“We rebuilt China over the past 25 years… But those days are over…

No longer will America’s leaders hope that economic engagement alone will transform Communist China’s authoritarian state into a free and open society that respects private property, the rule of law and rules of international commerce. Instead… the US now recognises China as a strategic and economic rival.”

– US Vice President Mike Pence in his second speech on China yesterday

90 years ago today, the US stockmarket was getting wrecked – day two of what would become known as “The Great Crash”.

Stocks are having a hard time as I write this, but it ain’t the biblical levels of 1929. Not yet, anyhow. I’m writing this having just finished watching the US Vice Presidents speech on China – and it didn’t disappoint.

As expected, he upped the ante. The VP called out previous administrations for aiding China’s rise while knowing of its human rights abuses, and the “Washington interests” who profited from them.

It was time to do “the harder right, rather than the easier wrong” and attacked a very long list of entities in the US who had taken Chinese money in exchange for influence: universities, state and federal officials, thinks tanks, not to mention C-Suite executives. The National Basketball Association is acting like a “wholly owned subsidiary” of the Chinese Communist Party… and Nike is in cahoots with them too!

And the movie studios didn’t get a free pass either…

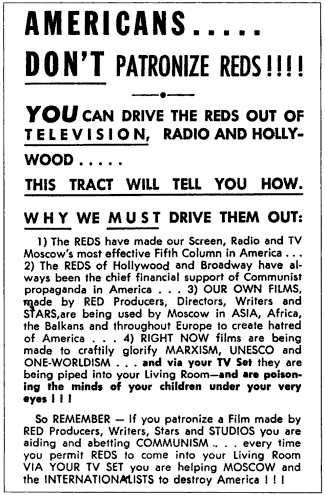

US Anti-communist propaganda from the ‘50s – click to enlarge. Source: WikiCommons

US Anti-communist propaganda from the ‘50s – click to enlarge. Source: WikiCommons

Pence isn’t lying. China’s strategy to infiltrate Hollywood is a fascinating tale, which we’ll explore in another letter.

I told Nickolai earlier this week that I was looking out for a missionary figure, a “Machine-Gun” Joe McCarthy (of ‘McCarthyism’ fame) to meaningfully sway the Western public against China as this Second Cold War intensifies. I don’t think Pence is the man – but he’s giving it his best shot.

Though Pence claimed that the US was not interested in containing China’s development, but he did so only after celebrating the damage done to the Chinese economy, and glorying in the fact that since the Trump office took charge, it was no longer on track to surpass the US’s. He also revelled in the US’s recent renewed military expansion, and renewed efforts to make sure China doesn’t assert itself further in international waters.

The path remains clear to Cold War II. But what’s the investment story here?

The US’s imports from low-cost Asian economies continue to change significantly against China. The Middle Kingdom used to dominate, producing 69% of those imports in 2013, but that’s now 60%, and will continue to drop as the US looks for alternatives. Vietnam has absorbed half of that move, and is booming as a result – investors who invested in a Vietnam fund Tim Price recommended in The Price Report portfolio are currently sitting on a 126% gain!

I told my girlfriend recently to look out for iPhones made in India, as some models are being manufactured there already for domestic sales, and US/China relations are only going to get worse.

She asked me if they’d be any cheaper. Probably not, but as globalisation meets a Cold War, the cheapest option isn’t always the best. For neither producer nor consumer will want to be accused of being a Red under the Bed by whomever takes up McCarthy’s mantle…

Wishing you a great weekend,

Boaz Shoshan

Editor, Capital & Conflict

Category: Market updates