I had a phone call yesterday evening with a man who caused the financial crisis.

He had been in the hedge fund business at the time. Bear Stearns was their prime broker. Lehman Brothers was their counterparty. And Fortis – a lesser-known casualty of 2008, a Belgian financial services company which was nationalised to prevent its bankruptcy – was their bank.

They had been deep within the plumbing of the financial system as it grew bloated and decayed in the run-up to 2008, surrounded by some of the most swollen and toxic institutions.

But they’d kept an ear to the floor. Listened to the stories ignored by the mainstream financial news. And clocked the scale of the trouble that began in the American housing market just in time.

They pulled their cash out of Bear Stearns four days before it went broke. They closed their counterparty agreements with Lehman before it collapsed, and transferred their funds from Fortis before it hit the rocks.

The death knell for any financial institution is a collapse in confidence, leading to a “run on the bank” as clients pull their money out. By pulling their cash out of these institutions they actively contributed to their demise.

In this way, he helped cause the financial crisis. Not that I blame him for his actions. But it was fascinating to speak to somebody so close to the action in 2008.

What business is he in now? I’ll give you a hint: it’s yellow, and heavy. I’ll hopefully be able to interview him sometime in January. Keep an eye out.

Looping downward

Meanwhile, Italy’s “Doom Loop” continues to spiral. We wrote about this phenomenon in Et in Arcadia Ego a few weeks back. European banks have lent so much money to their governments that the fate of those banks is now chained to the fate of those debts (bonds), and vice versa.

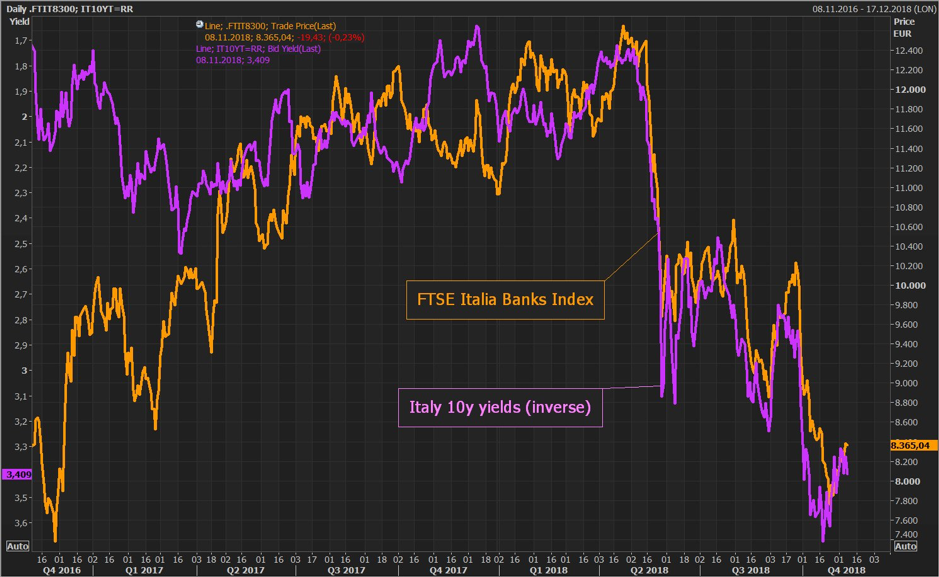

This link between government debt and banks is illustrated below, where Italian debt (in pink) now moves in lock step with Italian bank stocks:

Source: Holger Zschaepitz

To find out what the endgame is for this deadly union, you’ll need to read Nick Hubble’s book.

An interesting wildcard in Europe’s chaos is the emerging possibility of a German recession. Five German economic institutes have collaborated on a report for the German government, claiming that German’s export-led economy will be savaged if the US gets aggressive with Germany on trade.

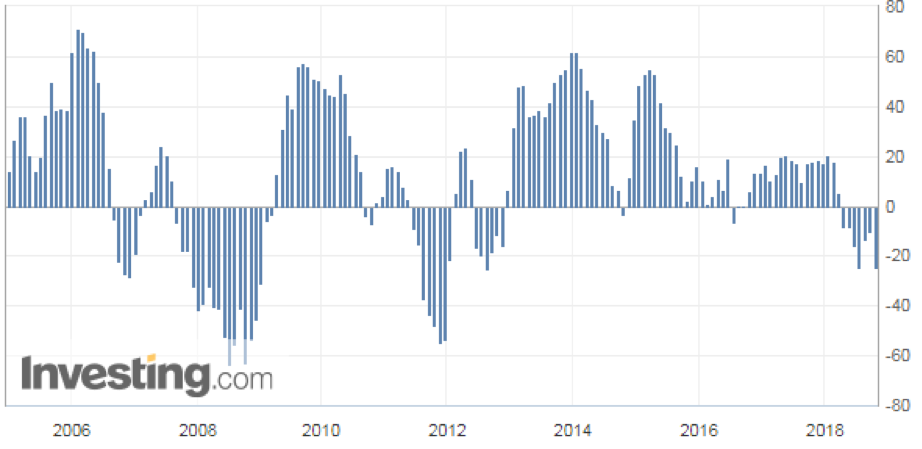

I’m probably as sceptical of economics institutes as you are, but there are others warning of a German recession too. Raoul Pal, a global macro trader, points to the Germany ZEW Economic Sentiment index as evidence of this. The index averages the opinion of institutions and analysts on their six-month outlook for Germany’s economy. As you can see below, men with the money think the German economy has run out of gas:

For all this talk of interest rate normalisation in the US and UK, if Germany, the so-called powerhouse of economic growth in the EU is running out of gas, you can wave goodbye to any semblance of hope for future monetary normality from the European Central Bank.

With rates nailed to floor already, and with quantitative easing still in operation, Super Mario is in yet another bind. Will it be time for him to drag interest rates deep into negative territory… and start talking about abolishing cash again..?

But that’s enough talk of markets and monetary mayhem from me. This weekend is a time for reflection – and this Sunday is a time for remembrance.

Wishing you a good weekend,

Boaz Shoshan

Editor, Southbank Investment Research

Category: Market updates