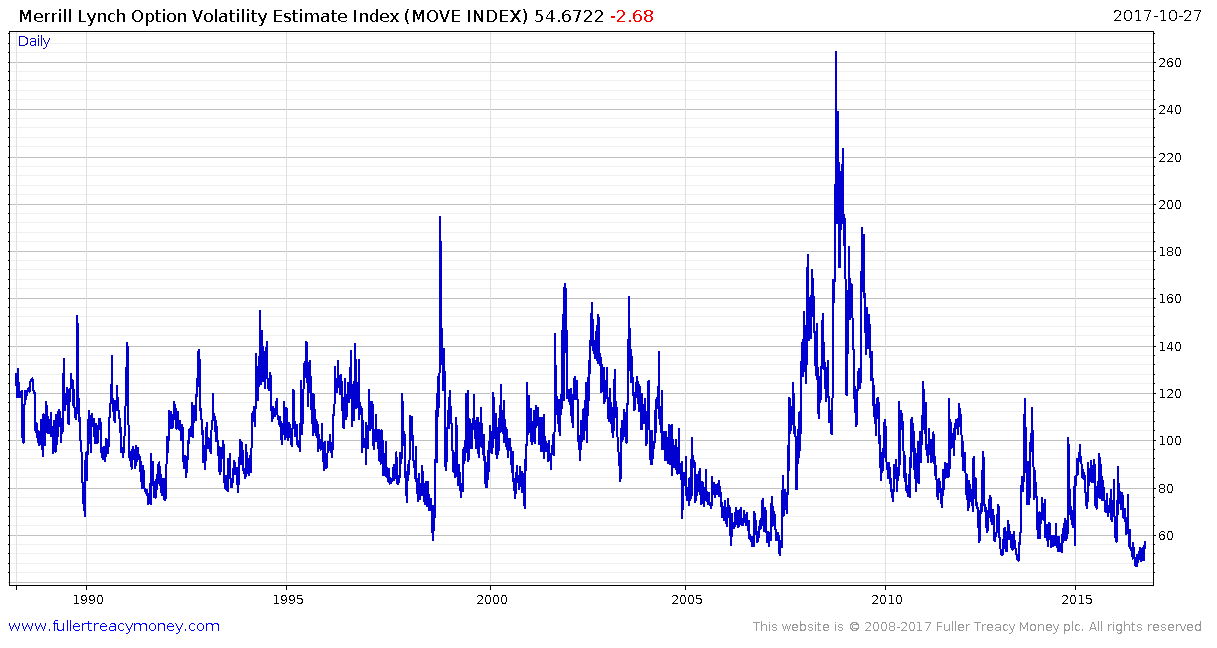

And volatility is not just low in the S&P 500. This is the move, which measures the volatility of US government bonds:

Markets take the stairs up, and the elevator down, as the saying goes. The gradual ascent of a bull market makes for low volatility, while the fear and uncertainty of a bear market makes for high volatility.

But despite Brexit, Donald Trump, North Korea, conflict in the Middle East and drama in the eurozone… market volatility is at historic lows.

Why are markets so still?

Fear is crushed

The hammer which crushes volatility begins with central banks.

Since the credit crisis, central banks around the world have kept interest rates low.

Companies can now borrow money to purchase their own shares back from the market cheaply, thanks to the low rates. This boosts their EPS (earnings per share) and creates the illusion of a more valuable company.

Whenever the stockmarket dips, companies take advantage of their low share prices to buy their own shares back, which bids up their price, lowering volatility.

At the same time, passive investing has caught the imagination of retail investors, who now pour their money into tracker funds. Passive investors do not care for stockmarket fundamentals or valuations – they buy indiscriminately. The recent flows of passive money into the market have also bought up stocks whenever they dip and pushed them higher.

These forces pushing volatility down have not gone unnoticed

Investors have since bet $60 billion that volatility will stay low, with up to $1.5 trillion invested in investment strategies that rely on volatility staying low to be profitable.

Low volatility is dependent on low interest rates. When central banks begin to hike rates, or should stockmarkets fall further than the corporate buybacks or passive investors be able to support them, we will see a winding of the great volatility trade… and it won’t be pretty.

But volatility is not just the metric of markets. Have a read of this, from Christopher Cole of Artemis Capital Management (emphasis mine):

Volatility as a concept is widely misunderstood. Volatility is not fear. Volatility is not the VIX index. Volatility is not a statistic or a standard deviation, or any other number derived by abstract formula.

Volatility is no different in markets than it is to life.

Regardless of how it is measured, volatility reflects the difference between the world as we imagine it to be and the world that actually exists.

We will only prosper if we relentlessly search for nothing but the truth, otherwise the truth will find us through volatility.

How much volatility are we due? [email protected].

Until next time,

Boaz Shoshan

Editor, Southbank Investment Research

Related Articles:

Category: Economics