The most powerful bank CEO in the world had to have emergency heart surgery yesterday. I don’t blame him.

I was going to write to you about something different today, but the level of sheer stress writhing within the financial system market has reached a critical juncture that deserves your attention.

Let’s start with the most prominent sector of the market. Investors in stocks all over the world were seeing red yesterday:

IG’s market indices, yesterday evening

IG’s market indices, yesterday evening

It’s not a good sign for your average investor when the only things going up in the stockmarket are measures of its volatility.

It’s times like this when the mainstream investing wisdom of globally diversifying your portfolio to reduce risk simply doesn’t apply. When markets go “risk-off”, it goes risk off. Stocks? Sell.

The Japanese stockmarket is now threatening to break down through a trend that has supported it for over a decade:

Source: Raoul Pal, on Twitter

Source: Raoul Pal, on Twitter

We haven’t seen volatility in the European stockmarket like this since 2011:

Where the chaos across stocks actually becomes a problem for folks other than owners of the share is in the European bank sector. Stuffed with bad loans, they rely on the stockmarket as a source for capital if it’s required in a pinch.

That door to salvation is shutting before our eyes. Remember the SX7E index? It’s the European banking index I told you to keep an eye on last year (The bank run in disguise – 12 August 2019). It’s now hitting its sovereign debt crisis lows:

Source: Holger Zschaepitz, on Twitter

Source: Holger Zschaepitz, on Twitter

This reflects not only investors disdain for eurozone banks, but the fact that if those eurozone banks wanted to issue shares to recapitalise themselves, they wouldn’t be able to raise much salvation money.

To compound matters, all the cash that has been leaving the stockmarket has been getting into government bonds, and crowding out the returns that can be earned from them.

Banks use those government bonds as collateral to lend against, but they are now damaging instruments to hold: a ten-year loan to the German government, known as a bund, will pay you a historic new low of negative 0.72% if you wait the full ten years for the Germans to pay you back. This damages the profitability of the banks further, which makes more people look to government bonds as a safer place to invest capital, creating a vicious circle known as the “doom loop”.

The eurozone has managed to dodge this fatal threat so far, but that’s no guide to the future. More intervention in the near future is inevitable to keep it alive.

This bond dysfunction harming the banking system has until now been a eurozone and Japanese phenomenon, but it now appears to be heading west. The US government bonds are similarly being crowded into for safety, reducing their returns and similarly bleeding the US banking system. The US ten-year bond, the bedrock of the global financial system, not just the US, now returns less than 1%. It’s not zero yet… but it’s flirting with it, what I call the Golden Doughnut.

The US dollar is the world’s reserve currency, so the lower the interest rates for it get (using the US ten-year as a proxy for the broader dollar-based financial system), the lower global interest rates go. I call it the Golden Doughnut, as once the reserve currency’s interest rate hits zero or goes below it, gold becomes a superior asset to lend against. Gold may pay zero income, but that doesn’t matter when nothing else does, and it has zero risk of being defaulted upon.

It’s no surprise that now that as the bond market stares into the Golden Doughnut, it’s started attracting a serious bid. While it sold off on the need for liquidity by market participants last week, now that the Fed has begun providing liquidity it’s off on a tear.

Incredibly, bitcoin is over $9,000. Somebody wanted £1.2 billion worth of it on Wednesday:

Will this be when BTC finally proves itself as a safe haven asset outside a socialist country? Let’s watch.

Volatility unbound

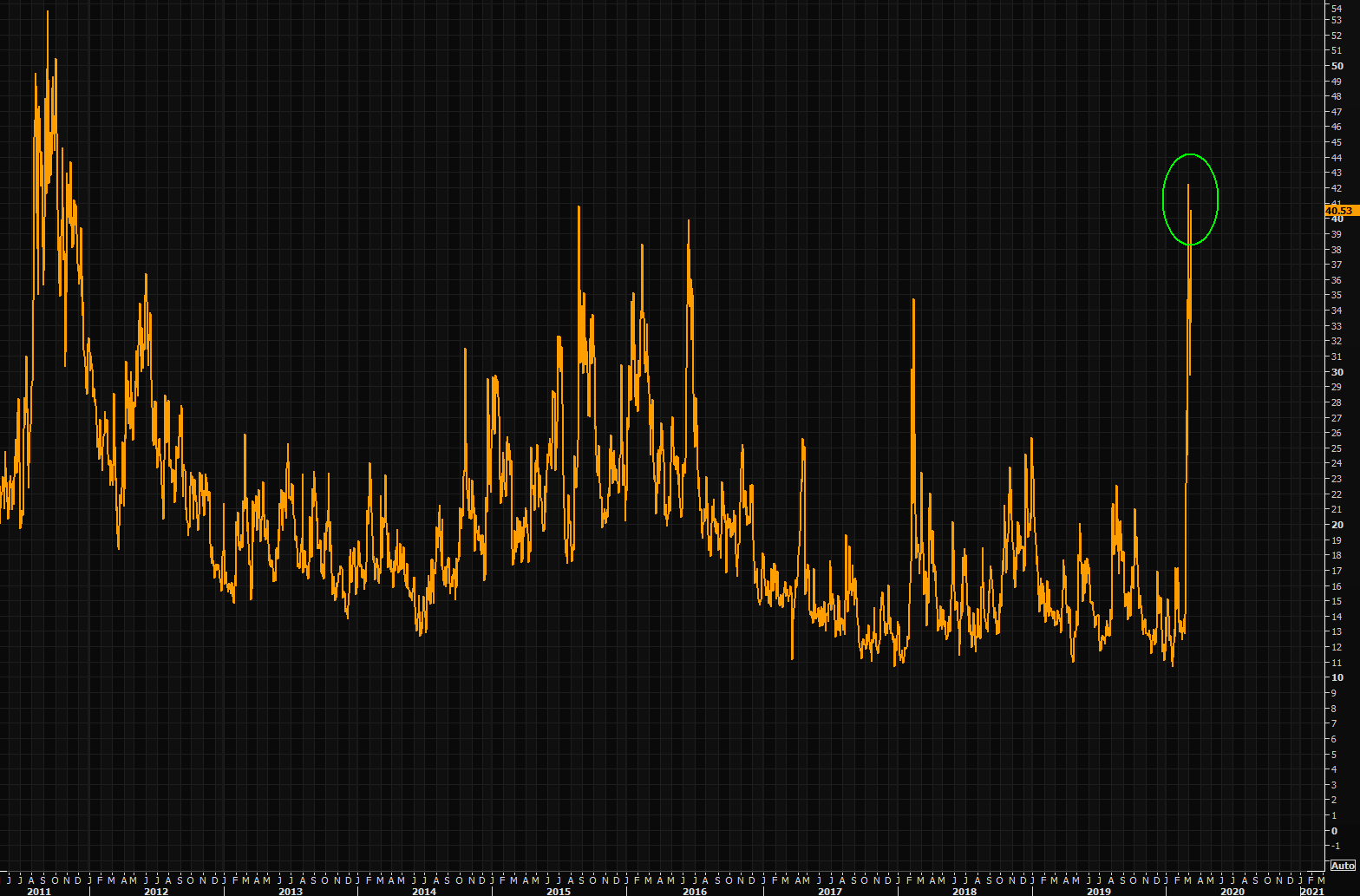

I told you earlier this week that I thought the VIX, Wall Street’s fear gauge, had peaked.

I was wrong.

It went parabolic yesterday and as of this morning is still heading up. To continue the Casino Royale metaphor from yesterday, James Bond is currently getting his ass handed to him.

I lost my bet – but that’s ok. I wasn’t driven by emotion, and had an exit strategy for if I was wrong. Hell, I’m glad just to have been there in what has become a historic market event.

VIX exploding. Carnage in the stockmarket. Bond yields hitting historic lows. Gold up. BTC up. Something big is happening.

My expectation for 2020 was that we would have a melt-up this year. Best-case scenario, it’s been delayed until further notice. Worst-case scenario, it’s

What if somebody threw a market, and nobody showed up?

Before Christmas, when trade unionists in France were cutting electricity to the French central bank, Nickolai Hubble and I wondered whether it would be an event like that which causes the next financial crisis.

Not a financial-based incident, like a default on an investment bond or a hedge fund algorithm running awry… an external shock like a power cut that literally prevented human beings from interacting with the market.

The evacuation of HSBC’s trading floor in Canary Wharf yesterday makes me wonder whether we might be approaching such a scenario.

Prices aren’t real until a transaction takes place. And if a significant player in the market isn’t there to take the other side of a transaction, it becomes increasingly obvious that the “price” you believed existed was totally illusory.

Watch for more stories about banks being evacuated. The more trading floors are empty, the more the chances are of market prices going “awry”…

Wishing you a good weekend,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates