You might think it’s politicians who are ruining Europe. Sure, they’re doing their best. But the real death knell is an unavoidable trend that’s entirely predictable. Demographics spell doom for Europe. And there’s no fix.

Thanks to incredibly low fertility rates and rapidly rising life expectancies, Europe is in deep economic trouble. Yes I know you’ve heard it before. But I’ll show you a twist to the usual story below. So bear with me…

It’s only when you combine low fertility rates and an ageing population that you realise just how bad things are. That’s because an ageing population hides just how bad the population decline really is. People are living longer, masking how fast the European workforce is shrinking. Of course in the end, older people must be cared for by the young, exacerbating the issue.

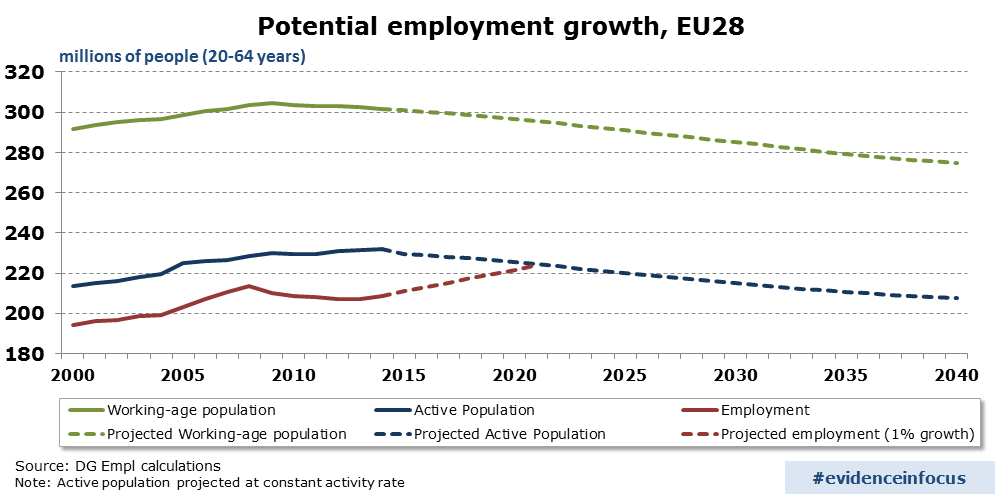

Here are some figures. Eurostat’s optimistic expectation is that the European workforce will decline by 0.4% a year until 2040. This is optimistic because it assumes a far higher workforce participation rate than we currently have, despite a rapidly ageing population. It also assumes continued high levels of immigration, and we know how that’s working out. Still, losing about 9% of your workforce over the next 23 years is enough of a nightmare.

But it gets worse. The continent is losing young workers and gaining retirees at a record pace. Europe’s 20 to 40 age bracket is on target to shrink by about a fifth in the 10 years to 2020 according to Deutsche Bank. So after 2040, the trend of a falling workforce will speed up.

The real issue is that Europe isn’t a single demographic bundle. Several countries are in deeper demographic trouble than others. And that will cause contagion for those who are facing the same fate, just several years later.

Only one country in Europe is experiencing natural population growth – Kosovo. About nine months ago I saw a queue outside an outhouse in the middle of a field in Kosovo. Other than that, I saw nothing to hint Kosovo is experiencing a demographic boom which will counteract the decline in the rest of Europe.

In my birthplace, Germany, the dependency ratio will hit 1:1 in 2030. This means there’ll be one worker for every person not employed. We Germans are an efficient bunch, but that’s asking a bit much.

If the economy breaks down in Germany, the rest of Europe will be in trouble too.

But what about home? The UK is slightly better off than Europe as a whole. Its workforce will flatline in numbers for a few more decades. But the proportion of those over 65 will surge rapidly in coming years. And when the continent starts to unwind, Britain won’t be isolated.

The interesting thing about all this isn’t just the effect on government budgets and pension systems. You can read about that elsewhere. There’s something else that nobody has quite figured out…

Who will buy your shares?

Most people take a look at demographics and change their investment strategy a little. They invest in retirement village developers and cruise ship companies instead of education providers and home builders.

I’m worried that just won’t work.

Think about it like this: Who will buy your shares? When you downsize, who will be lining up on your street to buy your home?

The baby-boomer generation has accumulated the biggest bundle of assets ever seen in the history of the world. Trillions in property, stocks and other assets are sitting in pension and retirement accounts. They’re waiting to be sold off to pay for retirements.

But who will buy? I’ll tell you the answer: Not enough of us. The baby boomers didn’t have enough children to buy their investments. There simply aren’t enough young people to buy all those assets.

If workforces are declining in developed countries around the world, just when the number of retirees and the length of their retirement is surging, the maths simply doesn’t work.

It’s basic supply and demand, really. The number of buyers are falling or flatlining. The number of sellers is going through the roof. What do you think that will do to the price of investment assets? They’ll fall.

They’ll fall slowly at first. But then my generation will wake up. Once we realise investing is a losing proposition, for demographic reasons, why invest at all? Young people will refuse to be the greater fool which baby boomers were hoping to offload their investments to.

That’s when things get scary. It doesn’t matter whether you’re holding the right stocks if there’s no buyer in the market.

Too outrageous to believe?

Does all this sound too profound? I can understand you saying so. But it’s happened before. But only once. In Japan over the last few decades.

If you tell your Japanese parents, just hypothetically speaking, that you’re buying an investment property, they’ll be mystified. I’ve tried it a few times in person. Once with my potential Japanese in-laws. The reason for their confusion is simple. Property prices don’t go up in Japan, they go down. Year after year.

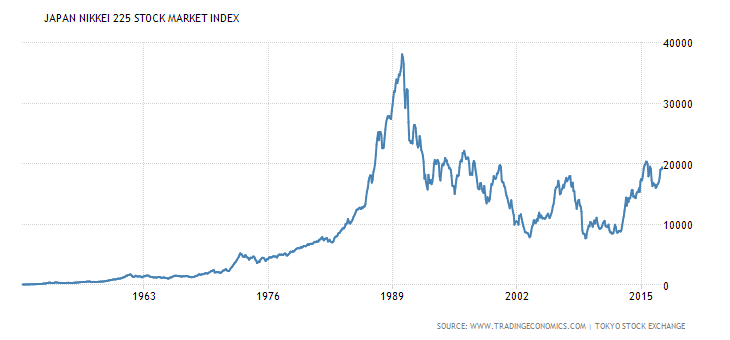

Index investing in Japan was a losing proposition for 20 years too. Stocks steadily fell, as you can see below. It’s only since the Bank of Japan started buying shares with newly created money that things changed. Even then, they’ve got a long way to go:

What is it about 1990? That’s just when Japan’s demographics started to change in the same way Europe’s did in 2012. Germany’s decline will be worse than Japan’s.

The point is the Japanese know investment prices don’t just magically go up in the long run. They go up because of demographics – supply and demand. It’s not a revelation to them. Well, it was in 1990. But not anymore.

So what now for Europe?

Are there any stocks which can buck a trend as powerful as demographics? Of course, but they’re really up against it. Even if a company’s profits surge, share prices could fall if there aren’t enough buyers in the stock market.

One strategy is to focus on dividends, as The Dividend Letter editor Stephen Bland does. Another is to turn your investing into a series of targeted trades. It’s also just as easy to profit off falling investment prices these days, if you have the right tools.

But the best option is new technologies. Or brand new industries. For example, it’s now possible to invest in an industry which you used to be excluded from. At least I expect you were excluded. But this particular industry is so popular with young people, it might just be one of the few good bets in coming years. You can find out more here. Just don’t tell them I sent you.

On a national level, it’s clear what Britain should do. If we want to survive Europe’s demographic debacle, our immigration policy is simple: Steal Europe’s workers. Good luck selling that to the electorate…

Nickolai Hubble

Editor, Capital & Conflict

Category: The End of Europe