We spend far more time discussing the “capital” element of our brief than we do the “conflict” part. That’s mostly by design: the markets keep us busy enough. And changes in the financial world are much more likely to have a direct impact on your finances.

But that doesn’t mean we should neglect the conflict component of our mission. Global (or domestic) conflict might not always feel like it has a real effect on our lives. But it does. It’s just not always direct or immediately visible. That doesn’t make it any less important.

We got a reminder of that just yesterday here at the Southbank Investment Research offices, which are situated a stone’s throw from Southwark Cathedral, where the funeral of PC Keith Palmer took place. As you’d expect, given the fact that PC Palmer was the victim of the terrorist attack at Westminster last month, security was extremely and noticeably tight. There’s nothing like roadblocks at eye level and marksmen on the rooftops to underline just what a security threat we live under here in Britain.

But that’s just on the domestic front. On a global level, geopolitical and military tensions are rising in the wake of the US airstrikes on Syria last week. Syria has always threatened to become a “proxy war” situation, with Russia and Iran backing one side and the US, Britain, Israel (and others) backing another.

The joint statement from Russia and Iran yesterday underlined that fact: “What America waged in an aggression on Syria is a crossing of red lines. From now on we will respond with force to any aggressor or any breach of red lines from whoever it is and America knows our ability to respond well,” said the statement.

There are a number of ways you can read that statement. One is to just take it as diplomatic rhetoric – bluster, essentially. You’ll see that from both sides. It’s to be expected in a situation like this. And the threat to respond with “force” has to be taken with a pinch of salt. Is Russia really prepared to attack the US over Syria? Is that really in the best interests of the Russian state?

I’d argue not.

Unless, of course, “force” means something different to the kind of force the US used.

What do I mean by that?

In a word: cyber.

The simplest way to respond with force – without technically declaring war – is to attack the infrastructure of your enemy using your cyber operatives. That’s my reading of the Russian/Iranian threat. It speaks to the idea that they can assault, degrade or influence their enemies without needing to drop bombs on them.

We’ll see if that’s true over the coming month or so. But I would not be surprised to see a large scale cyber disruption in the US or Britain in the near future. Or at least… the attempt of one.

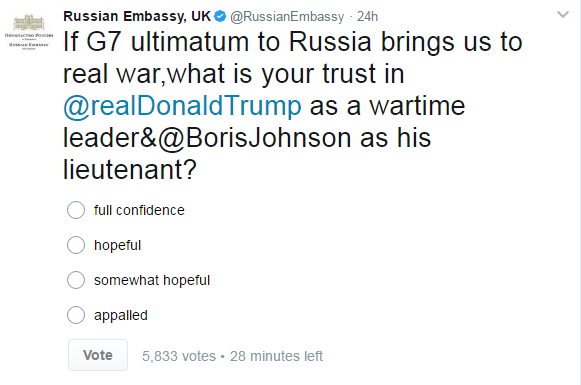

If that worries you, then here’s another reading of the situation: it’s all one big troll and the Russians don’t really care what happens. Let me point your attention to a series of tweets from the Russian embassy in the UK over the weekend as evidence of that. There were many of them. I’ve included examples of two below. They all have the same tone and basic content: taking the piss out of the West/Boris Johnson for the actions and rhetoric of the last few days. Here’s one:

Here’s another:

Of course, it could all be a part of the Russian embassy’s attempts to increase engagement with its social media audience. Or it’s just the Russians trolling the political establishment in the West. Or it’s an attempt to bring some levity and perspective to the situation. Maybe it could be all of the above.

I can’t say for sure. But the cyber element of this story is worth watching. I’ll keep my eye out for more news. More on that another time.

Rigged by the state

What is a real free market? I’d say it comes down to something very simple: the voluntary exchange of goods and services between free individuals (or companies).

That exchange helps us understand what the price of something should be. It sends signals to producers and consumers. And it stimulates competition. You may not like the price of something… but if every party in the market is free to walk away or make a deal on their own terms, it’s the best process we have.

That’s why true free market supporters tend to be libertarian, anti-state types. The state imposes a level of coercion into the process. It forces people to act. Noncompliance is punishable by imprisonment. Therefore no interaction with the government – or which the government regulates – can ever be truly voluntary.

I’m painting the world as black and white when perhaps we know it isn’t. But the principles are crystal clear.

And let’s face it: most government types – no matter how much they may claim to support free markets – don’t really believe in voluntary exchange. They believe they know best. So when something is “wrong” – in their view – they try to “fix” it.

Fix, meaning correct

Or in the case of the Libor rate scandal, fix takes on a different meaning: to rig.

Until now it’s mostly been the banks who’ve been targeted as the chief fixers of the rate. But it turns out the government and the Bank of England were both perfectly willing to set aside their free market credentials when it suited them. Here’s an exchange taken from an upcoming Panorama show, between Barclays manager Mark Dearlove and his Libor submitter Peter Johnson:

Dearlove: “The bottom line is you’re going to absolutely hate this… but we’ve had some very serious pressure from the UK government and the Bank of England about pushing our Libors lower.”

Johnson: “So I’ll push them below a realistic level of where I think I can get money?”

Dearlove: “The fact of the matter is we’ve got the Bank of England, all sorts of people involved in the whole thing… I am as reluctant as you are… these guys have just turned around and said just do it.”

It’s corrupt. But it’s entirely predictable. Freedom is incompatible with government. There’s always going to be a level of implicit or explicit coercion. Dealing with that is everyone’s problem. Exposing it is our mission.

Cannabis ETF launches

It’s not all restriction and coercion. Sometimes the state allows things to move in the other direction, albeit in a limited fashion.

Cannabis is one such situation. It’s fast becoming a legal commodity. I told you yesterday that Canada is expected to start the legal groundwork for full legalisation this week. I should also have mentioned that just last week, the first cannabis exchange-traded fund (ETF) launched (again listed in Canada). The index tracks 16 firms, most of which are Canadian.

It’s becoming big business. But if you want Eoin Treacy’s advice, there aren’t 16 companies you need to look at… there are only two.

Best,

Nick O’Connor

Associate Publisher, Capital & Conflict

PS Before I leave you, one more thing just caught my eye. Answer me this: in the decade since the financial crisis, what do you suppose has happened to global debt? I’m talking public, corporate and personal debt here.

Given the financial crisis was predominantly caused – and certainly exacerbated – by debt, you might have expected to see a mass global deleveraging. Paying down debt would make sense. And it’d explain why growth has been so anaemic.

Except, that isn’t what has happened.

According to the Institute of International Finance, global debt in the last ten years rose by $70 trillion. Western, developed economies owe 390% of GDP. That’s a lot of borrowing. And it’s achieved… not a lot of economic growth. Perhaps, as Bill Bonner wrote in Hormegeddon, we’re past the point of marginal utility for borrowing. Or perhaps we’re doing the wrong kind of borrowing. More on that next week.

Category: Economics