How much are you prepared to pay for safety? And is what you’re buying really safe? We’re about to find out the answer to both questions. A total of three British property funds have frozen redemptions. Interest rates on government bonds continue to plumb new depths. And gold has broken out.

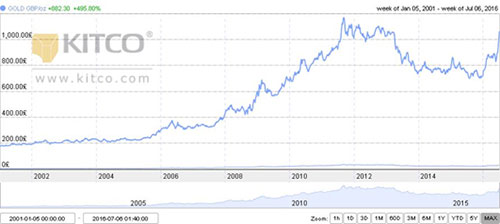

Let’s deal with gold first. At $1,370, the US dollar price of gold hasn’t been this high since March 2014. That’s saying something, given that the dollar itself is moving up against the pound and the euro. Gold and the dollar going together higher as one! Who would have guessed it?

But the gold price action in pounds is probably what you’re more interested in. At £1,058, the gold price in pounds hasn’t been this high since January of 2013. And since the night of 23 June, the gold price is up 24.3% (from £851). It is, however, still down about 7.5% from the all-time high of £1,145 set on 12 September, 2011.

Anecdotally, friends in the industry tell me that in the immediate aftermath of Brexit, volumes in gold bullion trading exploded. But there were more sellers than buyers. That makes sense when you look at the chart. Why?

Anyone who bought gold bullion in the summer of 2011 has been out of the money for about five years. Only now do they have a chance to get out of that position with a small gain. And since gold has not – until now – behaved as an inflationary hedge, the traditional rationale for buying it and holding it hasn’t seemed justified.

But gold loves inflation, as Charlie Morris, the Investment Director of The Fleet Street Letter, often says. The next few days and weeks are crucial when watching the price action. Once the long-term holders have sold, we’ll have a clearer picture of how many new buyers we have right now too. And whether gold is getting a bid as an inflation hedge.

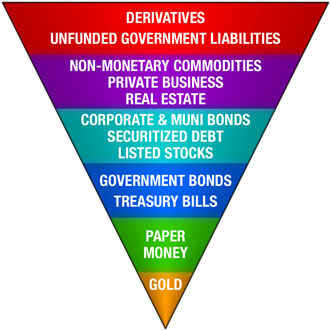

Of course if you look around the world, the only real inflation you see anywhere is in financial asset prices (mostly government bonds). 30-year Japanese government bonds yield just 0.015%. Both 10-year German and Japanese bonds have a negative yield. And the flood of money into the 10-year US Treasury drove its yield down to an intraday low of 1.34% yesterday. All of which prompts me to remind you of the image below. It helps explain (and predict, I would suggest) where liquidity flees in a deflationary crisis. Have a look…

Source: Wikimedia commons

The inverse pyramid, by the way, is known for a former Fed central banker named John Exter. Exter was in charge of international banking and precious metals operations at the New York branch of the Federal Reserve in the 1950s. He was the consummate insider.

His view was that in a deflationary crisis, money and liquidity would flee from derivative and less secure credit and debt instruments to more liquid and more secure real assets. He believed the ultimate secure and real asset – the foundation of the entire global financial system – was gold. Gold wasn’t anyone else’s liability, could not be printed or devalued, and in the end is a real, physical, tangible asset.

Think about the pyramid in the context of what’s happening in the British property fund sector. Three different funds, run by Standard Life, Aviva, and M&G, have suspended redemptions in the wake of Brexit. These funds derive their value from the underlying assets, commercial real estate in the UK.

The Ultimate Asset

That’s not exactly liquid, although it is tangible. Investors selling are probably panicking a bit, anticipating that a lower pound will lead to a crash in UK commercial property. They want their money now, before that happens.

When you get a run on a fund like that, the managers have to decide how they want to meet redemptions. They can sell assets to raise cash. But selling assets because you have to (and not because you want to) is what we call a distressed sale. That leads to less confidence, more panic, and lower asset prices (contagion).

Funds can borrow money to meet redemptions. But this increases leverage, which in turn can weaken confidence for the investors who remain. It makes it less likely they’ll want to remain. Hence the vicious cycle of selling begetting more selling.

Exter held that in a deflationary crisis – and I’ll take that as given for the purposes of today’s letter – money would flee ‘down the pyramid’ into the most liquid and tangible assets. That’s exactly what you’re seeing now, as money flows into government bonds, cash, and gold. The only thing missing on the pyramid above is blue-chip multinational stocks (the FTSE 100 was up again yesterday).

Now that is an even more interesting question. Which institution has a better chance of survival over the next 10 years: Unilever or the European Union? Which institution is fitter for purpose in a high-debt, low-growth world? Which institution is the safest place to invest in?

Or in which institutions can you most safely (and least destructively) ride out the consequences of the monetary endgame (with deflation now and inflation later being the most likely scenario)?

Speculators loving it

Low rates and currency devaluations (China let the yuan sink lower against the dollar overnight) are a nightmare for savers and those on a fixed income. And it’s not a bag of hamburgers for insurance companies or company pension plans that have long-term liabilities. But speculators love it.

For example, Eoin Treacy’s first trade with Trigger Point Trader was a gold miner. As far as I know, Eoin’s trading method is entirely technical. But it got him – and his subscribers – into a gold stock before Brexit. And then boom – the gold price took off.

The gold stocks give you massive leverage to the gold price. And if you feel like central banks are forcing you to speculate for higher yield – and that nothing is really safe anymore – then you can see why the gold and silver miners could prove popular. But a word of warning.

Gold – as Tim Price consistently says – is a signal. When the gold price moves up (in all currencies) it’s a signal that investors and the public are losing confidence in the financial system. They’re losing confidence in central bankers and their product (paper money).

This is why Exter had gold at the base of his pyramid and cash just above it. And incidentally, this is why Tim is probably quite correct, in The War on Cash, that governments and central banks would like to remove cash as a safety/liquidity option for you, in order to keep money tied up in government bonds and in the system. Gold and cash out of the system are the ultimate signs of fear.

Category: Market updates